**

Image: www.youtube.com

Options trading, a versatile financial instrument, has garnered immense popularity among investors seeking to enhance their portfolios. These contracts offer unique advantages, including the potential for exceptional returns, flexibility in strategy implementation, and mitigating investment risks. Embark on this comprehensive tutorial to master the intricacies of options trading and unravel its boundless opportunities.

Understanding Options Trading: A Journey into Possibilities

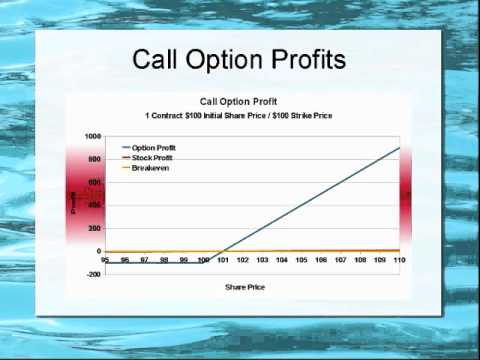

Options contracts are financial agreements that confer upon their holders the right, but not the obligation, to either buy (call option) or sell (put option) an underlying asset at a specified price within a predetermined time frame. The underlying asset can be stocks, bonds, commodities, or even an index. Call options allow investors to potentially profit from rising asset prices, while put options provide a cushion against potential losses or enable speculative plays on declining prices.

Navigating the Dynamics of Call and Put Options

Call options grant the holder the right to buy the underlying asset at the strike price on or before expiration. Conversely, put options empower holders to sell the underlying asset at the strike price. The strike price represents the pre-determined price at which the option can be exercised. Additionally, each option contract represents 100 shares of the underlying asset, adding a layer of scale to investment potential.

Strategies for Successful Options Trading: Unlocking Profitable Outcomes

Options trading presents a diverse array of strategies, catering to varying risk appetites and investment objectives. One of the most straightforward strategies is buying a call option, aiming to capitalize on anticipated price increases. Buying a put option, on the other hand, is employed to hedge against potential declines in the underlying asset’s value or to speculate on downward price movements.

| CALL | PUT |

|---|---|

| Buy (Long) | Buy (Long) |

| Sell (Short) | Sell (Short) |

| Profit from rising prices | Profit from falling prices |

| Limited loss | Limited loss |

| Unlimited profit potential | Unlimited profit potential |

Mastering Advanced Options Trading Techniques

Beyond the basics of call and put options, seasoned options traders employ more sophisticated strategies to enhance their portfolio performance. These techniques include:

- Spreads: Combining multiple options contracts to create customized risk-reward profiles.

- Straddles: Simultaneous purchase of a call and a put option with the same strike price and expiration date, profiting from high volatility.

- Strangles: Similar to straddles, but with different strike prices, offering a wider range of profit potential.

Overcoming Common Challenges in Options Trading

While options trading holds immense promise, it also presents unique challenges. Novice traders commonly face:

- Time decay: The erosion of option value over time, as expiration approaches.

- Volatility risk: Fluctuations in the underlying asset’s price can significantly impact option premiums.

- Margin requirements: Options trading typically requires margin accounts, which may expose traders to additional financial risks.

Tips for Enhancing Options Trading Performance

To navigate the complexities of options trading successfully, consider these invaluable tips:

- Educate yourself: Immerse yourself in books, articles, and online courses to gain a comprehensive understanding of options trading principles.

- Practice with paper trading: Simulate real-world trading conditions without risking capital, allowing for experimentation and refinement of strategies.

- Manage risk effectively: Implement sound risk management practices, such as position sizing and stop-loss orders, to safeguard your investments.

- Monitor market trends: Stay abreast of economic data and market movements that can influence option prices.

Conclusion

Options trading, an intricate yet lucrative financial instrument, beckons traders to explore its boundless opportunities. By delving into the concepts, mastering strategies, and navigating potential challenges, investors can unlock exceptional returns and enhance their portfolios. Remember, the key to successful options trading lies in diligent research, continuous learning, and a well-honed trading plan. Embrace the challenge, unravel the intricacies of options, and reap the rewards that await.

Image: getbitcoinnow999.blogspot.com

Tutorial For Options Trading

Image: www.tradethetechnicals.com