A Beginner’s Guide to Demystifying Option Contracts

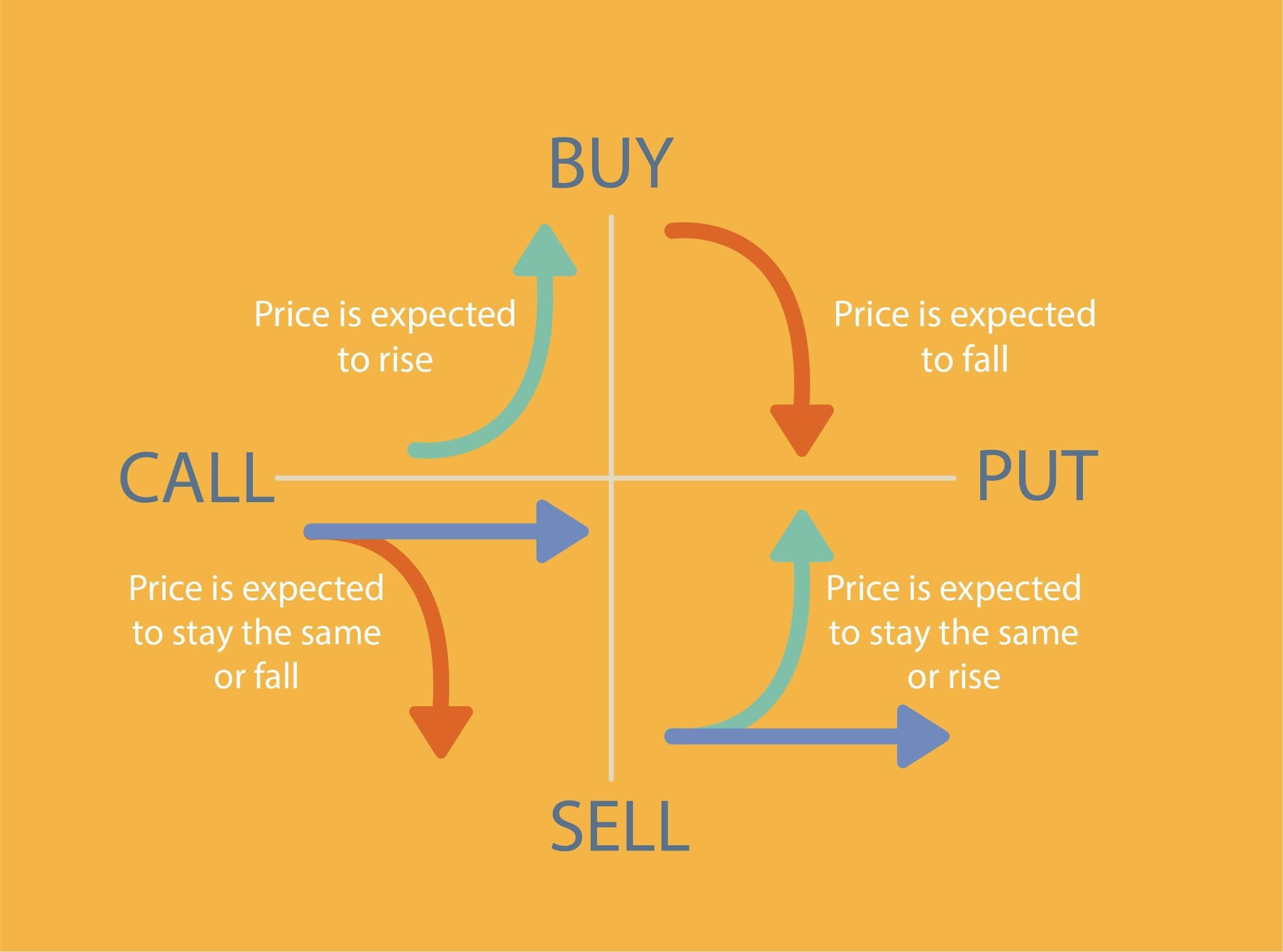

Trading options can be a complex and intimidating realm, but understanding purchase options is crucial for navigating this intricate landscape. Purchase options, also known as “call options,” empower traders with the right to buy an underlying asset at a predetermined price on or before a specific expiration date. Dive into this comprehensive guide to unravel the mysteries of purchase options and unlock their potential in your trading strategy.

Image: www.markettradersdaily.com

Defining Purchase Options

In the world of options trading, purchase options grant traders the privilege, but not the obligation, to acquire a certain amount of an underlying asset at a set price, known as the strike price, within a predetermined period. These contracts bestow upon the trader two key rights: the right to buy the underlying asset and the right to let the option contract expire worthless.

Unlocking the Value of Purchase Options

The financial value of purchase options stems from intrinsic value and time value. Intrinsic value represents the difference between the current market price of the underlying asset and the strike price of the option contract. Positive intrinsic value indicates that the option is “in the money,” meaning it would be profitable to exercise it immediately. Time value, on the other hand, reflects the potential for the underlying asset’s price to fluctuate favorably before the option’s expiration date.

Exploring Purchase Options in Practice

Let’s delve into a practical example to illustrate how purchase options work. Suppose you purchase a call option on 100 shares of Apple stock with a strike price of $150 and a premium of $5 per share. This option contract grants you the right to buy those shares at $150 per share anytime before the expiration date. If the stock price rises to $160 per share, your purchase option is now worth $10 per share, representing a potential profit of $500 (minus the premium paid).

Image: telegra.ph

Mastering Purchase Option Strategies

Seasoned traders leverage purchase options in diverse strategies to capitalize on market conditions. Some popular strategies include:

- Bullish Calls: Traders purchase call options when they anticipate the underlying asset’s price to rise. This strategy allows them to profit from both intrinsic and time value gains.

