Imagine you could predict the future direction of a stock, but without the risk of owning it outright. That’s the power of options trading, a sophisticated financial tool that allows you to speculate on price movements and potentially profit from them.

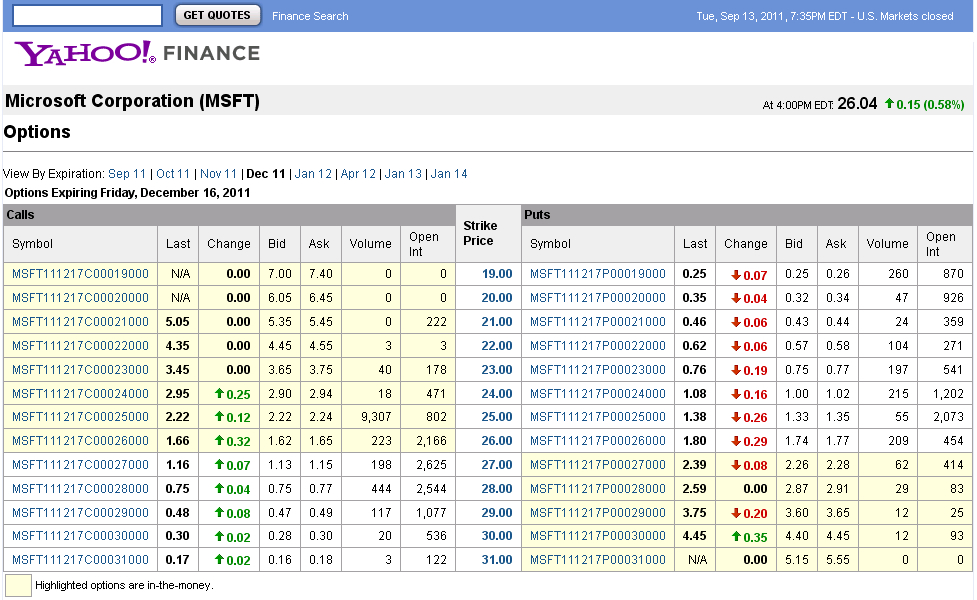

Image: www.optiontradingtips.com

Options come in two main types: puts and calls. Puts give the buyer the right to sell a stock at a specific price, while calls give the right to buy at a specific price. By understanding how these options work, you can develop strategies to manage risk and potentially enhance your returns.

What are Put and Call Options?

**Put options** grant the buyer the right, but not the obligation, to sell a specific number of shares of a stock at a predetermined price (strike price) on or before a specific date (expiration date). The buyer of a put option typically expects the stock price to decline.

**Call options** confer the right, but not the obligation, to buy a specific number of shares of a stock at the strike price on or before the expiration date. The buyer of a call option typically expects the stock price to increase.

How Options Work

When you buy an option, you pay a premium to the seller, who is obligated to fulfill the terms of the contract if you exercise it. The premium reflects the market’s assessment of the likelihood of the stock price reaching the strike price before expiration.

If the stock price moves in the direction you anticipated, you can exercise your option to buy or sell the stock at the strike price, regardless of the current market price. If the stock price moves against you, you can choose to let the option expire worthless, losing only the premium you paid.

Benefits of Options Trading

Options trading offers several potential benefits:

- Leverage: Options can provide substantial leverage, allowing you to control a large number of shares with a relatively small investment.

- Risk management: Puts and calls can be used to hedge against potential losses by locking in a price for future transactions.

- Income generation: Selling options can generate income if the stock price moves as anticipated.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Image: scuba-dawgs.com

Latest Trends in Options Trading

The options market is constantly evolving, with new strategies and products emerging:

- **Exchange-traded funds (ETFs) tracking options:** These provide exposure to tailored option strategies without the need for active management.

- **Automated options trading platforms:** These platforms use algorithms to optimize trade execution based on market conditions.

- **Increased regulatory scrutiny:** Regulators are paying greater attention to options trading to protect investors from potential risks.

