In the ever-evolving financial landscape, options trading has emerged as a powerful tool for investors seeking to navigate market volatility and potentially maximize their returns. At the heart of successful options trading lies a deep understanding of options trading graphs, which provide invaluable insights into market trends and price fluctuations. This comprehensive guide will delve into everything you need to know about options trading graphs, empowering you to make informed decisions and enhance your trading strategies.

Image: www.binaryoptionsu.com

Defining Options Trading Graphs: A Window into Market Dynamics

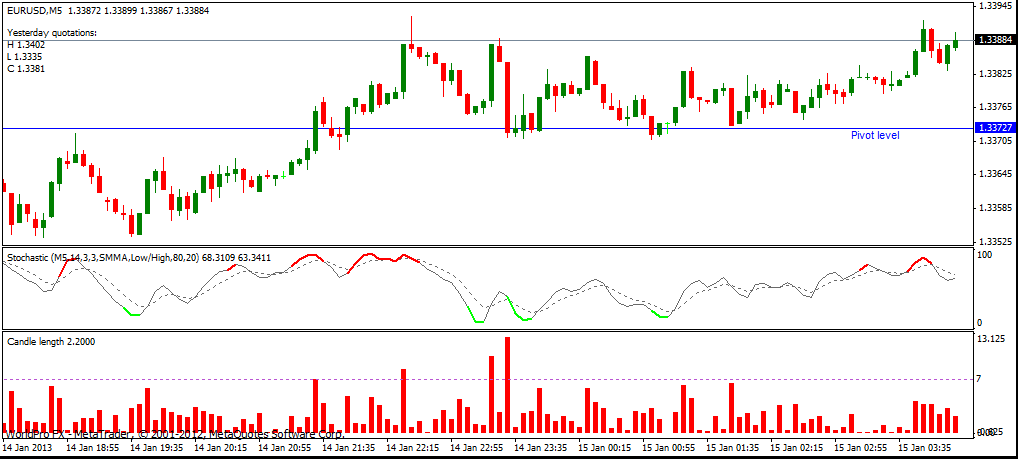

Options trading graphs, also known as options charts, are graphical representations that depict the relationship between an option’s price and its underlying asset’s price. These graphs allow traders to visualize how options prices change in response to market fluctuations and identify potential trading opportunities.

The vertical axis of an options trading graph represents the option’s price, while the horizontal axis represents the price of the underlying asset. Lines or candlesticks are used to plot the option’s price over time, providing a clear visual representation of its performance.

Essential Elements for Interpreting Options Trading Graphs

To effectively interpret options trading graphs, traders must familiarize themselves with several key elements:

- Strike Price: The price at which the underlying asset can be bought or sold under the terms of the option contract.

- Expiration Date: The date on which the option contract expires and becomes worthless if unexercised.

- Option Type: There are two main types of options: calls, which give the holder the right to buy the underlying asset, and puts, which give the holder the right to sell the underlying asset.

- Time Value: The portion of an option’s price that reflects the remaining time until its expiration date.

Technical Indicators: Unlocking Valuable Insights

Options trading graphs become even more powerful when coupled with technical indicators, which are mathematical formulas that analyze historical price data to identify potential trading patterns and trends. Some of the most widely used technical indicators include:

- Moving Averages: Lines plotted on a graph that represent the average price of an option or underlying asset over a specified period.

- Bollinger Bands: Envelopes that plot the standard deviation of an option’s price around its moving average, indicating potential overbought or oversold conditions.

- Relative Strength Index (RSI): A momentum indicator that measures the magnitude of recent price changes.

By incorporating technical indicators into their analysis, traders can gain valuable insights into market momentum, potential trend reversals, and oversold or overbought conditions, enhancing their decision-making process.

Image: sanapidyqel.web.fc2.com

Real-World Applications of Options Trading Graphs

Options trading graphs are not merely theoretical concepts; they have practical applications in the real world of investing. Traders use these graphs to:

- Identify Trading Opportunities: By studying options trading graphs, traders can spot potential trading opportunities based on technical indicators, price patterns, and market trends.

- Assess Risk: Options trading graphs provide visual cues that help traders assess the potential risk associated with an options trade before entering into a contract.

- Manage Positions: Traders can use options trading graphs to monitor the performance of their existing options positions and make informed decisions about adjustments or adjustments or exits.

Options Trading Graphs

Empowering Traders: Leverage Options Trading Graphs for Success

Understanding and interpreting options trading graphs is a crucial skill for traders who want to navigate the complex world of options trading. By mastering these graphs and incorporating technical indicators into their analysis, traders can gain a competitive edge in the market, increase their trading effectiveness, and ultimately achieve their financial goals.

Remember, options trading carries inherent risks. Always conduct thorough research, consult financial professionals, and consider your personal risk tolerance before making any trading decisions. With the guidance provided in this comprehensive guide, you can embark on your options trading journey with confidence, equipped with the knowledge necessary to unlock the potential of options trading graphs.