Navigating the Maze of Options Trading on Trading 212

In the ever-evolving realm of financial trading, options have emerged as a versatile and potentially lucrative tool. Their ability to hedge risk, amplify gains, and provide leverage has piqued the interest of both seasoned investors and those seeking to venture into the world of derivatives. However, navigating the complexities of options trading can be daunting, particularly for beginners. This comprehensive guide delves into the intricate details of options trading on Trading 212, empowering you with the knowledge and understanding necessary to make informed decisions.

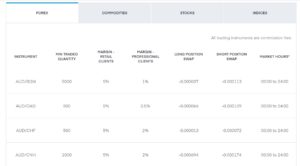

Image: buyshares.co.uk

Understanding the Basics of Options Trading

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain timeframe. This unique characteristic differentiates options from traditional stocks, which represent ownership in a company and confer the right to buy or sell shares at any time. Options trading can enhance your portfolio by providing additional strategies for managing risk, generating income, and pursuing speculative opportunities.

There are two main types of options: calls and puts. Call options give the holder the right to buy the underlying asset, while put options grant the right to sell. The strike price refers to the predetermined price at which the underlying asset can be bought or sold, and the expiration date marks the end of the option’s validity.

Trading Options on Trading 212

Trading 212 is a popular online trading platform that offers a user-friendly interface and a wide range of financial instruments, including options. To trade options on Trading 212, you will need to create an account and fund it with sufficient capital. Options contracts are typically priced per share of the underlying asset, and the overall cost of an option will vary depending on factors such as the strike price, expiration date, and volatility of the underlying asset.

When purchasing an option, you are essentially paying a premium to acquire the right to exercise the option at a later date. The premium you pay will be influenced by the same factors that determine the overall cost of an option contract. It is important to carefully consider the potential risks and rewards associated with options trading before entering into any contracts.

Tips and Expert Advice for Options Trading

To enhance your success in options trading, it is essential to seek guidance from experienced traders and industry professionals. Here are some valuable tips and expert advice to help you navigate the complexities of this market:

- Start with paper trading: Before risking real capital, practice options trading using a paper trading platform. This allows you to simulate real-world conditions without jeopardizing your funds.

- Choose liquid options: Opt for options with high trading volume and open interest to ensure that you can easily enter and exit positions.

- Understand the Greeks: The Greeks are a set of metrics that measure the sensitivity of an option’s price to changes in various factors. Understanding the Greeks can help you make informed decisions about option selection and risk management.

- Set realistic profit targets: Avoid chasing unrealistic profits and instead focus on setting achievable goals. Options trading involves risk, and it is important to have a clear understanding of your risk tolerance and financial objectives.

- Seek professional advice: If you are unsure about any aspect of options trading, do not hesitate to consult with a financial advisor or experienced broker.

Image: www.nutsaboutmoney.com

Frequently Asked Questions (FAQs)

- Q: Can I buy options on Trading 212?

A: Yes, Trading 212 offers options trading on a wide range of underlying assets. - Q: How do I trade options on Trading 212?

A: Create an account, fund it, and follow the platform’s instructions to place option orders. - Q: What is the minimum capital required to trade options on Trading 212?

A: The minimum capital requirement may vary depending on the option contract you are considering. - Q: What are the risks involved in options trading?

A: Options trading involves risk of financial loss. It is important to carefully consider the potential risks and rewards before entering into any contracts. - Q: How can I learn more about options trading?

A: Seek guidance from erfahren traders, study industry resources, and consider taking a course on options trading.

Can You Buy Options On Trading 212

Conclusion

Options trading on Trading 212 can be a powerful tool for enhancing your investment strategies and pursuing financial growth. By understanding the basics, following expert advice, and managing risk diligently, you can unlock the potential of this versatile financial instrument.

Are you interested in delving deeper into the world of options trading? Join a trading community, engage in further research, and immerse yourself in the dynamic and rewarding realm of financial derivatives.