Tips and Expert Advice for Options Trading

To enhance your success rate in options trading, consider these tips from experienced traders:

- Understand the risks: Options involve significant risk, and you should only trade with capital you can afford to lose.

- Choose sound strategies: Develop a trading plan that aligns with your risk tolerance and investment goals.

- Manage your trades: Monitor your options positions vigilantly and adjust them as needed based on market conditions.

- Seek professional guidance: Consult with a qualified financial advisor if you’re new to options trading or have complex investment goals.

By embracing these strategies and seeking guidance from experienced traders, you can increase your chances of success in the dynamic world of options trading.

FAQs on Put and Call Options

- Q: What’s the key difference between puts and calls?

A: Puts confer the right to sell, while calls confer the right to buy a stock at a specific price.

- Q: When should I consider using a put option strategy?

A: When you expect the stock price to decline.

- Q: How much does it cost to trade options?

A: The premium you pay to the seller when you purchase the option.

- Q: Can options trading be profitable?

A: Yes, but it requires skill, experience, and risk management.

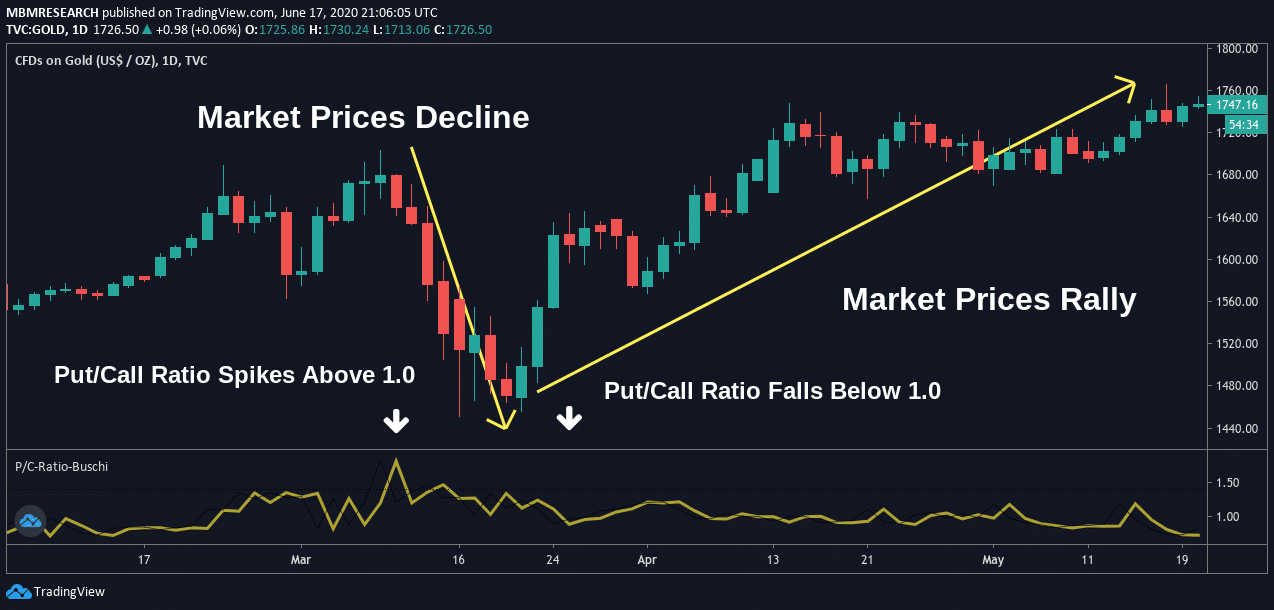

Trading With Put And Call Options

Image: www.asktraders.com

Conclusion

Trading with put and call options is a sophisticated financial tool that offers potential rewards, but also significant risks. By understanding how options work, embracing sound strategies, and managing your trades prudently, you can harness the power of options to potentially enhance your returns. Join me in exploring the depths of this fascinating and dynamic market.

Would you like to continue learning more about options trading? Share your questions and insights in the comments below!