In the ever-evolving landscape of financial markets, trading bots have emerged as indispensable tools for savvy investors and traders. These automated software programs utilize advanced algorithms to analyze market data, identify trading opportunities, and execute trades seamlessly. Embracing the latest technological advancements, trading bots have revolutionized how traders navigate the financial sphere, empowering them with enhanced precision, efficiency, and profitability.

Image: blog.autonomoustrading.io

The Anatomy of Profitable Trading Bots

The profitability of trading bots stems from their ability to operate 24/7, eliminating the human limitations of fatigue and emotion. They constantly monitor market conditions, identifying anomalies and potential trading opportunities that might escape manual traders. Equipped with sophisticated algorithms, these bots analyze vast amounts of historical data, identifying patterns and correlations that inform their trading strategies. By utilizing complex mathematical models and statistical analysis, trading bots can make informed decisions, optimizing trades for maximum profitability.

At the core of profitable trading bots lie their robust risk management capabilities. These bots are programmed to set predefined stop-loss points, limiting potential losses if market conditions turn unfavorable. Additionally, they can employ advanced hedging strategies to mitigate risks and protect profits. By continuously monitoring market volatility and adjusting their positions accordingly, trading bots ensure that risks are managed effectively, preserving capital and maximizing the potential for returns.

Choosing the Right Trading Bot Platform

Selecting the most suitable trading bot platform is crucial to unlocking its full potential. Several reputable providers offer platforms with varying features and capabilities. Consider the following factors when choosing a platform:

- Supported exchanges: Ensure the platform integrates with the exchanges you trade on.

- Trading strategies: Evaluate the platform’s available trading strategies and their alignment with your investment objectives.

- User interface: Opt for platforms with intuitive and user-friendly interfaces, simplifying setup and operation.

- Customer support: Choose platforms with responsive and knowledgeable customer support teams to assist you promptly.

Tips for Optimizing Trading Bot Performance

While trading bots provide significant advantages, optimizing their performance is essential for maximizing profitability. Here are some expert tips:

- Backtest your bots: Before deploying bots in live markets, backtest their strategies using historical data to assess their performance and refine parameters.

- Monitor performance: Regularly review your bot’s performance, analyzing its trades and adjusting strategies as needed to capitalize on changing market conditions.

- Diversify your bots: Employ multiple bots with different strategies to spread risk and enhance overall profitability.

- Control your emotions: Resist the temptation to override the bot’s decisions. Trust in the algorithm and its ability to make rational decisions based on data.

Image: www.techicy.com

Frequently Asked Questions

Q: Are trading bots legal?

A: Yes, trading bots are generally legal as long as they comply with exchange regulations and do not engage in illegal activities such as market manipulation or insider trading.

Q: How much money can I make with a trading bot?

A: The potential profitability of trading bots varies depending on market conditions, trading strategies, and risk tolerance. It’s crucial to manage expectations and approach trading with a realistic mindset.

Q: Do I need to be an experienced trader to use a trading bot?

A: While technical proficiency is beneficial, trading bots are designed to be accessible to traders of all experience levels. Beginner traders can leverage bots to automate their trades, while experienced traders can utilize advanced bots to enhance their strategies.

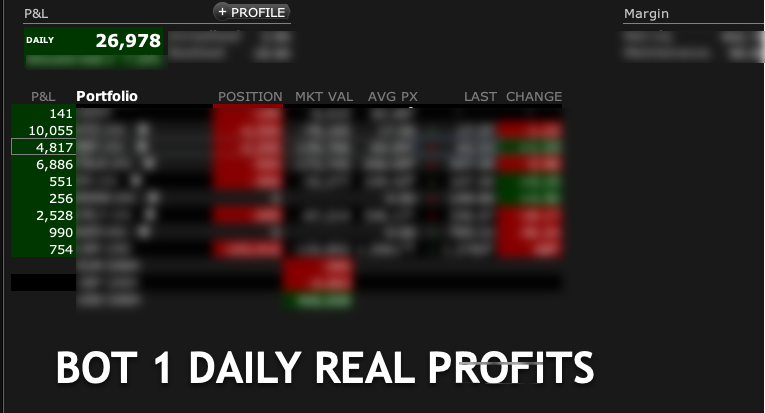

Most Profitable Trading Bot Options

Image: br.pinterest.com

Conclusion

Trading bots represent the future of financial markets, enabling investors to automate their trading and tap into the full potential of market opportunities. By carefully selecting, optimizing, and monitoring trading bots, traders can reap the rewards of increased profitability, efficiency, and risk management. As technology continues to advance, trading bots will undoubtedly become even more sophisticated, further empowering traders to navigate the dynamic and often unpredictable financial landscape with precision and success.

Are you ready to unlock the world of automated trading and elevate your financial acumen? Explore the possibilities of trading bots and embark on a journey of profitability, efficiency, and empowerment.