Introduction

Trading reverse options can be a lucrative way to generate a weekly income. By selling options that expire on Fridays, you can collect a premium from other traders who are willing to pay for the right to buy or sell the underlying asset at a specified price. If the option expires out of the money, you keep the premium. If it expires in the money, you are obligated to buy or sell the underlying asset at the strike price, potentially incurring a loss.

Image: www.reddit.com

The key to success in trading reverse options is to carefully select your trades and manage your risk. You should only trade options on assets that you understand and that have a high probability of expiring out of the money. You should also set stop-loss orders to limit your potential losses.

How to Trade Reverse Options

To trade reverse options, you will need to open an account with a broker that offers options trading. Once you have an account, you can start by selecting the underlying asset that you want to trade. You can choose from stocks, ETFs, indices, and commodities.

Once you have selected an underlying asset, you need to choose the type of option that you want to sell. You can choose from calls (which give the buyer the right to buy the underlying asset) or puts (which give the buyer the right to sell the underlying asset). The strike price of the option is the price at which the buyer can buy or sell the underlying asset.

The expiration date of the option is the date on which the option expires. You can choose from options that expire on Fridays, Saturdays, or Mondays. Options that expire on Fridays are the most popular because they give you the opportunity to collect a premium every week.

The premium of the option is the price that the buyer is willing to pay for the right to buy or sell the underlying asset. The premium is determined by a number of factors, including the strike price of the option, the expiration date of the option, and the volatility of the underlying asset.

When you sell a reverse option, you are selling the right to someone else to buy (or in the case of a put options, to sell) the underlying asset at the strike price on or before the expiration date. Typically, traders of reverse options are betting that the underlying asset will remain relatively flat to down during that time period.

Traders that sell options tend to be neutral about the performance of the underlying asset or have a belief it will go down in price. If it does, the reverse option will be out of the money and expire worthless, and the seller of the option keeps the premium. On the other hand, if the underlying asset price increases (for a call option) or decreases (for a put option), the option is likely to end in the money and be assigned, requiring the option seller to buy or sell the shares according to the option contract.

These types of options can be part of a larger portfolio and income strategy designed for both capital appreciation and generation of income. These options are not as speculative as traditional options strategies, and while they do not offer unlimited profit potential like some strategies, they can potentially offer consistent returns.

Tips for Trading Reverse Options

Here are a few tips for trading reverse options:

- Start with small positions. This will help you to limit your risk.

- Trade options on assets that you understand. This will help you to make better decisions about which options to sell.

- Set stop-loss orders to limit your potential losses.

- Only trade options that have a high probability of expiring out of the money.

- Do your research. The more you know about options trading, the better your chances of success.

FAQs About Reverse Options

Here are a few frequently asked questions about reverse options:

- What are the benefits of trading reverse options?

- The benefits of trading reverse options include the potential to generate a weekly income, the ability to limit your risk, and the opportunity to trade on a variety of underlying assets.

- What are the risks of trading reverse options?

- The risks of trading reverse options include the potential to lose money, the possibility of being assigned the option, and the need to manage your risk carefully.

- How can I learn more about trading reverse options?

- You can learn more about trading reverse options by reading books, articles, and online forums. You can also attend webinars and seminars on the topic.

