In the labyrinthine world of financial markets, equities options trading emerges as a captivating dance of strategy and risk-taking. This intricate workflow requires a symphony of understanding and meticulous planning to navigate its delicate terrain. Enter this article, your trusted guide to orchestrating an effective equities options trading workflow.

Image: arebapinuho.web.fc2.com

Understanding the Options Universe

At its core, an option grants you the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price on or before a specific date. These financial instruments dance on the stage of volatility and time value, offering traders a multifaceted toolkit to manage risk and enhance their trading prowess.

Navigating the Workflow

Equity options trading typically follows a structured workflow:

-

Market Analysis: Delve into the depths of market research, examining economic indicators, company fundamentals, and technical analysis. Identify potential trading opportunities and assess the inherent risk.

-

Strategy Formulation: Craft a trading strategy tailored to your risk tolerance, investment horizon, and market outlook. Choose from a symphony of option strategies, each designed to dance to a unique market rhythm.

-

Option Selection: With your strategy in hand, it’s time to select the specific options contracts. Consider the strike price, expiration date, and option premium. Each element plays its own part in the grand scheme of your trading plan.

-

Order Placement: Enter the trading arena and execute your order through a brokerage account. Fine-tune your order parameters, including order type, quantity, and price limits.

-

Trade Management: Once your trade is live, a watchful eye is crucial. Monitor market movements, adjust your strategy as needed, and consider closing or adjusting your position to manage risk and optimize returns.

-

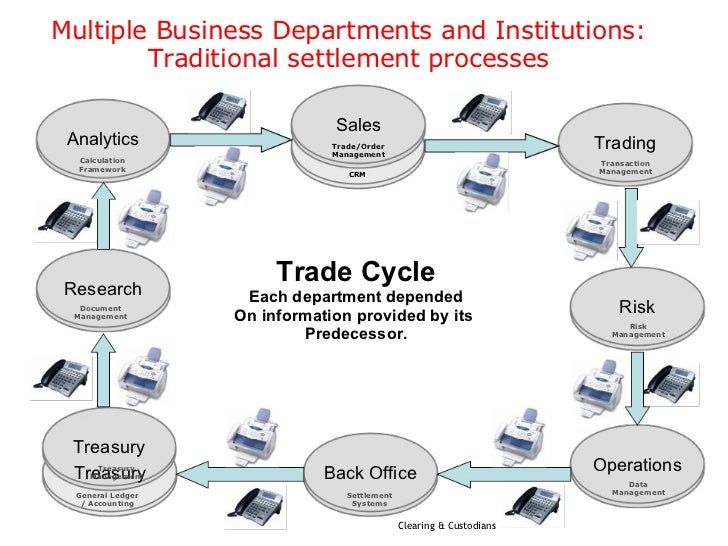

Settlement: As the expiration date approaches, the options contract nears its resolution. Understand the settlement process for both assigned and unexercised options.

Expert Insights

From the hallowed halls of trading wisdom, esteemed experts lend their guidance:

-

“Thorough research is the cornerstone of successful options trading.” – Warren Buffett

-

“Manage risk by diversifying your option strategies and never exceed your risk tolerance.” – Mark Cuban

-

“Technical analysis can provide valuable insights into market patterns, but always consider it within the broader context of market fundamentals.” – Steve Eisman

Unleash Your Trading Prowess

Embark on your path to equities options trading mastery by:

-

Educating Yourself: Immerse yourself in the world of options trading through books, articles, and online courses.

-

Practicing with Simulators: Before venturing into the live market, hone your skills on paper trading or simulation platforms.

-

Consulting with a Financial Advisor: Seek the counsel of a qualified financial advisor to tailor an options trading strategy aligned with your individual circumstances.

Remember, the dance of equities options trading demands skill, perseverance, and a clear understanding of the risks involved. Embrace this journey with a thirst for knowledge, a keen eye for opportunities, and a unwavering commitment to prudent risk management. Unleash the power of this transformative financial instrument and let your trading prowess soar.

Image: www.tweakbiz.com

Equities Options Trading Workflow

Image: www.bestexecution.net