Unveiling the Enigmatic World of Options Trading

In the realm of investing, where high rewards often dance alongside elevated risks, options trading emerges as a captivating yet perilous endeavor. These financial instruments, shrouded in layers of complexity, offer investors the tantalizing potential for exponential gains. However, the path to profitability is fraught with pitfalls that can ensnare even the most seasoned traders.

Image: www.wealthwithin.com.au

Options, in essence, are contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. While this flexibility can bestow immense profits, it also harbors inherent risks that must be thoroughly understood before venturing into this alluring domain.

Deciphering the Risks of Options Trading

To venture into options trading with a conscious mind, it is imperative to unravel the tapestry of risks embedded within this intricate realm.

Unpredictability of Market Movements

The primary risk associated with options trading stems from the inherent volatility and unpredictability of financial markets. Options derive their value from the fluctuations in the underlying asset’s price. As markets swing in unpredictable rhythms, so too do the fortunes of options traders. Should the market move against a trader’s initial expectations, substantial losses can accumulate swiftly.

Leverage and Magnified Losses

Options, like double-edged swords, amplify both profits and losses. Unlike stock investments, where gains and losses are typically capped at the investment amount, options contracts leverage the trader’s capital, potentially resulting in exponential returns. However, this amplified leverage also magnifies the magnitude of potential losses. A single wrong bet can wipe out a trader’s account in alarmingly quick succession.

Image: www.options-trading-mastery.com

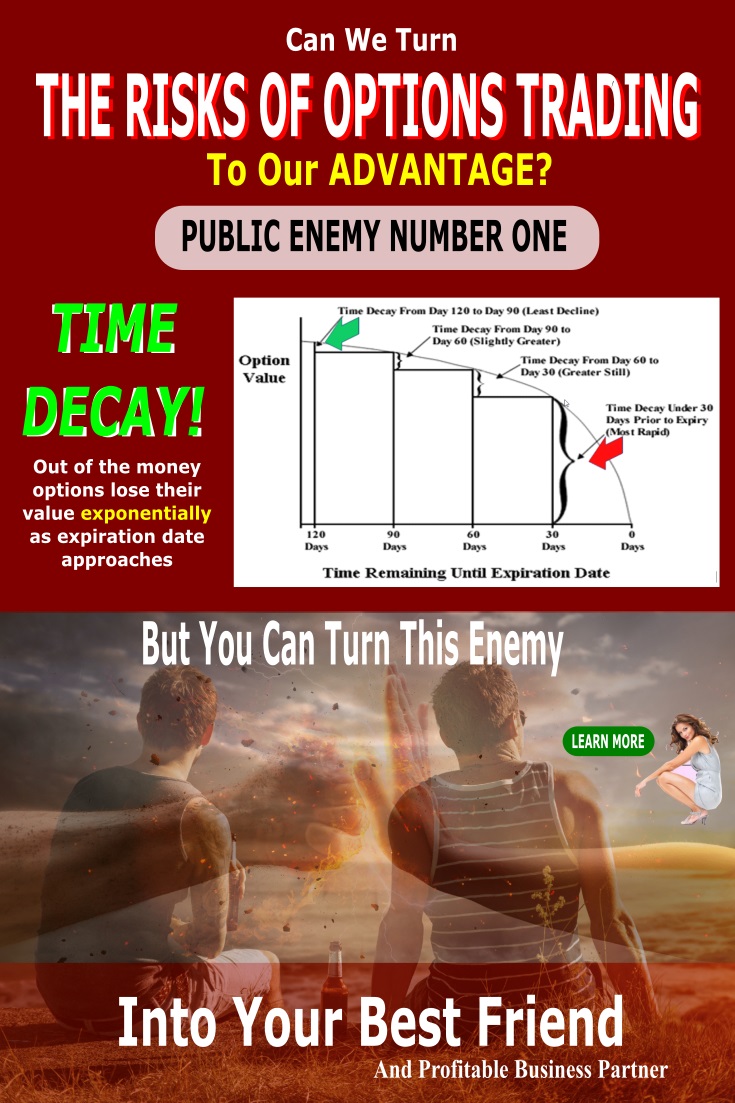

Time Decay and Theta Risk

Time, in options trading, holds a relentless grip on the trader’s potential profits. As the expiration date of an option contract draws near, its value steadily erodes due to time decay. This phenomenon, known as theta risk, becomes even more pronounced for out-of-the-money options, where the likelihood of significant price movement prior to expiration diminishes.

Liquidity and Counterparty Risk

Liquidity, the ease with which an asset can be bought or sold without significantly impacting its price, is a crucial factor in options trading. Illiquid options, especially those with extended expiration dates or low trading volumes, can present challenges when attempting to close out positions, potentially exacerbating losses. Counterparty risk, the risk of the other party in an options contract defaulting on their obligations, also comes into play.

Mitigating Risks in Options Trading: Strategies for Prudent Investors

While options trading inherently carries risks, adopting prudent strategies can help mitigate their impact and enhance the prospects of achieving profitable outcomes.

Diligent Research and Risk Assessment

Before embarking on any options trade, it is paramount to arm oneself with a comprehensive understanding of the underlying asset, the specific option contract, and the potential risks and rewards involved. This entails analyzing historical price movements, assessing volatility, and evaluating the macroeconomic factors that could influence market direction.

Conservative Position Sizing

Recognizing that the biggest risk in options trading lies in losing more money than intended, responsible position sizing plays a crucial role in risk management. Traders should carefully determine the maximum amount they are willing to risk on any given trade and allocate their capital accordingly. Avoid overleveraging and maintain a diversified portfolio to spread the risk across multiple positions.

What Risks Are There In Options Trading

Image: freebuyers203.weebly.com

Masterclass from the Masters: Taming Market Volatility

-

Embrace Hedging Strategies: Seasoned traders often resort to hedging strategies to shield themselves from the potential pitfalls of market volatility. Hedging involves entering into multiple, complementary trades that aim to mitigate the impact of adverse price movements.

-

Seeking Balance: The prudent investor diligently weighs the potential rewards against the inherent risks. While options alluringly dangle the carrot of exponential profits, never succumb to the temptation to take reckless risks. Seek harmonic balance between ambition and caution to navigate the tempestuous seas of options trading.

-

Curtail Leverage: Leverage, like a double-edged blade, cuts both ways. While it can amplify profits, it also magnifies losses. Approach leverage with a discerning eye, understanding that it is not a panacea for financial success. Limit leverage and adopt a conservative approach to safeguard your capital.

-

Monitor Positions Assiduously: The markets are a living, breathing entity, constantly shaping and reshaping the contours of opportunity and risk. Diligent monitoring is essential to swiftly identify changes in market sentiment and underlying asset prices. Closely monitor your positions, ready to adjust or exit as needed.

-

Continuous Learning and Adaptation: Options trading presents a dynamic landscape, forever shifting and evolving. Immerse yourself in a continuous learning process, staying abreast of market trends, novel strategies, and the latest insights. Adapt to new developments and refine your approach to stay competitive in the ever-evolving realm of options trading.