Introduction

Imagine yourself as a driver on a high-stakes race track, where the allure of speed and the potential for victory entice you. However, in this analogy, the vehicle you drive is your trading account, and the track represents the fast-paced world of options trading. Just as race cars require advanced features and enhancements to maximize performance, options trading demands a specialized account known as a margin account.

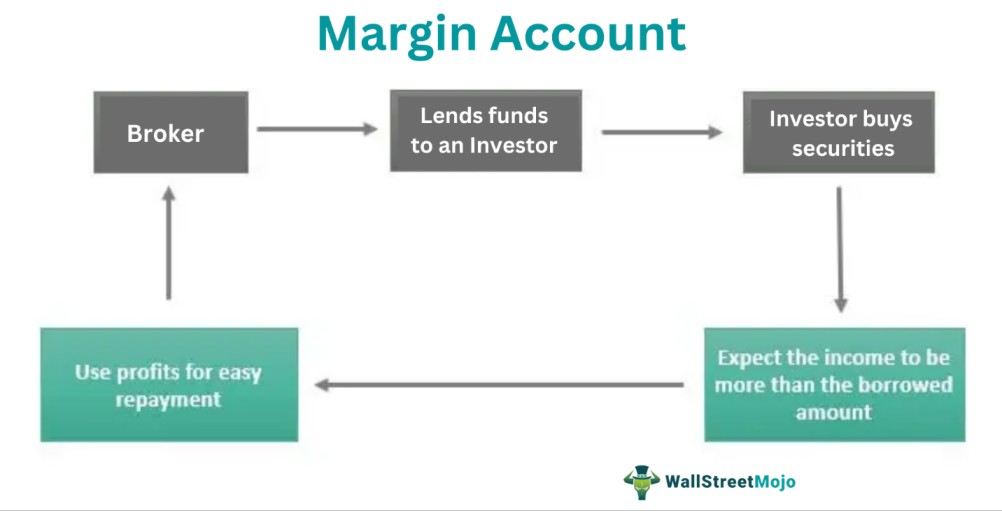

Image: www.wallstreetmojo.com

In this comprehensive guide, we’ll delve into the intriguing world of margin accounts in options trading. We’ll explore their mechanics, unravel their inherent risks, and provide indispensable tips and expert advice to empower you on your trading journey. Read on to gain a deeper understanding of these accounts and harness their potential for enhanced profits while mitigating associated risks.

Margin Accounts: A Deeper Dive

What is a Margin Account?

In essence, a margin account is a brokerage account that allows traders to borrow funds from their brokers to increase their buying power. This borrowed money, known as margin, can significantly amplify a trader’s potential profits. However, it’s crucial to remember that this amplification also magnifies potential losses.

Leverage and Margin Ratio

The concept of leverage plays a central role in margin trading. Leverage refers to the ratio of borrowed funds to the trader’s own capital. For instance, a leverage ratio of 2:1 indicates that for every $1 of their own funds, the trader can access $2 in margin. This leverage allows traders to control a larger portfolio with a smaller initial investment, potentially increasing their returns.

Image: www.schwab.com

Eligibility and Requirements

Obtaining a margin account is not automatic. Brokerage firms typically subject applicants to a stringent evaluation process that considers factors such as net worth, trading experience, and investment objectives. To be eligible for a margin account, traders generally need to maintain a minimum account balance, meet certain income or asset requirements, and possess a thorough understanding of options trading strategies.

Risks Associated with Margin Accounts

While margin accounts offer the tantalizing prospect of higher profits, they also carry inherent risks that traders must carefully consider. One of the primary risks is the possibility of a margin call. A margin call occurs when the account’s equity falls below a predetermined maintenance margin requirement. In such a scenario, the trader is obligated to deposit additional funds or liquidate positions to restore the account to the required equity level.

Another significant risk associated with margin trading is the potential for unlimited losses. Unlike regular trading accounts where losses are limited to the amount of invested capital, margin accounts can result in losses that exceed the initial investment. This is because the borrowed funds used to increase buying power can also amplify losses.

Expert Advice and Tips for Margin Trading

Plan and Manage Risk Effectively

Effective risk management is paramount in margin trading. Traders should meticulously plan their trades, carefully considering potential risks and rewards. It’s prudent to establish clear stop-loss orders to limit potential losses and avoid catastrophic outcomes.

Understand Leverage Limits

It’s crucial to fully comprehend the leverage limits imposed by your brokerage firm. These limits vary among brokers and are typically based on factors such as account size and trading experience. Exceeding leverage limits can lead to margin calls and substantial financial losses.

FAQ on Margin Accounts

Q: Can anyone open a margin account?

A: No, eligibility for margin accounts typically requires meeting certain criteria, such as net worth, trading experience, and investment objectives.

Q: What is a margin call?

A: A margin call is a demand by the brokerage firm to deposit additional funds or liquidate positions to restore the account to the required equity level.

Q: Can I lose more money than I invest in a margin account?

A: Yes, margin trading carries the risk of unlimited losses, as the borrowed funds used to increase buying power can also amplify losses.

What Is Margin Account With Options Trading

Image: centerpointsecurities.com

Conclusion

Margin accounts in options trading offer the tantalizing promise of higher profits, but it’s imperative to fully grasp the inherent risks involved. Careful planning, effective risk management, and a thorough understanding of leverage limits are essential for navigating the complexities of margin trading. Armed with the insights provided in this comprehensive guide, you can harness the potential of margin accounts while mitigating associated risks. Embark on your trading journey with confidence, always conscious of the delicate balance between potential rewards and potential pitfalls.

Are you intrigued by the world of margin accounts in options trading? Share your thoughts and questions in the comments below. Your engagement and curiosity will help foster a vibrant and informative discussion on this captivating subject.