Embark on the Path of Options Trading with Fidelity

Options trading holds immense potential, offering investors a flexible tool to amplify returns while managing risk. However, before delving into this realm, it’s paramount to understand the nuances and ensure your account is properly equipped for the journey. In this comprehensive guide, we’ll illuminate the steps involved in enabling options trading within Fidelity, empowering you with the knowledge to unlock this transformative financial instrument.

Image: www.youtube.com

Accessing Fidelity’s Options Trading Platform

Fidelity seamlessly integrates options trading into its robust investment platform. To initiate the process, visit the “Accounts & Trade” tab, select “Options,” and click on the “Enable Options Trading” button. Follow the prompts provided, ensuring you thoroughly review and acknowledge the associated risks and disclosures. Once your application is approved, you’ll be granted access to Fidelity’s comprehensive options trading platform.

To leverage this feature effectively, ensure you maintain a margin account or upgrade your cash account to a margin account. This step is essential as it enables you to trade on borrowed funds, maximizing your purchasing power and increasing your potential profit and loss potential. Thoroughly research and comprehend the intricacies of margin trading before engaging in options strategies.

Navigating Options Trading with Fidelity

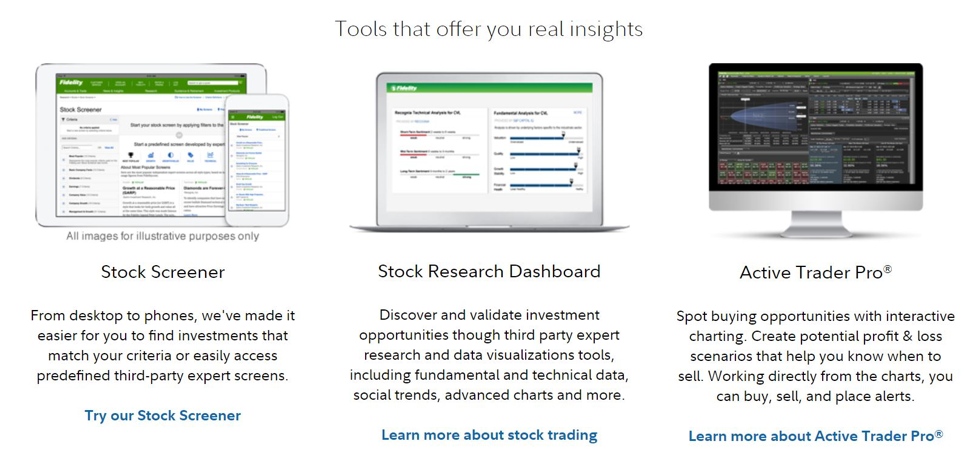

Fidelity’s options trading platform empowers you with an intuitive interface, real-time market data, and advanced charting tools. Begin by familiarizing yourself with the options chain, which displays the available options contracts for a particular underlying security. Each contract represents a specific price, expiration date, and premium associated with buying or selling the underlying asset.

Carefully evaluate the underlying asset, strike price, and expiration date before making a decision. The strike price is the agreed-upon price at which you can buy or sell the underlying asset when the option is exercised. Opt for a strike price that aligns with your investment strategy and risk tolerance. The expiration date signifies when the option contract expires, rendering it worthless if not exercised or sold prior to that date.

Unveiling the Latest Trends in Options Trading

Options trading continues to evolve, with innovative strategies and regulations emerging. Stay abreast of current trends to optimize your trading approach. One recent development is the growing popularity of options on exchange-traded funds (ETFs). These options offer diversification benefits while allowing investors to speculate on the performance of entire market sectors or industries.

Moreover, social media platforms and online forums have become vibrant hubs for options trading insights and strategy sharing. Engage with these communities to glean valuable perspectives, learn from experienced traders, and stay up-to-date with the latest market developments.

Image: www.trading101.com

Expert Advice for Enhancing Your Options Trading Journey

To succeed in options trading, adopt proven strategies and heed the advice of experienced professionals. Here are some valuable tips:

- Start by paper trading to gain experience without risking capital.

- Understand the risks and rewards associated with options trading.

- Develop a clear strategy and stick to it.

- Use stop-loss orders to manage risk.

Frequently Asked Questions (FAQs) about Options Trading

Q: What is options trading?

A: Options trading involves buying or selling contracts that give investors the right but not the obligation to buy or sell an underlying asset at a predetermined price before a specific expiration date.

Q: Why is options trading beneficial?

A: Options trading provides various advantages, including the potential to amplify returns, hedge against risk, and generate income. It also offers flexibility and allows investors to customize strategies based on their risk tolerance and investment goals.

Q: What are the risks associated with options trading?

A: Options trading carries inherent risks, including the potential for significant losses. Investors can lose the entire premium paid for the option if it expires worthless. Moreover, options trading requires sophisticated financial knowledge and can be complex.

How To Enable Options Trading In Fidelity

Image: www.youtube.com

Conclusion: Embark on the Options Trading Journey with Confidence

We hope this guide has shed light on the exciting world of options trading in Fidelity. By following the steps outlined, you can unlock access to this powerful tool and embark on a journey toward financial success. However, it’s crucial to remember that options trading involves inherent risks and should be approached with caution.

Are you ready to explore the transformative opportunities of options trading with Fidelity? Share your thoughts and experiences in the comments below, and let’s navigate the markets together.