Introduction

Image: www.thetechedvocate.org

In the dynamic world of financial markets, futures and options stand as powerful tools that empower traders to manage risk, enhance returns, and capitalize on market trends. These complex instruments play a pivotal role in modern investment strategies, allowing individuals to delve into different corners of the financial world. However, navigating the intricacies of futures and options can be daunting, especially for those venturing into these markets for the first time. This comprehensive guide will unravel the labyrinth of futures and options, providing you with a deep understanding of their nature, mechanisms, and potential in trading.

What are Futures?

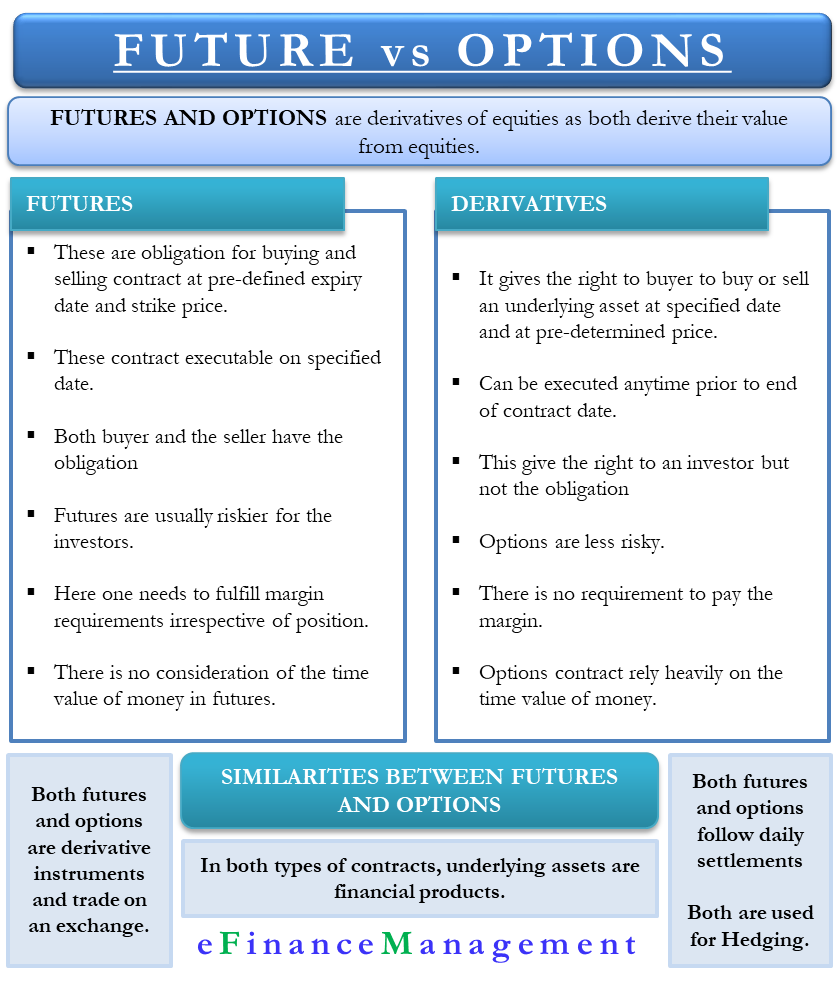

Futures contracts are standardized agreements that obligate the buyer to purchase a specified quantity of an underlying asset, such as a commodity, index, or currency, at a predetermined price on a future date. Essentially, the buyer “locks in” today’s price for a future delivery of the asset. Futures offer a unique means of hedging against price fluctuations and managing risk, making them valuable tools for both speculators and businesses.

What are Options?

Options, on the other hand, provide traders with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a certain date. Unlike futures, options grant traders the flexibility to exercise their rights at their discretion, allowing them to tailor their strategies to their specific investment goals.

How Futures and Options Differ

While both futures and options involve contractual agreements, they differ in several key aspects. Futures contracts are binding obligations that require the buyer to purchase or the seller to deliver the underlying asset on the settlement date. Options, however, provide the holder with the optionality to exercise or not exercise their rights, offering greater flexibility and control.

The Benefits of Futures and Options

The allure of futures and options lies in their numerous advantages. These instruments enable traders to:

- Hedge risk: Protect against adverse price movements in the underlying asset.

- Enhance returns: Leverage market fluctuations to generate potential profits.

- Manage volatility: Offset price fluctuations and mitigate risk in volatile market conditions.

- Speculate on price movements: Make predictions about future prices and reap rewards from market trends.

Real-World Applications

Futures and options find widespread applications in various sectors of the financial industry. They are commonly utilized by:

- Commodities traders: Hedge against price fluctuations in agricultural products, energy, and metals.

- Asset managers: Manage portfolio risk and capture investment opportunities.

- Institutional investors: Engage in sophisticated trading strategies and risk management.

- Retail investors: Supplement their investment portfolios and explore alternative sources of returns.

Getting Started with Futures and Options

Venturing into the realm of futures and options requires a thorough understanding of the underlying concepts, market dynamics, and risk management principles. Aspiring traders should consider the following steps:

- Educate yourself: Familiarize yourself with the basics of futures and options, their underlying mechanisms, and market behaviors.

- Choose a reliable broker: Partner with a regulated and reputable broker that offers access to futures and options markets.

- Develop a trading plan: Define your investment goals, risk tolerance, and trading strategy before engaging in any trades.

- Manage risk prudently: Employ risk management techniques such as stop-loss orders and diversification to mitigate potential losses.

- Monitor the market: Stay up-to-date with market news, economic data, and technical analysis to make informed trading decisions.

Conclusion

Futures and options are versatile financial instruments that empower traders of all levels to navigate the complexities of financial markets. Their flexibility, risk management capabilities, and potential for enhancing returns make them indispensable tools in the arsenal of modern traders. By understanding the intricacies of these instruments, mastering risk management techniques, and leveraging market insights, you can harness the power of futures and options to achieve your financial objectives. Remember, trading carries inherent risks, and it is crucial to approach these markets with a well-informed and prudent approach.

Image: www.youtube.com

What Is Future And Options In Trading

Image: boomingbulls.com