In the ever-changing landscape of the financial world, options trading has emerged as a formidable force, captivating the attention of both seasoned investors and ambitious learners alike. Among the plethora of options available, one that stands out for its volatility and allure is the SVXY option. With its potential for both exponential gains and harrowing losses, SVXY options have become a subject of intense interest and intrigue. This comprehensive guide will delve into the intricacies of SVXY options trading, providing you with the knowledge and insights necessary to confidently navigate the market’s complexities.

Image: www.volatilitytradingstrategies.com

Delving into the World of SVXY Options

SVXY, short for VelocityShares Daily Inverse VIX Short-Term ETN, is an exchange-traded note (ETN) that takes an inverse position on the S&P 500 VIX Short-Term Futures Index (SVIX). In essence, SVXY aims to provide returns that are opposite to those of the SVIX, which measures the implied volatility of the S&P 500 index over the next 30 days. As a result, when market volatility increases, the value of SVXY tends to decline, and conversely, when market volatility decreases, SVXY typically rises in value.

Options, on the other hand, are financial contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) before a specified expiration date. In the context of SVXY, options trading involves speculating on the future value of the SVXY ETN. Traders can purchase either call or put options, depending on their outlook on the market’s volatility.

Navigating the Nuances of SVXY Options Trading

Trading SVXY options requires a thorough understanding of the underlying asset and the complexities of options contracts. Here, we break down the essentials to help you navigate this dynamic market with confidence:

Understanding Volatility: The key to successful SVXY options trading lies in an accurate assessment of market volatility. When volatility is high, SVXY’s value tends to decline, creating opportunities for put options to gain value. Conversely, in periods of low volatility, call options may flourish as SVXY’s value rises.

Options Premiums: When you purchase an option, you pay a premium, which represents the cost of acquiring the right to buy or sell the underlying asset at the strike price. The premium is influenced by factors such as the time remaining until expiration, the market’s implied volatility, and the strike price.

Expiration Dates: SVXY options have specific expiration dates, which define the time frame within which you can exercise your right to buy or sell the underlying asset. The time value of an option decays as the expiration date approaches, affecting the premium’s value.

Leverage and Risk: Options provide a leverage effect, enabling traders to control a larger number of shares than they could afford to purchase outright. However, this leverage comes with increased risk, as losses can be amplified when market movements go against your predictions.

Unveiling Expert Insights and Actionable Tips

Mastering SVXY options trading demands a combination of theoretical knowledge and practical wisdom. Here, we present insights from seasoned experts and proven strategies to help you optimize your trading decisions:

Follow Market Trends: Keeping a watchful eye on the broader market sentiment and economic indicators can provide valuable insights into the potential direction of market volatility. Events like economic releases, geopolitical tensions, and corporate earnings can significantly impact SVXY’s value.

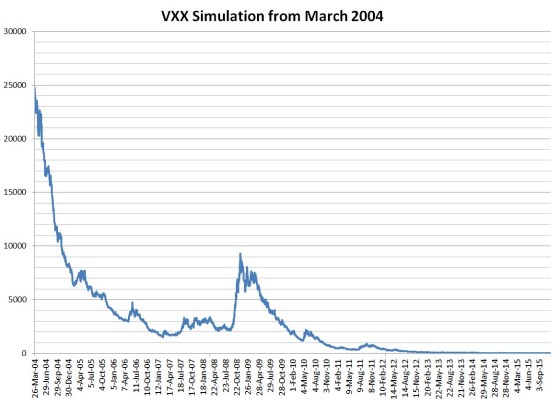

Analyze Historical Patterns: Studying historical price movements and volatility patterns of SVXY can help you identify potential opportunities and avoid pitfalls. Technical analysis tools like Bollinger Bands, moving averages, and candlestick charts can aid in pattern recognition.

Manage Risk Effectively: Risk management is paramount in SVXY options trading. Consider using stop-loss orders to limit potential losses and avoid overexposure by diversifying your portfolio with other financial instruments.

Image: steadyoptions.com

Trading Svxy Options

Image: cyclicalmarketanalysis.blogspot.com

Conclusion

SVXY options trading presents a compelling opportunity for both risk-tolerant and experienced investors to potentially profit from market volatility. By developing a comprehensive understanding of the underlying asset, mastering the fundamentals of options contracts, and embracing expert insights, you can strategically navigate the market’s complexities. Remember, successful trading hinges on continuous learning, prudent risk management, and the ability to adapt to the ever-changing market dynamics. Embrace the rollercoaster of SVXY options trading with confidence, knowing that knowledge is your ultimate weapon in conquering its challenges and harnessing its potential rewards.