Have you ever felt stuck in a trading rut, where every move you make seems to end in a loss? Frustration and self-doubt can creep in, leaving you questioning your trading skills. But don’t despair! Breaking out of a trading rut is possible with the right knowledge and strategy.

Image: optionstradingiq.com

**Understand the Causes**

Identifying the root cause of your trading rut is crucial for finding a solution. Common triggers include:

- Poor risk management

- Overtrading

- Lack of discipline

- Ineffective trading strategy

- Psychological factors (e.g., fear, greed)

Take some time to reflect on your trading habits and pinpoint potential problem areas.

**Break the Cycle**

Once you understand the causes, it’s time to break the vicious cycle. Here’s how:

- Review and refine your trading strategy: Evaluate your current approach and make necessary adjustments to increase its effectiveness.

- Focus on risk management: Implement strict risk management rules to protect your capital and prevent significant losses.

- Master your emotions: Recognize and manage your emotions, avoiding impulsive decisions driven by fear or greed.

- Stick to your plan: Consistency and discipline are essential. Avoid deviating from your trading strategy unless you have a valid reason supported by market analysis.

- Take breaks: Mental fatigue can lead to poor decisions. Take regular breaks to clear your mind and gain a fresh perspective.

**Expert Tips**

In addition to these general principles, consider these expert tips:

- Seek feedback: Ask a trusted friend, mentor, or professional trader for an objective assessment of your trading.

- Test your strategies thoroughly: Before implementing any new strategy, test it on a demo account to minimize risk.

- Learn from your mistakes: Analyze your losing trades to identify areas for improvement and prevent similar errors in the future.

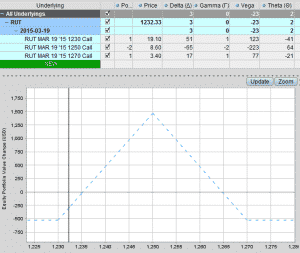

Image: optionstradingauthority.com

Trading Rut Options

Image: www.optionpundit.net

**FAQs**

Q: How long does it take to break out of a trading rut?

A: The timeframe varies depending on the individual and the severity of the rut. With persistence and consistency, it could take weeks or months to regain trading momentum.

Q: Is it possible to break out of a trading rut on my own?

A: While external support can be beneficial, it is possible to overcome a trading rut independently through self-reflection, analysis, and determination.

Q: Are there specific trading strategies that are more effective for breaking out of a rut?

A: No single strategy is universally effective. The best approach depends on your individual trading style and risk tolerance. Experiment with different strategies to find one that aligns with your needs.

Call to Action:

If you’re struggling with a trading rut, remember that breaking free is possible. Take the time to analyze the causes, implement effective strategies, and seek support when needed. By embracing the challenges and persevering, you can regain your trading confidence and achieve long-term success.