In the ever-evolving landscape of financial markets, options trading stands out as a sophisticated strategy with the potential to yield substantial returns. However, navigating the complexities of options can be daunting, even for seasoned investors. That’s where option trading strategy graphs come into play.

Image: www.pinterest.com

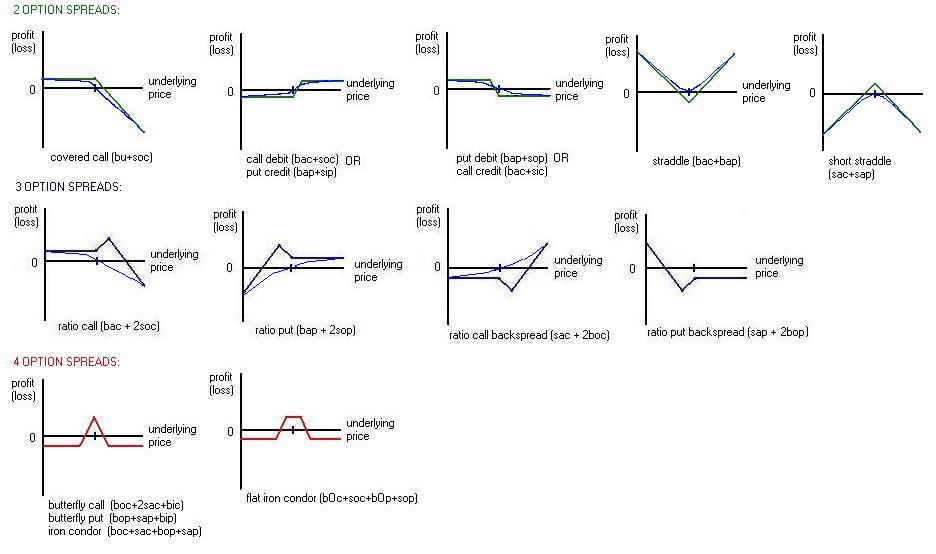

Visualizing options data through graphs provides traders with a valuable tool to understand market trends, assess risk, and make informed decisions. Join us as we delve into the world of option trading strategies and explore how graphs can empower you to seize opportunities and mitigate risks in this dynamic market.

Unveiling the Nuances of Option Trading

Options are contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on a specified date (expiration date). By understanding these fundamental concepts, you can set the foundation for navigating the intricacies of option trading.

Graphs: A Window into the Options Universe

Similar to stock or forex charts, option trading strategy graphs provide a visual representation of key data points, enabling traders to interpret fluctuations in option prices over time. These graphs depict variables like implied volatility, historical volatility, and open interest, shedding light on market sentiment and potential trading opportunities.

Decoding the Language of Option Trading Graphs

Navigating option trading graphs requires familiarization with specific indicators and patterns. Let’s decipher some of the most crucial elements:

-

Implied Volatility: This line measures market expectations of future volatility. A higher implied volatility suggests traders anticipate significant price swings in the underlying asset.

-

Historical Volatility: This metric indicates the actual volatility of the underlying asset over a specified period, displaying the extent to which its price has fluctuated in the past.

-

Open Interest: This statistic reflects the total number of outstanding option contracts for a given strike price and expiration date, revealing the level of market participation.

Identifying Trends and Spotting Opportunities

By analyzing option trading strategy graphs, traders can identify emerging trends and potential trading opportunities. Here are a few common patterns to watch for:

-

Rising Implied Volatility: Spikes in implied volatility signal anticipation of increased price action. This could indicate an opportune time to sell options to capitalize on the anticipated volatility.

-

Low Historical Volatility: Conversely, low historical volatility may present an opportunity to purchase options as the underlying asset is predicted to fluctuate within a narrow range.

-

Increasing Open Interest at Specific Strike Prices: High open interest at a particular strike price suggests that traders are expecting a significant move in the underlying asset towards that price level.

Expert Insights and Actionable Tips

To empower you further, let’s tap into the insights of industry experts and provide practical tips for using option trading strategy graphs:

-

Start with the Basics: Before diving into complex strategies, establish a solid foundation by understanding the fundamental concepts of options trading.

-

Leverage Historical Data: Analyze historical option trading graph data to identify patterns and make informed predictions about future behavior.

-

Consider Correlation: Explore the correlation between option strategies and other market variables, such as stock prices or economic indicators, to refine your trading decisions.

Conclusion: Empowered Trading Decisions

Option trading strategy graphs are indispensable tools that unlock the complexities of this lucrative market. By interpreting these graphs with skill, traders gain a clear understanding of market dynamics, potential trends, and hidden opportunities. Armed with this knowledge, you can confidently navigate the world of options trading and make informed decisions that lead to enhanced portfolio performance. Remember that education is paramount, and with dedicated practice, you can master the art of option trading and harness its potential for financial success.

Image: ferreteriavyc.com.ar

Option Trading Strategies Graph

Image: www.optionstar.com