Understanding Mark-to-Market Valuation

Mark-to-market (MTM) valuation is a crucial concept in options trading that estimates the fair market value of an option contract at any given time. It’s a hypothetical price that reflects the current market conditions and factors in various variables that influence option pricing. Unlike other financial instruments, the value of an option can fluctuate significantly between its purchase and expiration date due to external and exchange-based factors.

Image: www.tradingmatica.net

Significance of MTM in Options Trading

MTM plays a significant role in options trading for several reasons. Firstly, it provides traders with an up-to-date assessment of their positions. By tracking the MTM, traders can monitor the potential profit or loss associated with an option and make informed decisions about whether to hold, sell, or adjust their positions. Secondly, it allows traders to manage risk more effectively. By understanding the MTM, traders can identify potential losses and take necessary steps to mitigate them, such as implementing hedging strategies or adjusting their exposure.

Factors Influencing MTM for Options

The MTM valuation of an option is influenced by several key factors, including:

- Underlying Asset Price: The MTM of an option is directly tied to the price of the underlying asset. As the underlying asset price fluctuates, so will the option’s MTM.

- Time to Expiration: The time remaining until an option contract expires plays a crucial role in its MTM. As the expiration date approaches, the MTM of an option typically decreases.

- Volatility: The implied volatility associated with an option contract is a measure of how much the underlying asset’s price is expected to fluctuate. Higher implied volatility can lead to higher MTM for options.

- Interest Rates: Interest rates can affect the MTM of options, particularly forward contracts. Changes in interest rates can influence the time value of options.

- Dividend Yield: For options on dividend-paying stocks, dividend yield can influence the MTM. Ex-dividend dates can impact the option’s value.

Tips and Expert Advice for Using MTM

Here are a few tips and pieces of expert advice to leverage MTM effectively in options trading:

- Monitor MTM Regularly: Keep track of the MTM of your options positions regularly to monitor their performance and make necessary adjustments.

- Set Realistic Expectations: Understand that MTM is an estimate and can fluctuate rapidly. Avoid making trading decisions solely based on short-term MTM changes.

- Consider Underlying Asset Trends: Analyze the underlying asset’s historical trends and future expectations to forecast potential price movements and their impact on option MTM.

- Hedge if Necessary: Use hedging strategies to manage risk associated with options positions. Identify other instruments that can offset losses.

Image: www.fxcm.com

FAQs on MTM in Options Trading

Q: How often is MTM calculated for options?

A: MTM is continuously calculated throughout the trading day to reflect real-time market conditions.

Q: Can MTM be used to predict future option prices?

A: While MTM provides an estimate of current value, it’s not a reliable predictor of future option prices. Future prices are influenced by various additional factors.

Q: What are the benefits of using MTM in options trading?

A: MTM helps traders monitor positions, manage risk, make informed trading decisions, and adapt to changing market conditions.

Q: How do I incorporate MTM into my trading strategy?

A: Set realistic profit targets based on MTM estimates, adjust positions as needed, and monitor underlying asset trends to anticipate price movements.

What Is Mtm In Options Trading

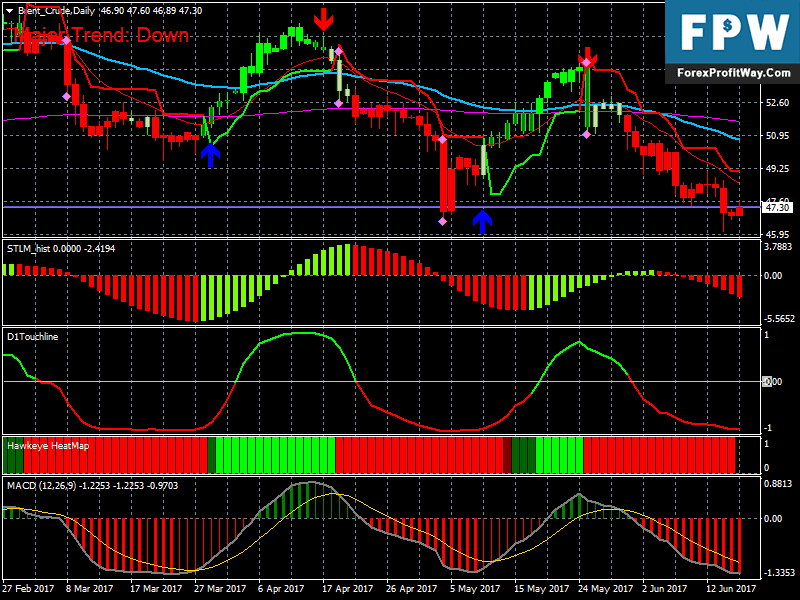

Image: forexprofitway.com

Conclusion

Mark-to-market (MTM) is an essential concept in options trading. By understanding MTM and considering the factors that influence it, traders can gain valuable insights into the current market value of their positions, make informed decisions, and manage risk effectively. It’s crucial to remember that MTM is an estimate and should be used in conjunction with comprehensive market analysis and trading strategies.

Are you interested in delving deeper into the realm of options trading and mastering the art of MTM valuation? Explore related articles, join trading forums, and connect with experienced traders to enhance your knowledge and gain actionable insights.