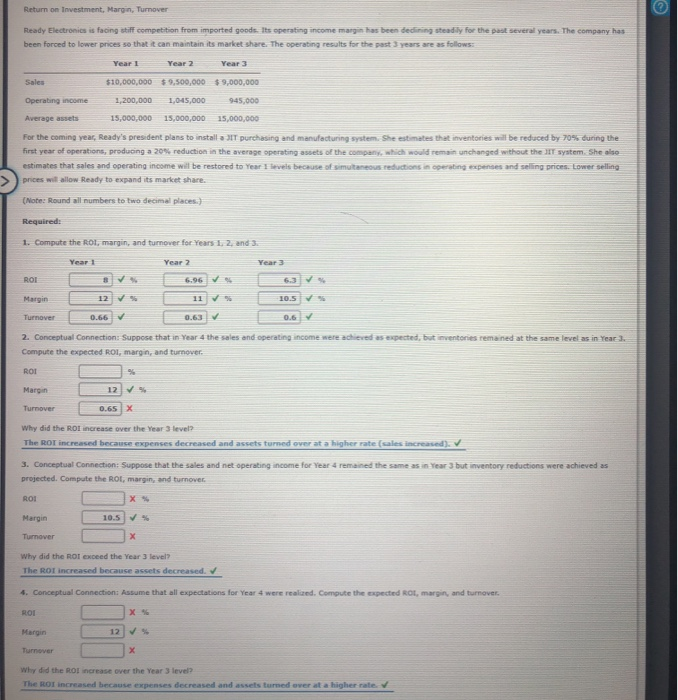

Image: www.chegg.com

Weekly Income By Trading Reverse Option

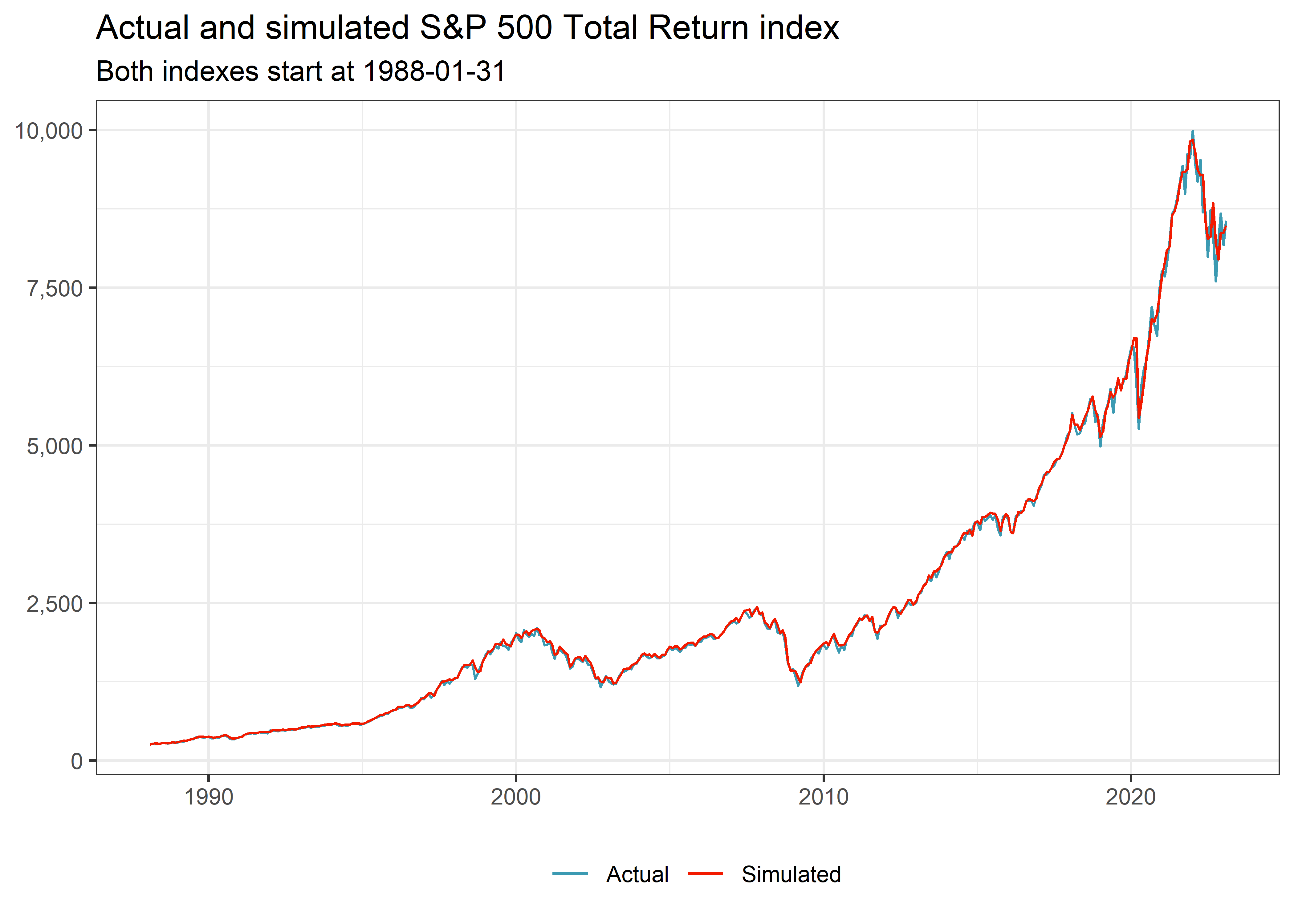

Image: www.tidy-finance.org

Conclusion

Trading reverse options can be a lucrative way to generate a weekly income. However, it is important to carefully select your trades and manage your risk. By following the tips in this article, you can increase your chances of success in trading reverse options.

Are you interested in learning more about trading reverse options?