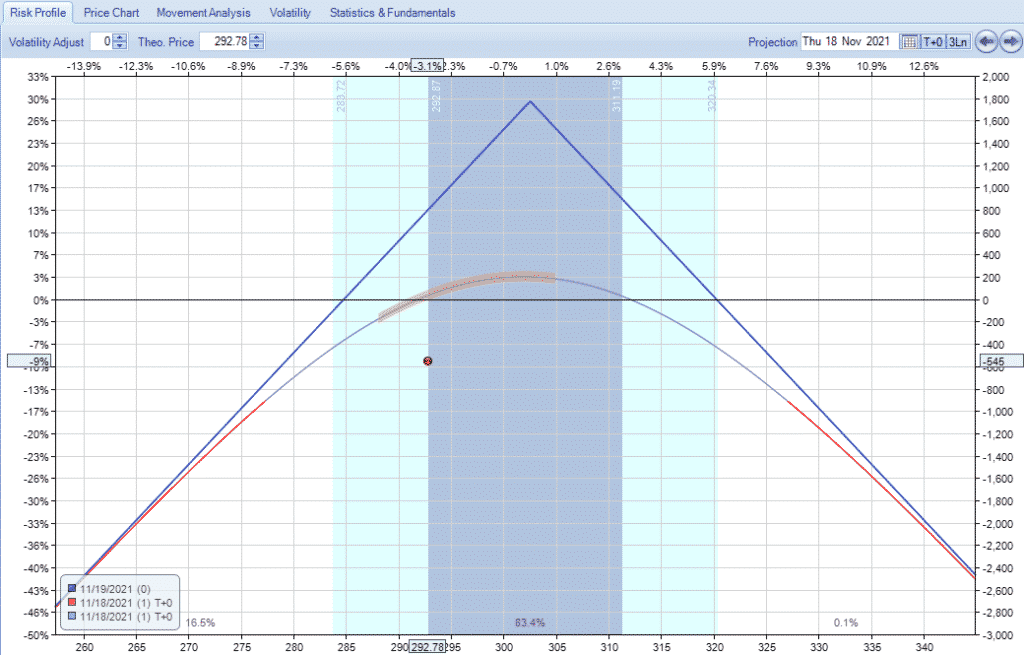

In the realm of options trading, implied volatility (IV) plays a pivotal role, and its sudden and significant drop, known as IV crush, can have profound implications. IV crush refers to the phenomenon where the implied volatility of an option contract plummets sharply around an earnings announcement or other major event. This abrupt volatility contraction often occurs due to the reduced uncertainty surrounding the underlying asset’s price, leading to narrower trading ranges and potentially significant losses for options traders.

