Introduction

Options trading can be a lucrative but complex financial strategy. This article explores various trading strategies involving options, providing a comprehensive overview and offering expert advice for maximizing your returns. Whether you’re a novice or experienced trader, this detailed guide will assist you in understanding and applying these innovative strategies.

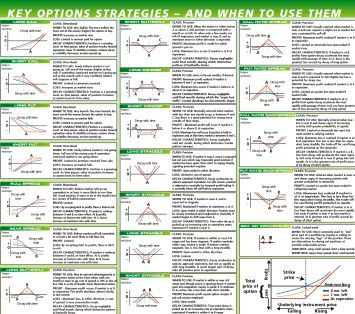

Image: pywoqif.web.fc2.com

Options Trading: A Brief Overview

Options are financial contracts that grant the holder the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). These versatile instruments can be used for various investment strategies, including hedging, speculation and income generation.

Understanding Options Strategies

- Selling Covered Calls: This strategy involves selling a call option while simultaneously holding the underlying asset. If the stock price rises above a specified level, the call option will be exercised and the trader will be obligated to sell the asset at the strike price. The premium received for selling the call option offsets potential losses from the underlying asset’s decline.

- Buying a Protective Put: This defensive strategy entails purchasing a put option while owning the underlying asset. If the stock price falls, the put option will provide a safety net by allowing the trader to sell the asset at a guaranteed price, thus limiting potential losses.

- Spreading Strategies: Spread options involve combining two options with the same expiration date but different strike prices. These strategies offer limited risk and have predefined profit potential. Common spread strategies include bull spreads (buying a call option and selling a higher-priced call option), bear spreads (selling a call option and buying a higher-priced call option), and butterfly spreads (selling one at-the-money option and buying two out-of-the-money options).

- Iron Condor: This neutral strategy involves selling two call options at different strike prices above the current price and buying two put options at different strike prices below the current price. This strategy profits from a limited move in the underlying asset.

- Bull Put Spread: This bullish strategy involves buying an at-the-money call option and selling an out-of-the-money call option. The trader expects the underlying asset to rise but limits the potential gains and losses.

- Bear Call Spread: This bearish strategy involves selling an at-the-money call option and buying an out-of-the-money call option. The trader anticipates the underlying asset to fall but limits potential losses and puts a cap on potential gains.

Tips and Expert Advice for Success

Choose the right options: Selecting the appropriate options for your strategy is crucial. Consider the underlying assets’ price, volatility, expiration date and strike prices.

Manage risk effectively: Implement risk management measures such as stop-loss orders and position sizing to protect your capital.

Stay informed: Keep up-to-date with market trends, economic data and news to make informed trading decisions.

Consider time decay: Understand the impact of time decay on option premiums and adjust your strategies accordingly.

Seek professional advice: If you’re new to options trading, consider seeking guidance from a qualified financial advisor.

Image: www.marketsmuse.com

FAQs on Options Trading Strategies

- Q: How do I choose the right strike price?

- A: The optimal strike price depends on your trading strategy, risk tolerance, and expectations for the underlying asset’s movement.

- Q: What is the best expiration date for options?

- A: The ideal expiration date balances premium costs and potential profit. Consider the estimated time it will take for the underlying asset to move in your favor.

- Q: How much time should I spend researching options before trading?

- A: Thorough research is essential before trading options. Spend as much time as necessary to understand the strategies, risks and potential rewards involved.

Conclusion

Options trading can be a rewarding but complex endeavor. Grasping the strategies outlined in this article, incorporating expert advice, and managing risk effectively will empower you to make educated trading decisions. By understanding the various options strategies and their potential benefits and risks, you will be well-equipped to navigate the world of options trading.

Trading Strategies Involving Options Chapter 10

Image: www.slideserve.com

Are you interested in learning more about options trading strategies?