I remember the thrill of my first successful options trade like it was yesterday. I had been studying hard, learning everything I could about options theory, and I finally felt confident enough to put my money where my mouth was.

Image: www.youtube.com

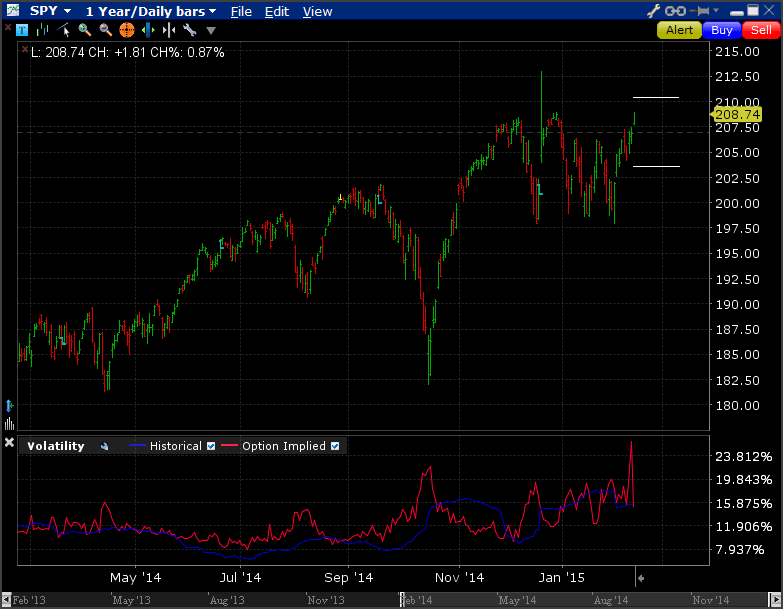

I chose to trade SPY weekly options because they offered me a great way to get started with options trading. They are relatively low-risk, and they move quickly, so I could make a profit (or loss) quickly. Of course, there is always risk involved in trading options, but I learned from my mistakes and eventually became a profitable trader.

What are SPY Weekly Options?

SPY weekly options are a type of option contract for the SPDR S&P 500 ETF Trust (SPY), an exchange-traded fund that tracks the S&P 500 index. Weekly options expire every Friday, and they offer traders a way to bet on the short-term direction of the S&P 500 index.

Benefits of Trading SPY Weekly Options

There are several benefits to trading SPY weekly options:

- They are relatively low-risk, as they expire quickly and have limited downside potential.

- They move quickly, so traders can make a profit (or loss) quickly.

- They are liquid, meaning there is always a buyer or seller for SPY weekly options.

- They offer flexibility regarding trading strategies.

How to Trade SPY Weekly Options

To start trading SPY weekly options, you will need an options trading account with a broker. Once you have an account, you can place a buy or sell order for SPY weekly options.

When placing an order, you will need to specify the following information:

- The type of order (buy or sell)

- The number of contracts

- The expiration date

- The strike price

Image: kovivygoqabut.web.fc2.com

Tips and Expert Advice

Here are some tips and expert advice for trading SPY weekly options:

- Start by learning the basics of options. Read books, articles, or take a course on options trading to learn the fundamental concepts of options.

- Trade with a small amount of money. Start with a small amount of money until learning how to trade options.

- Use a paper trading account. A paper trading account can help you learn how to trade options without risking real money.

- Trade consistently. The more you trade, the better you will become at it.

- Manage your risk. Always use stop-loss orders and position sizing to manage your risk.

FAQ

Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy the underlying asset at a specified price, while a put option gives the buyer the right to sell the underlying asset at the specified price.

Q: What is the strike price of an option?

A: The strike price is the price at which the buyer can buy or sell the underlying asset.

Q: What is the expiration date of an option?

A: The expiration date is the date on which the option contract expires.

Q: What is the premium of an option?

A: The premium is the price of the option contract.

Trading Spy Weekly Options

Conclusion

SPY weekly options are a great way to trade the S&P 500 index. They are relatively low-risk, and they move quickly, so traders can make a profit (or loss) quickly.

If you want to start trading SPY weekly options, follow the tips and advice in this article, and you will be on your way to profitability.

Are you interested in learning more about trading SPY weekly options? If so, I encourage you to continue reading my blog. I post daily content about options trading.