Tired of the daily grind and looking for a way to earn extra income? Consider delving into the world of option trading. With the rise of online trading platforms, individuals can participate in financial markets from the comfort of their homes, making it an accessible and appealing part-time pursuit.

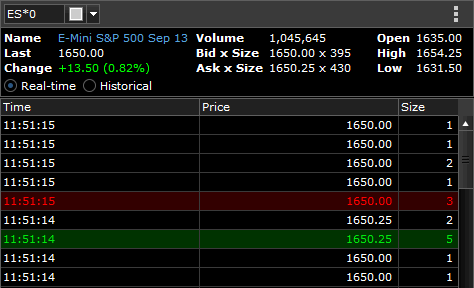

Image: www.barchart.com

Demystifying Option Trading

Options are financial contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a certain asset, such as a stock or currency, at a predetermined price (strike price) on or before a specified date (expiration date). These contracts provide flexibility and the potential for both limited risk and substantial profit.

The Power of Leverage

The real allure of option trading lies in its inherent leverage, which allows investors to control a substantial underlying asset with a relatively small upfront investment. Unlike buying a full stock, options only require a fraction of the price, known as the premium. This low entry barrier makes it an attractive option for those with limited capital or who want to enter the market without risking a significant portion of their savings.

Flexibility and Risk Management

Options trading offers a level of flexibility that suits part-time traders. Since options have definite lifespans, investors can select contracts that align with their availability and time constraints. Additionally, options provide built-in risk management tools. By strategically combining different option types, traders can create specific risk-reward profiles and mitigate potential losses.

Image: www.learntotradethemarket.com

Tailored to Your Schedule

The beauty of part-time option trading is that it can be tailored to fit your spare time. During intervals between work or other commitments, you can monitor markets, place trades, or adjust your positions as needed. With advancements in mobile trading technology, you can execute trades and manage your portfolio remotely, ensuring you never miss a potential opportunity.

Getting Started

Becoming an option trader in your spare time is a gradual process that requires proper preparation. Begin by educating yourself about the fundamentals of options trading, market forces that influence prices, and different trading strategies. Familiarize yourself with the terminologies, risk management techniques, and the various types of options available.

To enhance your understanding, consider opening a paper trading account or using a simulator to practice various scenarios without risking real money. The simulated environment provides a safe space to learn from both successes and mistakes.

Choosing the Right Strategy

Option trading offers a diverse range of strategies for both beginners and experienced traders. Some popular approaches include buying and selling simple call and put options, utilizing options spreads (combinations of two or more options), and engaging in covered calls (selling call options against stocks already owned). By researching and experimenting with different strategies, you can develop your trading plan that aligns with your risk tolerance and time availability.

Essential Considerations

While part-time option trading can be a profitable endeavor, it is crucial to proceed with caution. Market fluctuations, option complexities, and psychological biases can all pose risks to your capital. Always invest within your means, thoroughly analyze options before making trades, and manage your risk through strategic positioning and diversification.

Option Trading In Your Spare Time

Conclusion

Option trading in your spare time offers a potential path to financial growth and flexibility. It empowers individuals to leverage market movements and supplement their income while working around personal schedules. Through education, practice, and informed decision-making, you can tap into the rewards of option trading and create a lucrative side hustle that complements your primary time commitments.