In the realm of financial markets, precision and strategy reign supreme. Amidst the volatility and uncertainty, triple option trading 488 cc emerges as a sophisticated technique that empowers traders to navigate the market with finesse and potentially maximize their returns.

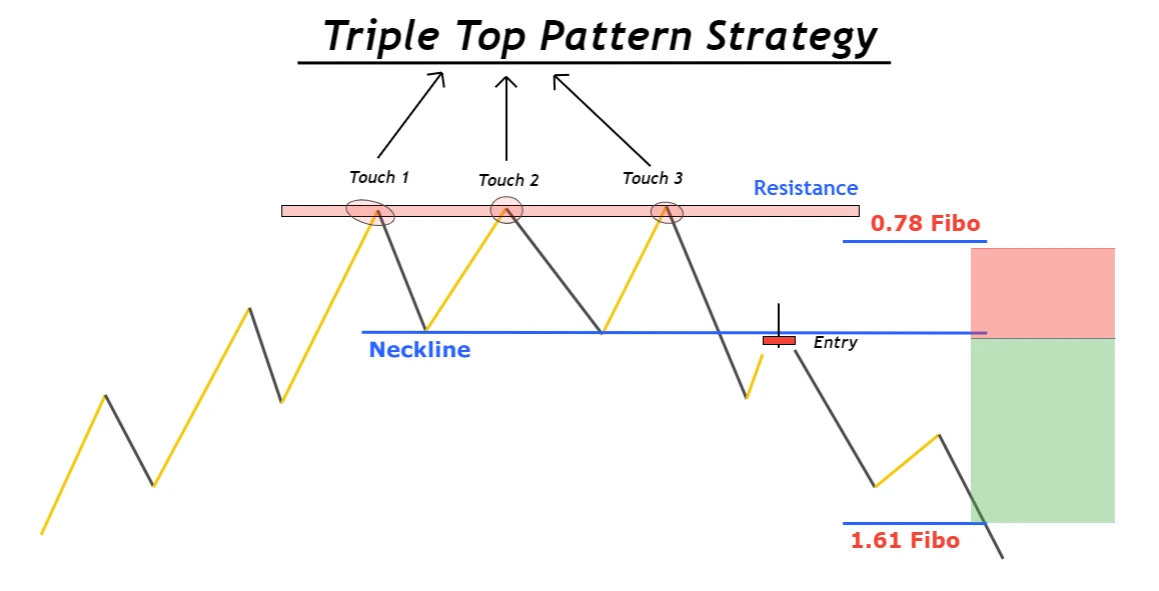

Image: forexbee.co

Defining Triple Option Trading 488 cc

Triple option trading 488 cc is a complex trading strategy that involves simultaneously buying and selling three options contracts with different strike prices and expiration dates. By carefully calibrating these options, traders seek to profit from price movements in the underlying asset, regardless of whether it rises, falls, or remains stagnant.

A Unique Combination

The 488 cc component of the strategy refers to the number of contracts involved in the trade. Traders typically purchase one at-the-money (ATM) option at the current market price and two out-of-the-money (OTM) options with strike prices above and below the ATM strike price. These OTM options are typically purchased for a lower premium, offering a higher potential for profit if the underlying asset price moves significantly in their direction.

Understanding the Strategy

Triple option trading 488 cc thrives on volatility and time decay. When the market is volatile, the premium of options contracts tends to fluctuate more, creating opportunities for traders to capture profits by buying low and selling high. Furthermore, as option contracts approach their expiration date, their value erodes due to time decay. This decay can benefit traders who hold OTM options that are not expected to be exercised before expiration.

The beauty of triple option trading 488 cc lies in its versatility. Traders can customize the strategy based on their risk tolerance and market outlook. If they anticipate significant price movements, they can opt for more aggressive options with lower strike prices. Conversely, if they expect a less volatile market, they may choose OTM options with higher strike prices to reduce their risk.