Image: optionstradingiq.com

Understanding Implied Volatility: The Key to Options Trading

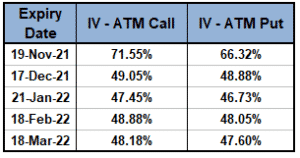

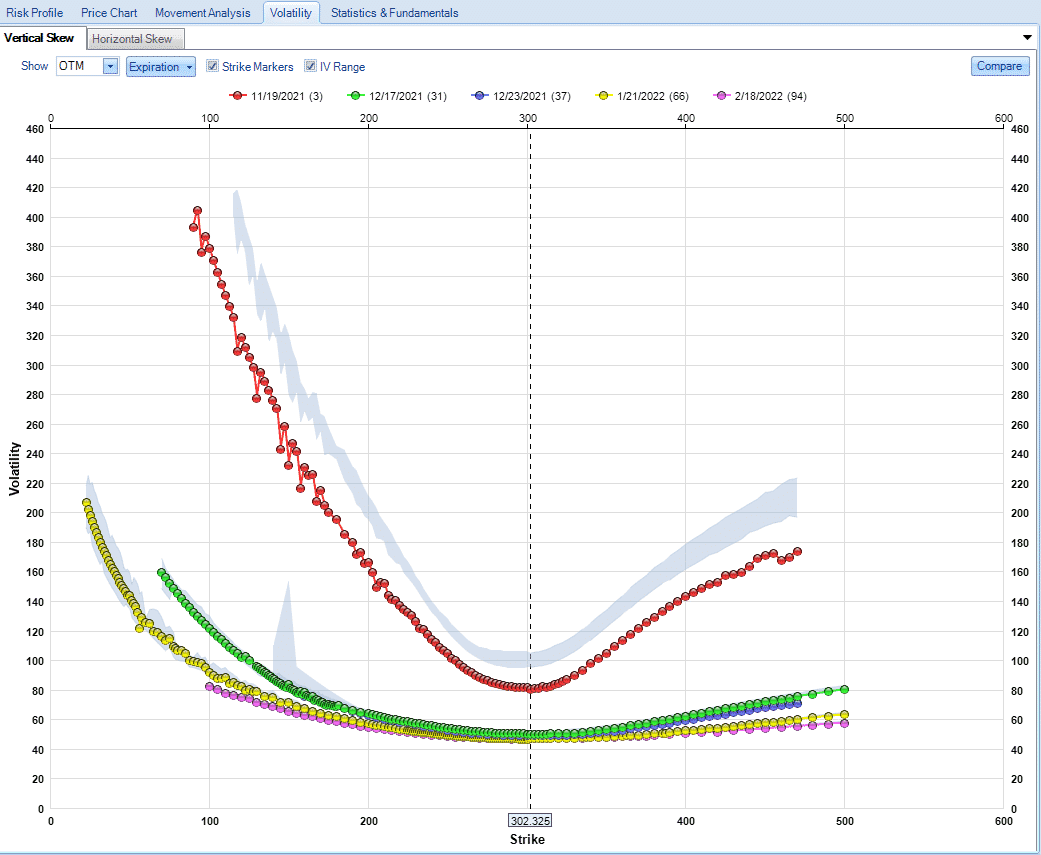

To grasp the essence of IV crush, it’s essential to understand implied volatility. IV is a measure of the market’s perception of the future volatility of an underlying asset. Before significant events, such as earnings announcements or economic data releases, uncertainty and anticipation run high, and IV tends to be correspondingly elevated. However, once the event occurs and actual volatility is realized, the market adjusts, and IV often undergoes a substantial correction, giving rise to the IV crush phenomenon.

The Impact of IV Crush on Options Strategies

IV crush can exert a dramatic impact on different options strategies. Strategies that rely on elevated IV, such as selling naked options, covered calls, and short strangles, are particularly vulnerable to IV crush. These strategies generate income from options premiums, but when IV drops sharply, the value of the options they sell plummets, leaving traders exposed to potential losses.

Conversely, strategies that benefit from lower IV, such as buying long options, can capitalize on IV crush. By purchasing options at higher implied volatility levels and then benefiting from the subsequent IV contraction, traders can potentially generate substantial profits. However, it’s important to note that IV crush does not always occur, and predicting the timing and magnitude of its impact can be challenging.

Timing the IV Crush: A Game of Precision and Uncertainty

Accurately predicting the timing of IV crush is crucial for maximizing gains or minimizing losses. Many traders rely on historical data and market sentiment to anticipate when IV might decline. Volatility indices, such as the VIX, which measures the implied volatility of the S&P 500 index options, can also provide valuable insights. However, it’s important to emphasize that IV crush is inherently unpredictable, and even experienced traders may encounter unforeseen market conditions.

Image: optionstradingiq.com

Risk Management in the Shadow of IV Crush

Managing risk in the face of IV crush requires prudent strategies and careful position sizing. For strategies sensitive to IV changes, smaller positions or spreading out positions over different expiration dates can help mitigate potential losses. Additionally, having a clear understanding of the potential impact of IV crush on different strategies and market conditions is paramount.

What Is Iv Crush In Options Trading

Image: optionstradingiq.com

The Ever-Evolving Options Landscape

The options market is a dynamic and ever-evolving landscape, and IV crush is a recurring phenomenon that traders must be aware of to navigate successfully. By understanding the nature of IV, its impact on different strategies, and the challenges and opportunities it presents, traders can improve their decision-making and adapt to changing market conditions effectively.