In the realm of financial markets, where volatility reigns supreme, option trading stands as a potent tool for discerning investors seeking to navigate risk and enhance their portfolios. Among the versatile strategies available, the credit spread has emerged as a cornerstone technique, offering investors both income generation and risk management opportunities.

Image: fabalabse.com

An option trading credit spread is a transaction involving the simultaneous sale of one option at a higher price (known as the short option) and the purchase of another option at a lower price (the long option), but both options have the same underlying asset, expiration date, and type (call or put). This strategy creates a net credit premium for the trader, which represents the difference between the premium received for selling the short option and the premium paid for buying the long option.

Credit spreads are commonly employed in two primary contexts: Income generation and risk mitigation. When used for income generation, the trader anticipates that the underlying asset’s price will remain within a specific range, allowing both options to expire worthless. In this scenario, the trader retains the net credit premium as profit. Conversely, when credit spreads are employed for risk mitigation, the trader seeks to reduce exposure to potential losses while maintaining some upside potential.

To fully grasp the mechanics of option trading credit spreads, let’s delving into a hypothetical example. Suppose an investor purchases a stock at $50 per share and simultaneously sells a call option with a strike price of $55 for $2 premium and buys a call option with a strike price of $60 for $1 premium. In this instance, the investor’s net credit premium amounts to $1 (the difference between the $2 premium received and the $1 premium paid).

Should the stock price at expiration fall below $55, both options will expire worthless, and the investor retains the net credit premium as profit. Conversely, if the stock price rises above $55, the short call option will be exercised, obligating the investor to sell the stock at $55, resulting in a loss if the stock price exceeds $56 (the breakeven point). However, the profit potential is limited by the strike price difference between the two options.

Understanding the intricacies of option trading credit spreads can empower investors with valuable tools for both profit generation and risk management. It is imperative to approach this strategy with a thorough understanding of the underlying concepts, market dynamics, and potential risks involved.

Exploring the Advantages and Considerations of Credit Spreads

The allure of option trading credit spreads stems from their inherent advantages:

Income Generation: Credit spreads provide the potential for steady income generation through the collection of net credit premiums. This strategy is particularly appealing in sideways or range-bound markets, where the underlying asset’s price fluctuates within a relatively narrow band.

Defined Risk: Unlike traditional long option strategies, credit spreads offer a defined risk profile. The maximum potential loss is limited to the difference between the strike prices of the two options, providing investors with a clear understanding of their financial exposure.

Flexibility: Credit spreads afford investors flexibility in tailoring their positions to suit their individual risk tolerance and profit objectives. By adjusting the strike prices and expiration dates of the options involved, traders can customize the strategy to align with their specific investment goals.

Despite these advantages, it is crucial to acknowledge the considerations associated with credit spreads:

Market Risk: Credit spreads are susceptible to market volatility, just like any other option strategy. Significant price fluctuations in the underlying asset can impact the profitability of the spread.

Time Decay: Option premiums erode over time, a phenomenon known as time decay. This factor can affect the profitability of credit spreads, especially those with distant expiration dates.

Opportunity Cost: Allocating capital to credit spreads means foregoing other investment opportunities. Investors must carefully weigh the potential returns against the opportunity cost of alternative investments.

Applying Credit Spreads in Diverse Market Scenarios

The versatility of credit spreads extends to their applicability in various market scenarios:

