Introduction

In the realm of finance, options trading emerges as a captivating and lucrative investment strategy, attracting traders seeking to harness the potential for both substantial gains and calculated risks. Options contracts have soared in popularity worldwide, granting individuals the ability to leverage their market understanding to maximize returns. In Thailand, options trading has gained significant traction, reflecting the country’s vibrant financial landscape and investor appetite for innovative trading instruments.

Image: www.youtube.com

Options, in essence, are financial derivatives that bestow upon their holders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price and date. This inherent flexibility empowers traders to speculate on the future direction of asset prices, potentially amplifying their profits while also managing risk exposure. However, options trading entails intricacies that warrant exploration for prudent decision-making.

Fundamentals of Options Trading

Call Options:

Call options grant the buyer the right to acquire an underlying asset at a specified price (strike price) on or before the contract’s expiration date. When market conditions align with the buyer’s predictions, substantial gains can be realized by purchasing the asset at a price below its prevailing market value.

Put Options:

Conversely, put options provide the buyer with the right to sell an underlying asset at a predetermined strike price by a certain date. Traders may utilize put options to hedge against price declines or speculate on market downturns.

Options Premiums:

The initial cost of purchasing an option is known as the premium. Premiums fluctuate based on factors such as the underlying asset’s price volatility, time to expiration, and prevailing market conditions. Traders must carefully evaluate premiums to determine the potential profitability of their trades.

Advantages of Options Trading

Leverage:

Options trading offers significant leverage, enabling traders to control large positions with relatively small capital investments. This inherent leverage can magnify both profits and losses, necessitating prudent risk management strategies.

Flexibility:

Options contracts provide traders with remarkable flexibility, allowing them to tailor strategies based on market expectations and risk tolerance. Whether seeking to hedge existing positions or pursue speculative opportunities, options offer versatile applications.

Limited Risk:

In contrast to traditional stock ownership, options trading limits potential losses to the initial premium paid. Prudent option selection and position sizing can assist in mitigating downside risks while preserving capital.

Challenges in Options Trading

Complexity:

Options trading involves inherent complexities that can pose challenges to novice traders. Understanding the intricacies of options contracts, including strike prices, expiration dates, and greeks (measures of option price sensitivity), is crucial for informed decision-making.

Volatility Risk:

Options premiums are highly influenced by the underlying asset’s price volatility. Unforeseen market fluctuations can significantly impact the value of options contracts, potentially eroding profits or exacerbating losses.

Expiration Dates:

Options contracts have finite lifespans, with values decaying as expiration dates approach. Traders must carefully consider the timing of their trades to optimize returns and avoid potential expiration-related losses.

Image: dcf.fm

What Is Options Trading In À¸ À¸²à¸©À¸²à¹„À¸—À¸¢

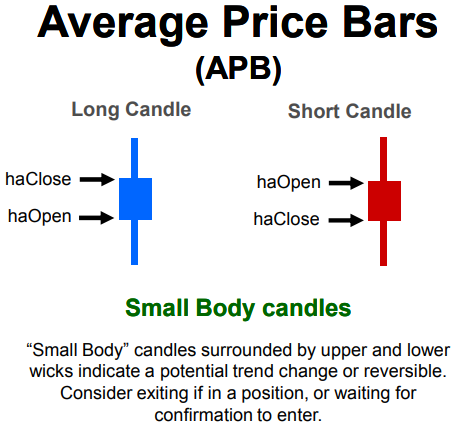

Image: www.forexfactory.com

Conclusion

Options trading in Thailand presents an arena of opportunities and challenges for discerning investors. By embracing the intricacies of options contracts and employing diligent risk management strategies, traders can harness the potential for financial gains while mitigating potential setbacks. As with any investment endeavor, meticulous research, a deep understanding of market dynamics, and a disciplined approach are paramount for maximizing the rewards of options trading.