In the labyrinthine world of financial markets, options trading presents a multifaceted investment strategy that can unlock remarkable opportunities for discerning investors. Among the burgeoning retail giants, Walmart stands out as a beacon of innovation, extending its influence into the realm of option trading. This comprehensive guide delves into the intricacies of Walmart option trading, empowering retail investors with an arsenal of actionable insights.

Image: warriortradingnews.com

What is Walmart Option Trading?

Walmart option trading involves speculating on the future price movements of Walmart shares through the buying and selling of options contracts. Options grant investors the right, but not the obligation, to buy (call option) or sell (put option) a specific number of Walmart shares at a predetermined price (strike price) on or before a set date (expiration date). Options trading offers a flexible and potentially lucrative avenue for investors seeking to navigate market volatility and supplement their portfolios.

Benefits of Walmart Option Trading

Walmart option trading offers a myriad of advantages for retail investors:

- Leverage: Options provide leverage, allowing investors to potentially amplify their returns with limited capital investment.

- Income generation: By selling covered calls or writing puts, investors can generate regular income while holding the underlying asset.

- Hedging: Options can be utilized for hedging purposes, mitigating potential losses on existing investments.

- Speculation: Options provide an avenue for investors to speculate on the future direction of Walmart’s stock price in a risk-defined manner.

Understanding Walmart Call and Put Options

Walmart call options empower investors to purchase a specific number of Walmart shares at the strike price on or before the expiration date. If the market price of Walmart shares rises above the strike price, the investor has the option to exercise the call and purchase the shares at the advantageous strike price, potentially realizing a profit from the difference. Conversely, Walmart put options offer the right to sell Walmart shares at the strike price on or before the expiration date, providing a hedge against potential market downturns.

Image: www.realforexreviews.com

Choosing the Right Walmart Option Strategy

Identifying the appropriate Walmart option strategy hinges on several factors, including the investor’s risk tolerance, market outlook, and desired payoff profile. Various strategies cater to distinct investment objectives:

- Bullish Call Options: These are ideal for investors anticipating a rise in Walmart stock prices. They offer the potential for unlimited profit but also come with limited risk.

- Bearish Put Options: Suitable for investors expecting a decline in Walmart stock prices, these options offer limited profit potential but protect against potential losses.

- Covered Calls: This strategy combines writing call options with owning the underlying Walmart shares, generating income while maintaining exposure to potential price appreciation.

Expert Insights and Actionable Tips

- Thorough Research: Meticulous research into Walmart’s financial performance, market dynamics, and economic indicators is essential before entering the world of Walmart option trading.

- Start Small: Allocate only a small portion of your investment portfolio to option trading until you have gained proficiency and confidence.

- Manage Risk: Employ stop-loss orders to mitigate potential losses and adhere to prudent risk management principles.

- Emotional Discipline: Avoid succumbing to emotional decision-making. Base trading decisions on thorough market analysis and a well-defined plan.

- Seek Professional Guidance: Consult a qualified financial advisor if you require tailored advice or assistance navigating the complexities of Walmart option trading.

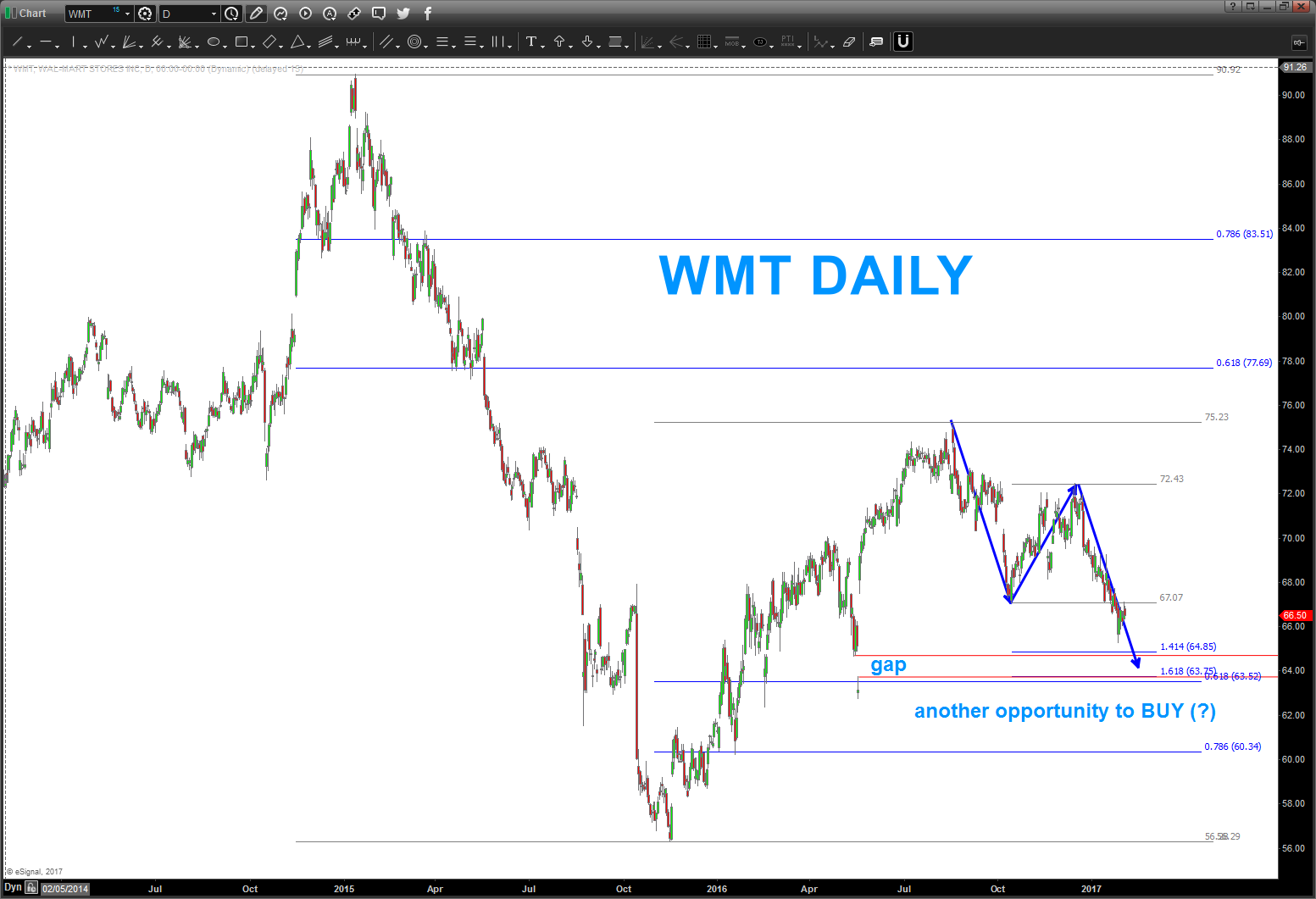

Walmart Option Trading

Image: www.seeitmarket.com

Unlocking Your Potential as a Walmart Option Trader

Walmart option trading empowers retail investors with a versatile tool to enhance their investment strategies, generate income, and mitigate risk. By embracing the insights outlined in this comprehensive guide, you can harness the power of Walmart’s market dominance and embark on a rewarding journey of financial growth. Remember, due diligence, informed decision-making, and emotional discipline are the cornerstones of successful option trading. With patience, perseverance, and a steadfast commitment to learning, you can unlock your potential as a Walmart option trader and achieve your financial aspirations