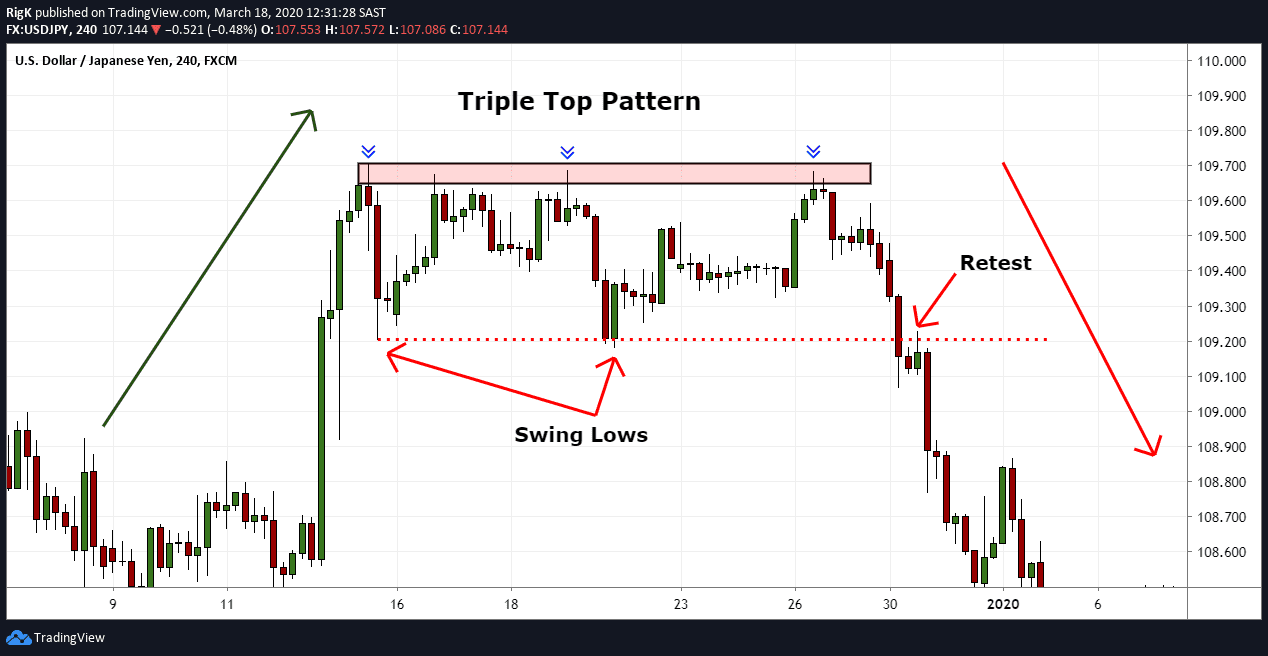

Image: chainsawpartsworld.com

Tips and Expert Advice

Mastering triple option trading 488 cc requires expertise and a disciplined approach. Experienced traders recommend:

- Managing Risk: Triple option trading 488 cc can amplify both profits and losses. It is crucial to define clear risk parameters and trade with a sound risk management strategy.

- Understanding Volatility: Volatility is the lifeblood of triple option trading 488 cc. Traders should monitor market volatility and adjust their strategy accordingly.

- Patience and Discipline: Patience is paramount in triple option trading 488 cc. Traders may need to hold positions for extended periods to capitalize on time decay and market movements.

FAQ

What is the difference between ATM, ITM, and OTM options?

- ATM (At-the-money) options have a strike price equal to the current market price.

- ITM (In-the-money) options have a strike price below the current market price (for calls) or above the market price (for puts).

- OTM (Out-of-the-money) options have a strike price above the current market price (for calls) or below the market price (for puts).

How does time decay affect triple option trading 488 cc?

Time decay refers to the decrease in the value of option contracts as they approach their expiration date. In triple option trading 488 cc, it can help to reduce the risk associated with OTM options that are unlikely to be exercised before expiration.

Triple Option Trading 488 Cc

Image: www.asktraders.com

Conclusion

Triple option trading 488 cc is an advanced strategy that can potentially yield substantial returns when executed effectively. By understanding the concepts, adapting tips and expert advice, and adhering to sound risk management practices, traders can harness the power of this strategy to navigate the markets with confidence. Are you ready to explore the intricacies of triple option trading 488 cc and elevate your trading game?