Understanding Triple Option Trading: An Introduction

In the realm of financial markets, where numerous trading strategies exist, triple option trading stands out due to its complexity and potential profitability. It involves the simultaneous execution of three different options contracts that are linked by a common underlying asset. By exploiting the relationships and price dynamics between these options, traders can craft intricate strategies that aim to generate returns under various market conditions. In this comprehensive guide, we will delve into the intricacies of triple option trading, explaining its history, fundamental concepts, and practical applications. We will also explore the latest trends and best practices to help traders navigate this fascinating and lucrative strategy.

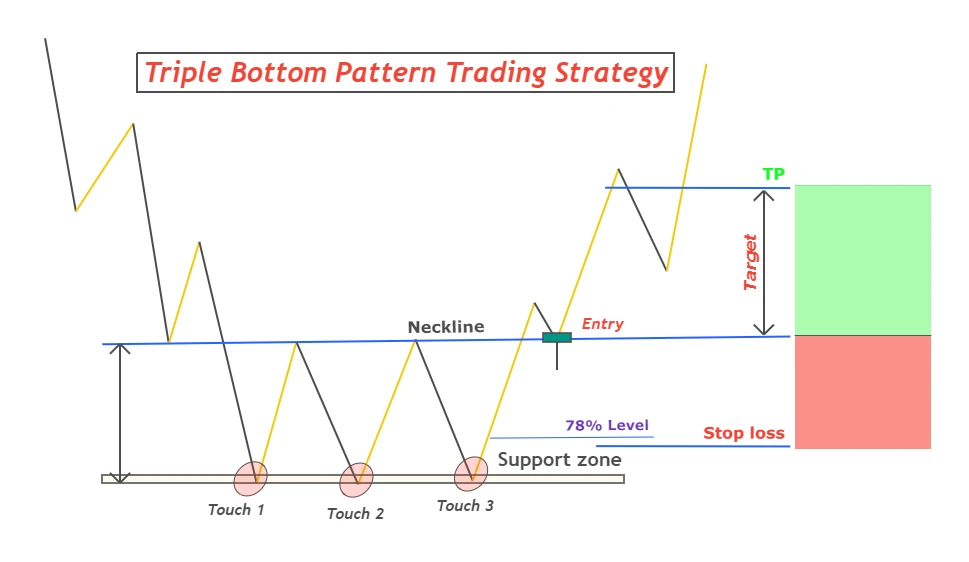

Image: fxpipsgainer.com

Historical Roots and Evolution of Triple Option Trading

The origins of triple option trading can be traced back to the early 20th century when options contracts emerged as a sophisticated financial instrument. However, it was not until the 1970s that traders began experimenting with the simultaneous use of multiple options contracts to enhance their trading capabilities. The development of sophisticated computer modeling and the advent of electronic trading platforms in the 1990s further accelerated the rise of triple option trading and made it accessible to a broader range of investors. Today, triple option trading is widely used by experienced traders, hedge funds, and institutional investors as a tool for generating income, hedging risk, and speculating on market movements.

Deconstructing the Essential Elements of Triple Option Trading

At its core, triple option trading involves the combination of three distinct options contracts: a call, a put, and an option on the underlying asset itself. The call option grants the holder the right to buy the underlying asset at a specified price (strike price) on or before a certain date (expiration date). Conversely, the put option confers the right to sell the underlying asset at the strike price by the expiration date. The third component, the option on the underlying asset, gives the holder the flexibility to either buy or sell the asset at the strike price. By understanding the interplay between these options contracts, traders can exploit price inefficiencies and create strategies that align with their market outlook and risk tolerance.

Practical Applications: Unlocking the Potential of Triple Option Trading

Triple option trading presents a plethora of opportunities for traders to capitalize on market movements. One common strategy involves simultaneously buying a call and selling a put while also buying the underlying asset. This strategy, known as a collar, provides limited upside potential but also protects against significant market declines. Another popular strategy is the straddle, which involves buying both a call and a put with the same strike price. This enables traders to profit from either a significant increase or decrease in the underlying asset’s value, regardless of the direction of the movement. By combining different types of options contracts and adjusting the strike prices and expiration dates, traders can tailor triple option strategies to suit their unique investment goals.

Image: forexbee.co

Emerging Trends and Best Practices in Triple Option Trading

As financial markets evolve, so too do the strategies and techniques employed by traders. In recent years, there has been a growing trend towards incorporating algorithmic trading into triple option trading. Automated trading algorithms leverage advanced computational power to analyze market data and execute trades based on predefined parameters, enabling traders to capitalize on market inefficiencies and respond swiftly to changing conditions. Additionally, the increased availability of real-time market information and analytics has empowered traders to make more informed decisions when implementing triple option strategies. By embracing these latest trends and best practices, traders can enhance their trading performance and optimize their returns.

Triple Option Trading

Image: www.facebook.com

Conclusion: Harnessing the Power of Triple Option Trading

Triple option trading offers traders a powerful and versatile strategy for profiting from market movements while managing risk. By understanding the fundamental concepts, various applications, and emerging best practices, traders can harness the potential of this complex strategy. However, it is crucial to recognize that triple option trading involves a higher level of risk compared to simpler options trading strategies. It requires a thorough comprehension of options pricing models, risk management techniques, and an in-depth understanding of market dynamics. Traders should carefully consider their investment objectives, risk tolerance, and knowledge level before venturing into triple option trading. With the right mix of skill, experience, and risk awareness, triple option trading can be a rewarding and potentially lucrative endeavor.