Headline: Unlock the Secrets of Nifty Options: Master Trading with Insider Tips

Image: www.slideshare.net

Introduction:

Have you ever found yourself mesmerized by the alluring charts of Nifty options, longing to delve into the exhilarating world of derivatives trading? The allure of quick profits and the thrill of leveraging market movements can entice even the most seasoned investors. While the potential rewards are alluring, navigating the treacherous waters of options trading requires a seasoned hand and a solid understanding of the intricacies involved. This article aims to equip you with the knowledge and insights you need to embark on your Nifty options trading journey with confidence and finesse.

Understanding Nifty Options

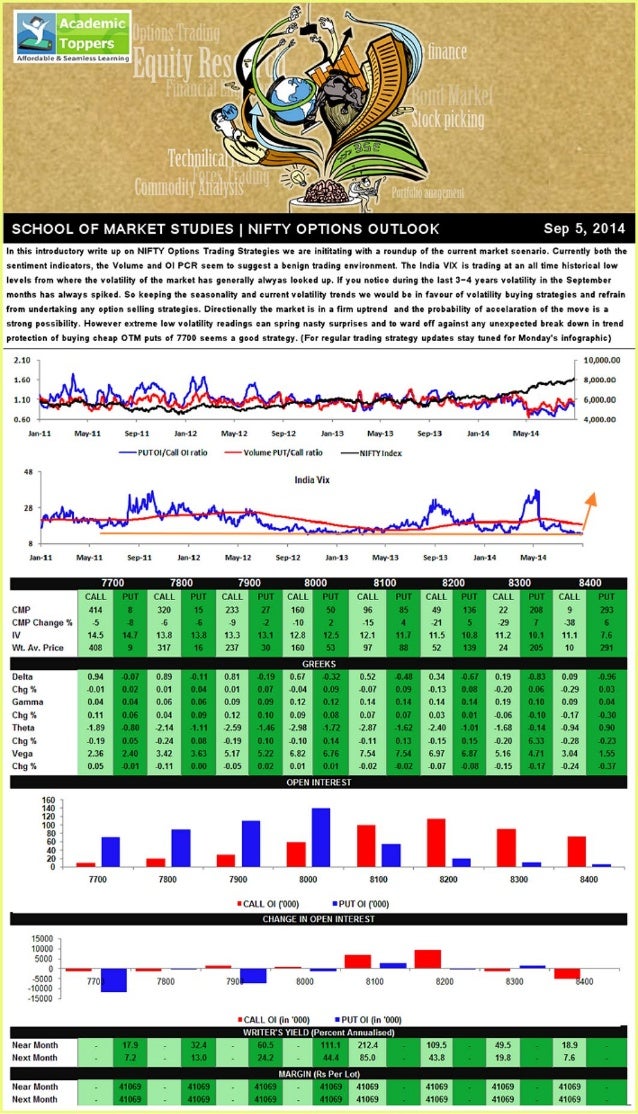

Nifty options are derivative contracts that allow traders to speculate on the future price of the Nifty 50 index. These contracts provide a unique opportunity to magnify profits from relatively small price fluctuations while limiting potential losses. The two main types of Nifty options are Call options (the right to buy) and Put options (the right to sell) at a specified price (strike price) on a predetermined date (expiration date).

Trading Tips to Maximize Returns

-

Technical Analysis Mastery: Become proficient in reading charts and identifying market trends. Technical indicators, such as moving averages and support and resistance levels, can provide valuable insights into potential market movements.

-

Understanding Volatility: Volatility, a measure of price fluctuations, plays a crucial role in options pricing. Higher volatility generally leads to more expensive options, while lower volatility makes them cheaper. Adjust your trading strategies accordingly.

-

Option Selection: Choose options with appropriate strike prices and expiration dates. The strike price should be realistically attainable based on market projections, and the expiration date should provide sufficient time for the desired price action to occur.

-

Risk Management: Discipline is paramount in options trading. Define clear entry and exit points and adhere to a strict risk tolerance level. Use stop-loss orders to limit potential losses in case of adverse market movements.

-

Position Sizing: Calculate the appropriate number of contracts to buy or sell based on your risk tolerance and account size. Avoid over-leveraging, as this can lead to significant losses.

-

Follow Market News: Stay abreast of the latest economic and political developments that can impact market sentiments and Nifty prices. This information can help you make informed trading decisions.

Expert Insights from Wall Street Wizards

“The key to successful options trading lies in understanding the underlying market forces. Focus on identifying trends and market inefficiencies to maximize your chances of profit,” says renowned options trader Peter Tuchman.

“Risk management should be the cornerstone of your trading strategy. Never risk more than you can afford to lose,” cautions veteran options strategist Jared Woodard.

Unleash Your Trading Potential

The knowledge you’ve gained through this article empowers you to embark on your Nifty options trading journey with informed confidence. Remember, success in this domain requires a combination of discipline, market acumen, and a willingness to continuously expand your understanding. Embrace these principles, hone your skills, and navigate the thrilling world of Nifty options with the potential to unlock substantial returns.

Image: yvilopup.web.fc2.com

Trading Tips On Nifty Options

Image: www.slideserve.com