Options trading, a realm of boundless potential and nuanced complexities, often leaves traders pondering the enigmatic concept of “breaking even.” Navigating this uncharted territory requires a profound understanding of its implications and the strategies that lead to this elusive outcome. Join us on an illuminating journey as we decipher the intricate labyrinth of breaking even in options trading, empowering you with the knowledge and insights to conquer this financial frontier.

Image: www.pinterest.ph

Defining the Equanimity of Breaking Even

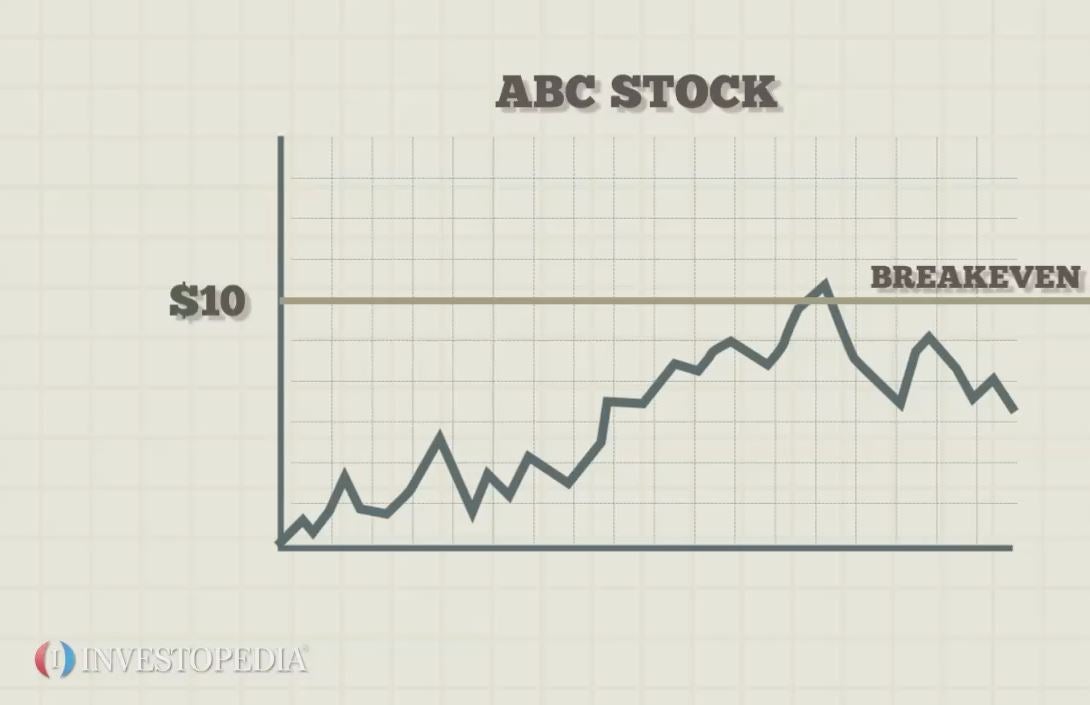

To elucidate the essence of breaking even in options trading, we must first grasp its fundamental definition. Breaking even simply implies a scenario wherein a trader neither gains nor loses any capital from their options contract. In this delicate equilibrium, the premium paid for the contract is precisely offset by the profit or loss incurred, resulting in a neutral financial position.

Breaking even represents a neutral outcome, a point of balance where neither elation nor despair holds sway. It signifies a successful execution of a trading strategy that adeptly manages risk and skillfully exploits market dynamics. Achieving this coveted state requires a careful calibration of knowledge, experience, and strategic finesse.

Breaking Down the Anatomy of Breaking Even

To fully comprehend the mechanisms underlying breaking even, we must delve into its integral components. Options trading involves two fundamental types of contracts: calls and puts. A call option grants the holder the right to purchase an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). Conversely, a put option confers the right to sell an underlying asset under similar terms.

The premium paid for an options contract represents the cost of acquiring this contractual right. When an option contract expires, it can manifest in three potential outcomes:

- In-the-money: The option is considered “in-the-money” when its intrinsic value exceeds the premium paid. This occurs when the underlying asset’s price moves in a favorable direction.

- At-the-money: The option is considered “at-the-money” when its intrinsic value is equal to the premium paid. This occurs when the underlying asset’s price is hovering near the strike price.

- Out-of-the-money: The option is considered “out-of-the-money” when its intrinsic value is less than the premium paid. This occurs when the underlying asset’s price moves in an unfavorable direction.

Navigating Strategies for Breaking Even

Breaking even in options trading is an art form, a delicate dance between risk and reward. Traders can employ a multitude of strategies to achieve this coveted outcome, including:

- Covered Call Strategy: This strategy involves selling a call option against an underlying asset already owned by the trader. The premium received from selling the call option reduces the overall cost of acquiring the underlying asset, thus increasing the likelihood of breaking even or even profiting from the transaction.

- Protective Put Strategy: This strategy entails purchasing a put option to protect against potential losses in an underlying asset. The premium paid for the put option acts as a form of insurance, providing a safety net against adverse price movements.

- Collar Strategy: The collar strategy combines a long position in a call option with a short position in a higher-strike-price call option. This strategy creates a defined range of potential profit and loss, providing a more controlled risk environment.

- Straddle Strategy: This strategy involves buying both a call option and a put option with the same strike price and expiration date. The straddle strategy profits from significant price fluctuations in either direction, making it suitable for volatile markets.

Image: satsdikk.blogspot.com

Expert Insights and Proven Tactics

Seasoned options traders often emphasize the paramount importance of:

- Thorough Research: Extensive research on the underlying asset, market conditions, and potential risks is crucial for informed decision-making.

- Risk Management: Implementing robust risk management measures, such as position sizing and stop-loss orders, is essential for mitigating potential losses.

- Patience and Discipline: Successful options trading requires patience and discipline, as market movements often unfold over time.

What Does It Mean To Break Even In Options Trading

Image: www.youtube.com

Embracing the Power of Breaking Even

Breaking even in options trading is not merely an absence of loss but a testament to sound trading practices and judicious risk management. It represents a critical milestone in the journey of every options trader, a stepping stone toward consistent profitability. By embracing the strategies and insights outlined in this comprehensive guide, aspiring traders can unlock the boundless potential of options trading, reaping the rewards of financial empowerment and enduring success.