Embrace Financial Freedom through Strategic Option Trading

Have you ever dreamt of venturing into the world of option trading, seeking the allure of limitless earning potential? Join the ranks of countless individuals who have harnessed the power of options to transform their financial destinies. With this comprehensive guide, we’ll delve into the intricacies of option trading strategies, empowering you with the knowledge and skills to conquer the markets fearlessly.

Image: www.projectfinance.com

Understanding Option Trading: A Gateway to Market Mastery

Option trading, the enchanting realm where sophisticated investors gather, presents a landscape of lucrative opportunities. At its core, an option contract bestows upon its bearer the profound ability to purchase or sell an underlying asset at a predetermined price on a specific date. This versatile instrument holds the unparalleled potential to accentuate market gains while mitigating potential risks.

The allure of option trading lies in its inherent flexibility, empowering traders to craft custom strategies tailored to their risk tolerance and investment horizons. An arsenal of option-based strategies beckons at your fingertips, meticulously designed to capture market nuances and yield handsome returns.

Diving into Option Trading Strategies: A Panoply of Possibilities

-

Call Options: A Bullish Gambit for Ascending Markets

When market optimism reigns supreme, call options emerge as the beacon of profit. These contracts bestow upon the bearer the right to purchase an underlying asset at a set price on a designated date. In a relentlessly bull market, the value of call options skyrockets, enriching their holders with substantial gains.

-

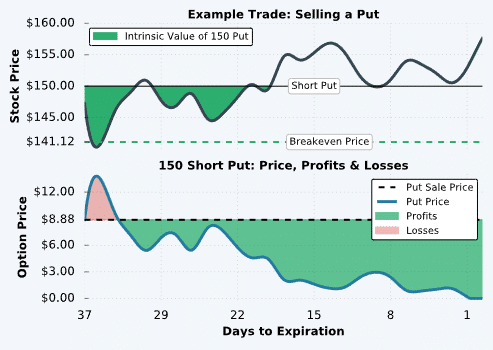

Put Options: Your Shield in Bearish Markets

Prepare for market downturns with the protective power of put options. These contracts grant the bearer the privilege of selling an underlying asset at a set price on a specified date. Amidst market chaos and plummeting stock values, put options serve as a sanctuary, guarding against financial storms.

-

Covered Calls: Supercharge Your Stock Holdings

Amplify your income streams by artfully combining covered calls with your existing stock portfolio. Sell call options on stocks you own, generating additional revenue while maintaining ownership of your underlying. This strategy proves especially lucrative in range-bound markets, capitalizing on fluctuating premiums.

-

Protective Puts: Insulate Your Portfolio from Market Turbulence

Safeguard your investments from unexpected market volatility with the astute deployment of protective puts. These options confer the right to sell an underlying asset at a predetermined price, safeguarding your capital from steep market declines. With protective puts, you’ll sleep soundly, knowing that your portfolio remains shielded from adverse market conditions.

-

Iron Condors: Forge Profits amid Market Tranquility

When the markets display a serene lack of volatility, iron condors beckon as a veritable treasure trove of income. This astute strategy simultaneously sells both call and put options of differing strike prices and expiration dates. Iron condors thrive in low-volatility environments, generating steady premiums as markets meander within a predictable range.

Navigating the Nuances of Option Trading

-

Strike Price: The Line of Demarcation

The strike price serves as the battleground where options collide. For call options, a higher strike price elevates the breakeven point at which profitability emerges. Conversely, put options flourish with lower strike prices, lowering the point of profitability.

-

Expiration Date: The Crucible of Time

Options exist on a time-sensitive dance floor, with expiration dates marking their inevitable demise. This fleeting nature underscores the constant race against time for option traders, requiring strategic timing and meticulous execution.

-

Premiums: The Price of Opportunity

Premiums represent the cost of purchasing an option contract, acting as a gateway to the world of potential profits. Option pricing is a complex dance, influenced by a symphony of factors, including underlying asset price, volatility, time to expiration, and risk-free interest rates.

Image: s3.amazonaws.com

FAQs: Deciphering the Enigma of Option Trading

Q: What is the minimum capital required for option trading?

A: This varies depending on the brokerage and strategy employed, but generally, a few thousand dollars is a prudent starting point.

Q: Is option trading suitable for beginners?

A: While option trading offers potentially lucrative returns, it also entails significant risks. Beginners should approach it cautiously, armed with thorough research and education.

Q: How can I mitigate risks in option trading?

A: Knowledge is power! Bolster your defenses with sound market analysis, risk management strategies, and a disciplined approach to trading.

Option Trading Strategies With Example

Embrace the Call to Action: Elevate Your Financial Journey

Unleash your inner financial power with the mastery of option trading strategies. Dive into the world of options with purpose, guided by this comprehensive guide. Embrace the opportunity to transform your financial destiny, harnessing the limitless potential of the options market.

Are you ready to unlock the secrets of option trading and embark on a journey of financial empowerment? Seize this moment and witness your financial future soar to new heights.