In the realm of investing, options trading is a strategy that involves buying or selling contracts allowing the holder to buy or sell an underlying asset at a predetermined price on or before a certain date. While options trading can be a lucrative endeavor, it is crucial to be aware of the tax implications associated with these transactions. This article delves into the complexities of the tax rate on options trading, providing a comprehensive guide to help you navigate this aspect of investing.

Image: dividendonfire.com

Navigating the Nuances of Options Taxation

Options trading, in essence, involves acquiring a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price within a stipulated time frame. These contracts are traded on exchanges, and their prices are influenced by various factors such as the underlying asset’s price, time until expiration, and risk-free interest rates. Depending on the type of option and the nature of the transaction, different tax rates apply.

Understanding the Tax Treatment of Options

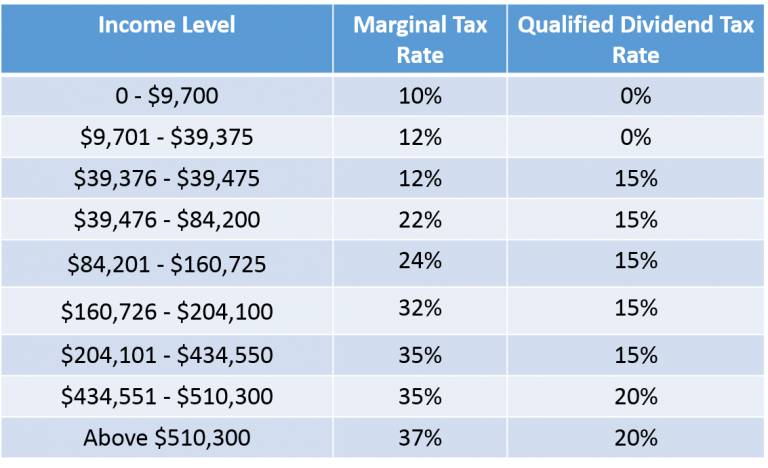

When buying an option, the transaction is considered a capital expense, and the premium paid for the option is added to the cost basis of the underlying asset. This means that when you sell the underlying asset, the premium you paid for the option is considered part of your overall investment cost and is subject to capital gains or losses tax.

On the other hand, when selling an option, the premium received is generally treated as ordinary income and is taxed accordingly. Depending on your tax bracket, this can result in a higher tax rate than capital gains tax rates. It is essential to note that this is true for both selling covered options, where you own the underlying asset, and naked options, where you do not.

Short-Term vs. Long-Term Options

The duration of an option also impacts its tax treatment. Options with an expiration date of less than one year are considered short-term options, and their profits or losses are taxed as ordinary income or loss. Conversely, options with an expiration date of one year or more are considered long-term options, and their gains or losses are eligible for favorable capital gains tax rates.

Image: findwes.com

Tax-Advantaged Accounts and Options Trading

Engaging in options trading within tax-advantaged accounts, such as IRAs or 401(k)s, can offer additional benefits. In these accounts, the investment earnings, including those from options trading, are generally tax-deferred or tax-free depending on the account type. This allows for potential tax savings and the accumulation of wealth over time.

Role of the Wash Sale Rule

The wash sale rule is a tax regulation that prevents investors from selling a losing security and then buying it back within 30 days to claim an immediate tax loss. This rule applies to options as well. If you sell an option at a loss and purchase an identical option within 30 days, the loss will be disallowed for tax purposes, and your cost basis in the new option will be adjusted.

Implications for Options Trading Strategies

Comprehension of the tax implications of options trading is vital for developing effective trading strategies. For instance, if you anticipate short-term gains from an option, it might be advantageous to hold the option for less than a year to qualify for ordinary income tax rates rather than capital gains rates. Conversely, long-term options strategies can leverage favorable capital gains tax rates.

Impact of Straddles and Strangles

Straddles and strangles, two common options trading strategies, involve the simultaneous purchase of both call and put options on the same underlying asset with the same expiration date. In these cases, the tax treatment of the options depends on whether the straddle or strangle is considered a “qualified” trade.

A qualified straddle or strangle meets specific criteria set by the IRS, and the gain or loss from these trades is treated as 60% long-term and 40% short-term, regardless of the holding period. This can result in a combination of capital gains and ordinary income tax treatment.

Taxation of Options in Different Jurisdictions

It is important to note that the tax treatment of options can vary depending on the jurisdiction in which the trading occurs. Factors such as residency, type of account, and tax treaties can influence the applicable tax rates and regulations. It is advisable to consult with a tax professional or seek guidance from the relevant tax authorities to ensure compliance with the specific tax laws in your jurisdiction.

What Is The Tax Rate On Options Trading

Image: accountingplay.com

Conclusion

Understanding the tax rate on options trading is crucial for informed investment decisions. By carefully considering the tax implications of your options transactions, you can optimize your tax strategy, maximize your returns, and minimize your tax liability. Remember to consult with a qualified financial advisor or tax professional for personalized guidance and to stay up-to-date with the latest tax regulations and interpretations.