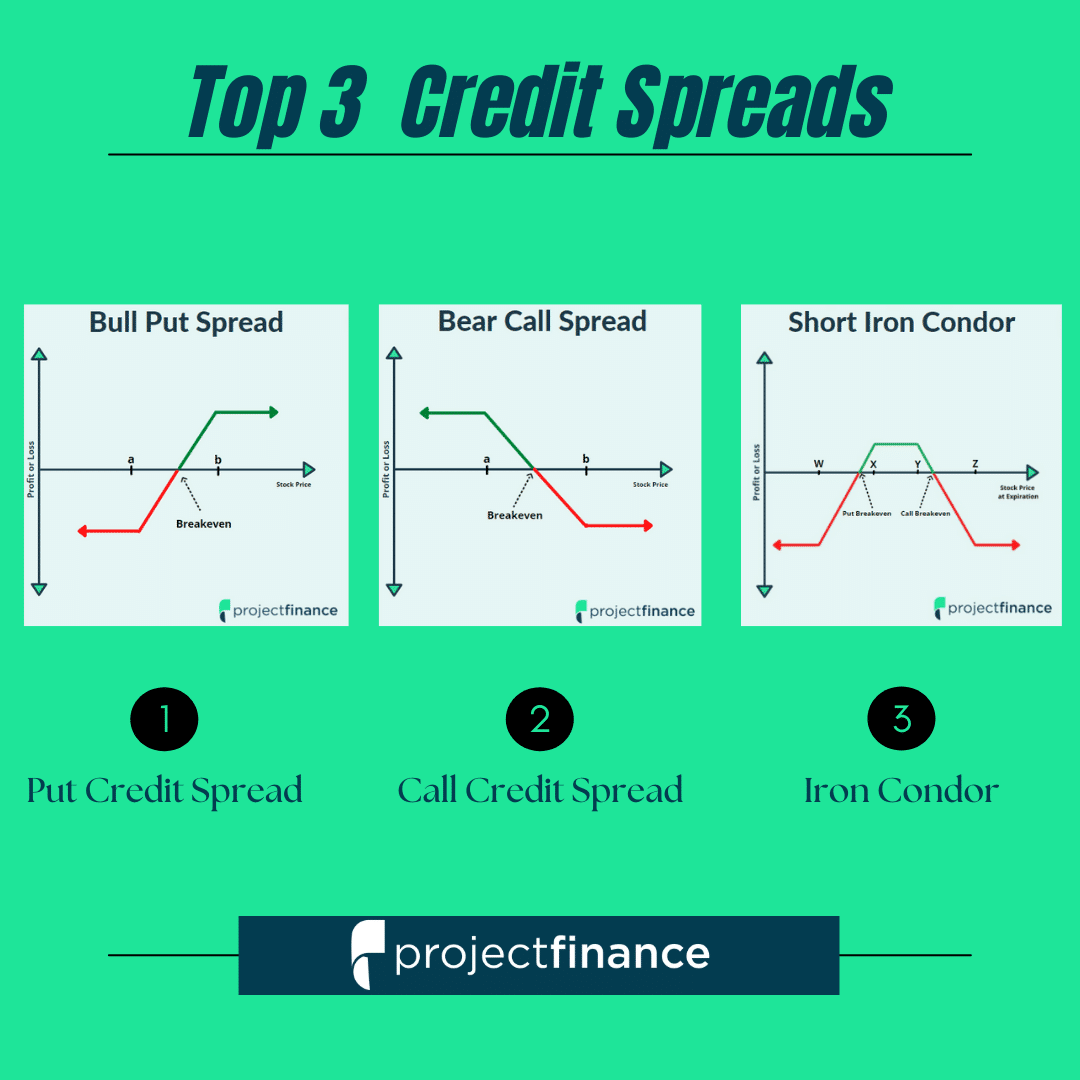

Bullish Markets: In anticipation of a sustained uptrend, investors may employ bullish credit spreads. This strategy involves selling a lower strike price call option and purchasing a higher strike price call option. The potential profit lies in the appreciation of the underlying asset, allowing the short option to expire worthless while the long option gains value.

Bearish Markets: In anticipation of a downtrend, investors may opt for bearish credit spreads. This strategy entails selling a higher strike price call option and purchasing a lower strike price call option. The potential profit arises from the decline in the underlying asset, causing the short option to gain value as the long option expires worthless.

Neutral Markets: In sideways or range-bound markets, investors may utilize neutral credit spreads to generate income. This strategy involves selling out-of-the-money call options (options with strike prices above the current market price) and buying out-of-the-money put options (options with strike prices below the current market price). The potential profit stems from the collection of net credit premiums should the underlying asset’s price remain within the defined range.

Maximizing Success with Credit Spreads: Expert Insights and Actionable Advice

To harness the full potential of option trading credit spreads, heed the following insights from seasoned experts:

Erik Day, a renowned options trader, emphasizes the importance of selecting the right underlying asset: “Choose assets with high liquidity and predictable volatility patterns. Avoid stocks that are prone to extreme price swings or manipulation.”

Kathy Lien, a distinguished currency strategist, advises traders to focus on risk management: “Determine your acceptable loss threshold before entering a credit spread. The maximum potential loss is the difference between the strike prices, so ensure you’re comfortable with that level of risk.”

Michael Carr, a seasoned options trader, encourages investors to employ technical analysis: “Identify potential support and resistance levels for the underlying asset. This information can help you determine appropriate strike prices for your credit spreads.”

Actionable Tips for Enhancing Your Credit Spread Trading:

-

Conduct thorough market research: Analyze historical price data, technical indicators, and news events to gain insights into potential market trends.

-

Set realistic profit targets: Avoid setting overly ambitious profit targets that could lead to excessive risk-taking.

-

Monitor your positions regularly: Keep a close eye on the underlying asset’s price and adjust your strategy as needed based on market conditions.

-

Consider using a trading journal: This tool can help you track your trades, identify patterns, and refine your strategies over time.

Image: www.pinterest.com

Option Trading Credit Spread

Conclusion: Unveiling the Potential of Credit Spreads

Option trading credit spreads offer a sophisticated approach to income generation and risk management in the dynamic world of financial markets. By understanding the mechanics, advantages, and considerations associated with this strategy, investors can harness its potential to enhance their portfolios. Remember to approach credit spreads with a disciplined mindset, embracing risk management principles and seeking guidance from expert insights. With a comprehensive understanding and a well-defined trading plan, investors can unlock the profit opportunities while mitigating potential risks, solidifying their position in the ever-evolving financial landscape.