- Covered Calls: This strategy involves selling call options while simultaneously owning the underlying asset. It generates income from the option premium while allowing the trader to limit their potential losses.

- Protective Puts: Traders buy call options as a hedge against potential losses on their existing stock positions. In the event of a market downturn, the call options can offset some of the losses incurred on the underlying asset.

Expert Insights into Purchase Options

To enhance your understanding, consider these expert tips:

- Thoroughly Research the Underlying Asset: Before trading purchase options, meticulously research the underlying asset’s historical performance, financial health, and industry trends.

- Set Realistic Expectations: Options trading involves inherent risks, and purchase options are not immune. Manage your expectations and invest only what you can afford to lose.

- Utilize Option Strategies: Explore various option strategies to suit your risk tolerance and profit targets. Consult with a financial advisor or broker for guidance.

FAQs on Purchase Options

Q: Can I lose money trading purchase options?

A: Yes, it’s possible to lose money if the underlying asset’s price moves against your prediction.

Q: What factors affect the price of purchase options?

A: The underlying asset’s price, volatility, time to expiration, and interest rates influence the value of purchase options.

Q: How do purchase options differ from other options types?

A: Purchase options give traders the right to buy the underlying asset, while other types, like put options, provide the right to sell.

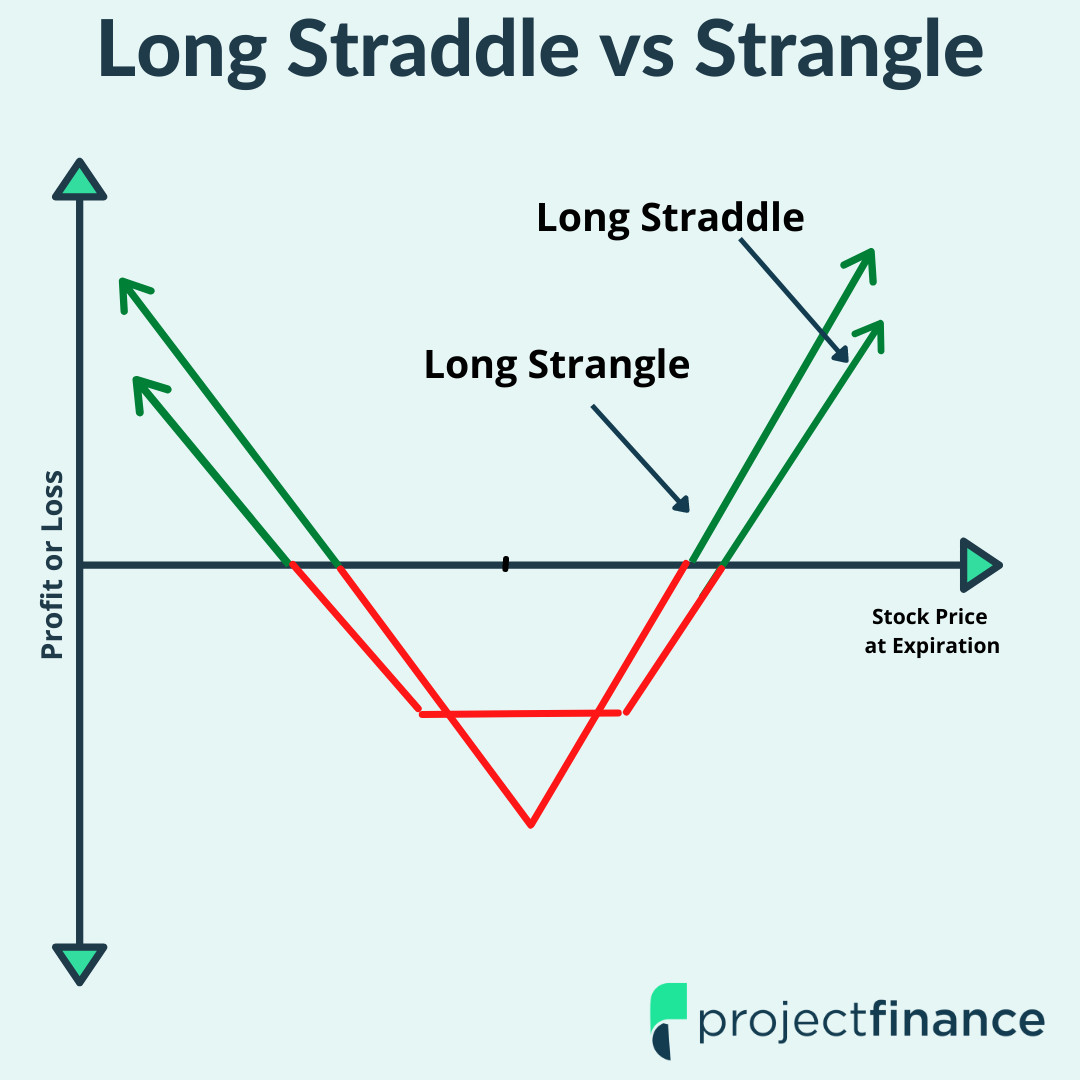

What Does Purchase Options Mean In Trading

Image: www.projectfinance.com

Conclusion: Embracing Purchase Options

Purchase options can be a powerful tool in the hands of informed traders. By comprehending their nuances and applying strategic approaches, you can potentially enhance your trading prowess. Whether you’re a seasoned veteran or just starting out in options trading, this guide has demystified the world of purchase options.

Are you ready to explore the possibilities of purchase options and embark on your trading journey?