As an experienced investor, I have always been drawn to the allure of options trading. Options provide a unique way to leverage my investments and potentially enhance my returns. However, traditional IRAs have historically been restrictive in terms of options trading. Fortunately, recent changes in regulations have opened up new avenues for options traders within the traditional IRA framework. This article will provide a comprehensive exploration of options trading with traditional IRAs.

Image: myinsidersource.com

Navigating the Nuances of Options Trading in Traditional IRAs

Options trading involves entering into contracts that give investors the right, but not the obligation, to buy or sell an underlying asset at a predefined price and date. When it comes to traditional IRAs, the ability to trade options provides several advantages. Firstly, options trading can enhance the income potential of an IRA portfolio by generating premiums from the sale of options contracts. Secondly, options provide flexibility and diversification, allowing investors to tailor strategies based on their risk tolerance and return objectives.

Fundamental Principles

To delve into options trading with traditional IRAs effectively, it’s crucial to grasp the key concepts and terminologies involved. The underlying asset refers to the asset related to the options contract, such as a stock or an index. The strike price represents the price at which the underlying asset can be bought or sold upon contract execution. The expiration date defines the timeframe within which the contract can be exercised.

Types of Options

There are two primary types of options: calls and puts. Call options provide the right to buy the underlying asset at the strike price, while put options provide the right to sell the underlying asset at the strike price. Each type of option can be further classified as either long (purchase) or short (sale).

Image: www.tastylive.com

Suitability and Considerations

Options trading within traditional IRAs is not suitable for all investors. It’s essential to possess a sound understanding of options before entering into any contracts. The complex nature of options and the potential for substantial losses require a profound grasp of risk management and investment strategies.

Benefits of Options Trading in Traditional IRAs

- Enhanced Income Potential: Options trading provides opportunities to generate premiums and enhance the income potential of an IRA portfolio.

- Flexibility and Diversification: Options trading allows for customized strategies based on risk tolerance and return objectives, contributing to portfolio diversification.

- Increased Control: Options trading can provide investors with greater control over their investments, enabling tactical adjustments based on market conditions and personal investment goals.

Risks of Options Trading in Traditional IRAs

- Complexity and Volatility: Options involve a significant level of complexity and volatility, which can lead to substantial losses if not managed properly.

- Limited Exemption: Options trading is prohibited within certain traditional IRA accounts, such as SEPs and SIMPLE IRAs. It’s crucial to check account restrictions before engaging in options trading.

- Penalties for Early Withdrawals: Early withdrawals from an IRA account before age 59½ may incur a 10% penalty.

Maximizing Options Trading Strategies

To effectively execute options trading with traditional IRAs, consider the following expert advice:

- Educate Yourself: Familiarize yourself with the intricacies of options trading before embarking on any strategies.

- Establish a Plan: Outline your investment strategy, including entry and exit points, risk management parameters, and profit targets.

- Manage Risk: Implement prudent risk management techniques, such as position sizing and stop-loss orders, to mitigate potential losses.

- Diversify Your Portfolio: Spread your investments across various options strategies and underlying assets to reduce overall risk.

Frequently Asked Questions (FAQs)

- Q: Is options trading permitted in all traditional IRAs?

A: Options trading is not allowed in certain traditional IRA accounts, such as SEPs and SIMPLE IRAs. It’s crucial to check account restrictions before participating in options trading. - Q: What are the tax implications of options trading in traditional IRAs?

A: Options trading within traditional IRAs follows the same taxation rules as other IRA investments. Gains are subject to ordinary income tax, while losses offset other IRA income. - Q: Is it advisable for beginners to engage in options trading within traditional IRAs?

A: Options trading can be complex and risky. It’s not recommended for beginners without a thorough understanding of options and risk management.

Traditional Ira Options Trading

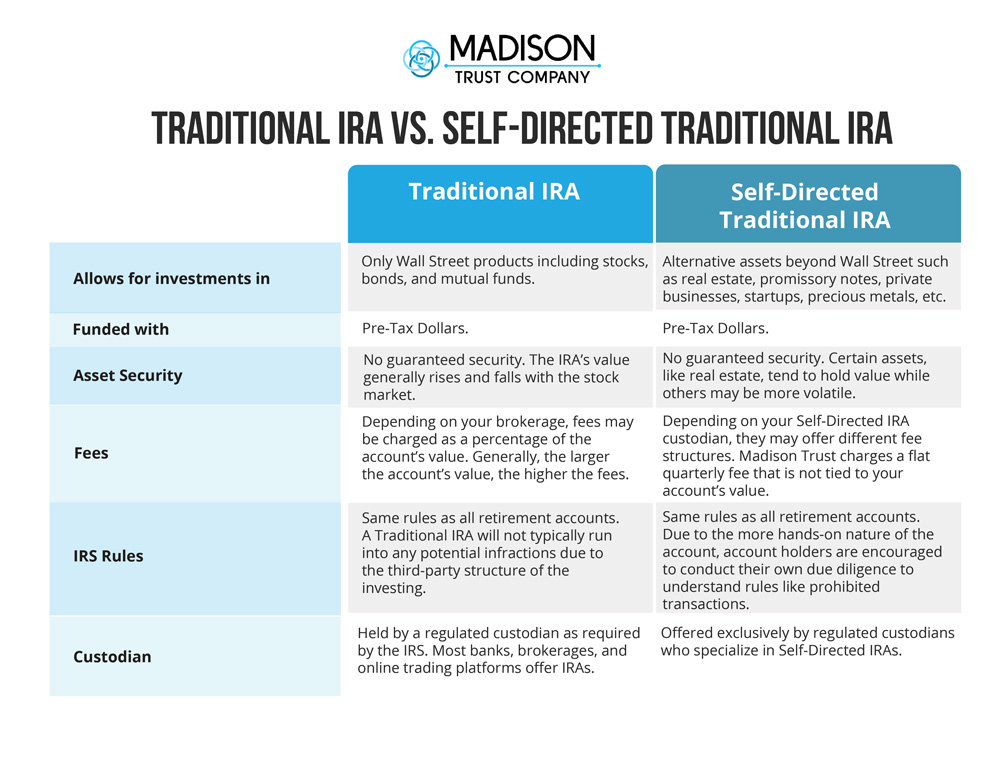

Image: www.madisontrust.com

Conclusion

Options trading within traditional IRAs provides savvy investors with new opportunities to enhance their retirement savings. Understanding the fundamentals, navigating the nuances, and implementing effective strategies are crucial for success. Embracing a calculated approach, investors can leverage the power of options to potentially maximize their returns within the confines of traditional IRA accounts. The decision of whether or not to engage in options trading should be based on a comprehensive evaluation of investment goals, risk tolerance, and individual circumstances.

Are you eager to delve deeper into the realm of options trading within traditional IRAs? Share your thoughts and questions in the comments section below, and let’s continue this exciting financial expedition together.