In the ever-evolving realm of financial markets, harnessing the potential of dollar index options trading on the Chicago Mercantile Exchange (CME) presents a lucrative opportunity for discerning investors. Whether you’re a seasoned professional or a novice dipping your toes into the waters of currency trading, this comprehensive guide will empower you with the knowledge and strategies to navigate this dynamic arena with confidence.

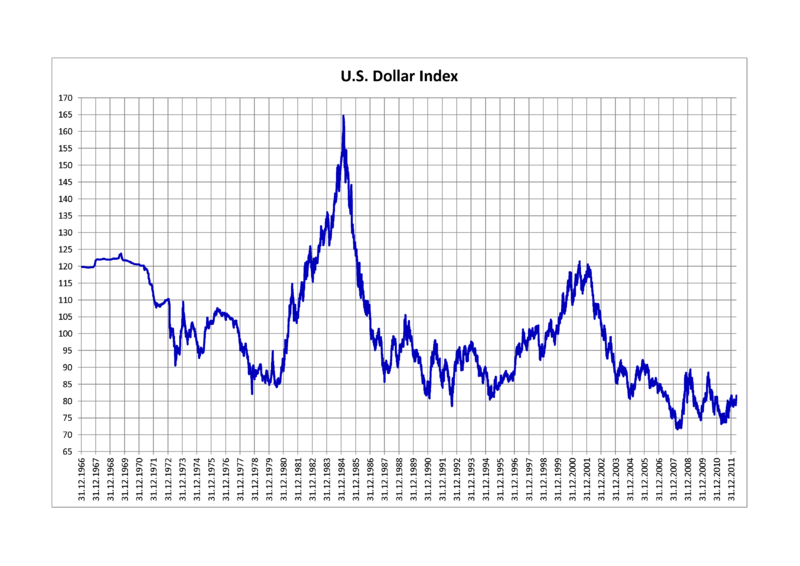

Image: www.sidewaysmarkets.com

Understanding Dollar Index Options Trading

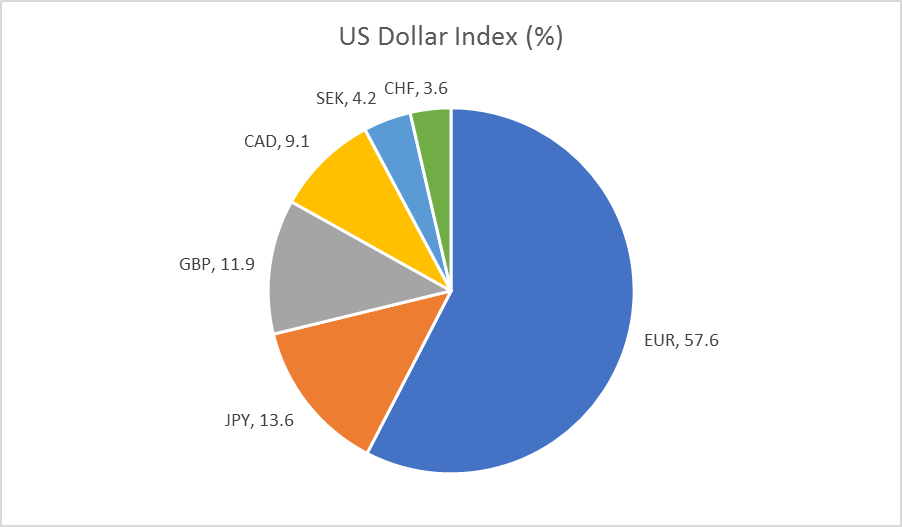

The Dollar Index (DXY), a benchmark for the value of the U.S. dollar against a basket of six major currencies, provides a crucial barometer for global economic conditions. By trading options contracts based on the DXY, investors gain the flexibility to speculate on the future direction of the dollar’s value, amplifying their potential returns.

Benefits and Applications

Dollar index options trading offers a myriad of advantages:

- Leverage: Options contracts magnify your exposure to market movements with relatively small capital outlays.

- Risk Management: Tailor strategies to mitigate potential losses while positioning yourself for gains.

- Speculation: Predict and capitalize on future fluctuations in the value of the U.S. dollar.

- Hedging: Protect existing currency positions against adverse price changes.

Foundations of Options Trading

Master the fundamentals before delving into options trading:

- Options Basics:** Comprehend the concept of calls and puts, expiration dates, and strike prices.

- Market Analysis: Study historical data, economic indicators, and global market sentiment to forecast DXY movements.

- Risk Management: Employ stop-loss orders and calculate risk-to-reward ratios to minimize losses.

Image: www.forbes.com

Trading Strategies

Equip yourself with proven strategies for successful dollar index options trading:

- Bullish Call Options: Predict a rise in the DXY and purchase call options to profit from its appreciation.

- Bearish Put Options: Anticipate a decline in the DXY and buy put options to capitalize on its depreciation.

- Long Strangles: Combine an at-the-money call and put option to gain from significant DXY movements in either direction.

- Short Strangles: Sell an at-the-money call and put option to profit from a prolonged stable DXY outlook.

Expert Insights

Harness the wisdom of industry experts:

- “Dollar index options trading provides a powerful tool for diversifying portfolios and hedging currency risks,” says renowned financial analyst Mark Newton.

- “Carefully analyzing market trends and applying prudent risk management techniques are paramount for consistent success,” advises trading guru Sarah Carter.

Dollar Index Options Trading On Cme

Image: www.gomarkets.ltd

Conclusion

Dollar index options trading on the CME presents an exciting avenue for traders seeking potential profits and risk management strategies. By mastering the fundamental concepts, employing proven techniques, and incorporating expert insights, you can unlock the full power of this dynamic market. As with any investment endeavor, proceed with caution, conduct thorough research, and prioritize risk management to maximize your chances of triumph. The CME’s dollar index options offer a vast universe of opportunity, and with the right approach, you can navigate it with skill and success.