Break into the Thrilling World of Option Trading and Seize Control of Your Financial Future

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Image: www.investopedia.com

Are you ready to take the next step in your investing journey? Look no further than option trading. Selling a call option is an excellent strategy that empowers you to generate income and manage risk simultaneously. Join me as we dive into the depths of this captivating financial instrument and uncover its secrets.

Understanding the Basics: What is Selling a Call Option?

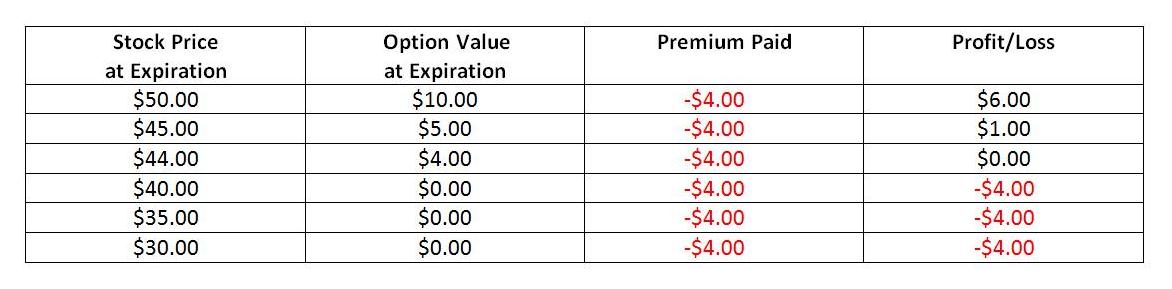

A call option grants the buyer the right, but not the obligation, to purchase a specific underlying asset, such as a stock or ETF, at a defined price (strike price) on or before a certain date (expiration date). By selling a call option, you agree to give the buyer this right in exchange for a premium payment.

Profiting from Option Trading: The Income Generator

The key beauty of selling a call option lies in the premium you receive. This upfront payment represents the income you will earn regardless of whether the buyer exercises their right to purchase the underlying asset. If the stock price remains below the strike price at expiration, the option will expire worthless, and you retain both the premium and the underlying asset.

Balancing the Scales: Managing Risk with Precision

While selling a call option offers income potential, it also involves inherent risk. As the seller, you have an obligation to deliver the underlying asset if the buyer exercises the option. Therefore, you must carefully consider the stock’s price volatility and the potential for it to rise above the strike price.

Image: marketrealist.com

Expert Guidance: Navigating the Option Trading Landscape

To maximize your success in option trading, seek advice and guidance from experienced professionals. Consult with a financial advisor who can assess your unique situation, risk tolerance, and financial goals. Their insights will help you navigate the intricacies of option trading and make informed decisions.

Proven Strategies for Success: Tips and Tricks from the Pros

Embrace these tried-and-tested strategies to enhance your option trading acumen:

-

Understand your risk tolerance: Selling a call option exposes you to potential losses. Define your comfort level before venturing into the market.

-

Research and analyze: Thoroughly study the historical price movements, trends, and volatility of the underlying asset. This knowledge will empower you to make informed decisions.

-

Set realistic strike prices: Avoid strike prices that are significantly below the current market value. Opt for prices close to the current value to mitigate risk.

-

Monitor the market: Keep a watchful eye on the stock’s price movements. If the price surges past the strike price, consider closing the option early to limit potential losses.

Option Trading Selling A Call

Image: www.onlinefinancialmarkets.com

Conclusion: Unlocking the Power of Selling Call Options

Selling a call option is an empowering and versatile strategy that can enhance your income generation and risk management capabilities. By embracing the insights and strategies outlined in this article, you can harness the full potential of option trading and achieve your financial aspirations. Remember to consult with a financial advisor to navigate the complex world of options and make informed decisions that align with your goals.