Captivating Story to Introduce the Topic

In the bustling world of finance, where fortunes are made and lost, there exists an arena where even the most seasoned investors tread with both exhilaration and caution: the realm of stock index options trading. Options, like secret tools, grant traders the power to amplify their returns, but they come with their own set of risks that can send shivers down the spine. If you’re yearning to unlock the potential of this captivating market, fasten your seatbelts as we embark on a journey that will unveil the captivating nuances of trading stock index options.

Image: theforexscalpers.com

Delving into the Marvelous World of Stock Index Options

Imagine yourself standing at the intersection of stock markets and options contracts. Stock index options are fascinating financial instruments that confer upon you the right, but not the obligation, to buy or sell a specific stock index at a predetermined price on a future date. This delightful concoction of flexibility and leverage empowers you to make strategic bets on the direction of the market without the hefty commitment of owning the underlying stocks.

Options trading has gained immense popularity among investors seeking to enhance their returns, hedge their portfolios, or even generate income through option premiums. Yet, this alluring realm also demands thorough comprehension and prudent risk management.

1. Comprehending the Anatomy of Stock Index Options:

Before venturing into this exciting arena, it’s imperative to understand the fundamental building blocks of stock index options:

-

Underlying Asset: Dive into the captivating world of stock indices, such as the S&P 500 or Nasdaq 100, which represent the collective performance of a basket of stocks. Options provide you with the opportunity to bet on the trajectory of these indices.

-

Call and Put Options: Call options bestow upon you the right to buy the underlying index at the strike price on or before the expiration date. Put options, on the other hand, grant you the right to sell the index at the strike price.

-

Strike Price: This magical number defines the hypothetical price at which you can buy or sell the index.

-

Expiration Date: Just like Cinderella’s midnight hour, options contracts have a finite lifespan. The expiration date marks the end of their trading journey, and you must exercise or liquidate your options before the clock strikes twelve.

2. Unveiling the Alluring Advantages of Index Options:

Stock index options shine with a constellation of advantages that have captivated the hearts of investors:

-

Enhancing Returns: Options provide a potent recipe for amplifying your gains. By effectively leveraging your capital, you can potentially reap significant returns, even with modest market movements.

-

Tailoring Your Risk Profile: Options offer investors the flexibility to sculpt their risk-reward profile. By blending different types of options strategies, you can craft a tailored approach that aligns with your appetite for adventure.

-

Earning Income from Time Decay: Premiums associated with options naturally dwindle as time marches forward. This fenómeno, known as time decay, can be harnessed to generate income, even if the underlying index remains stagnant.

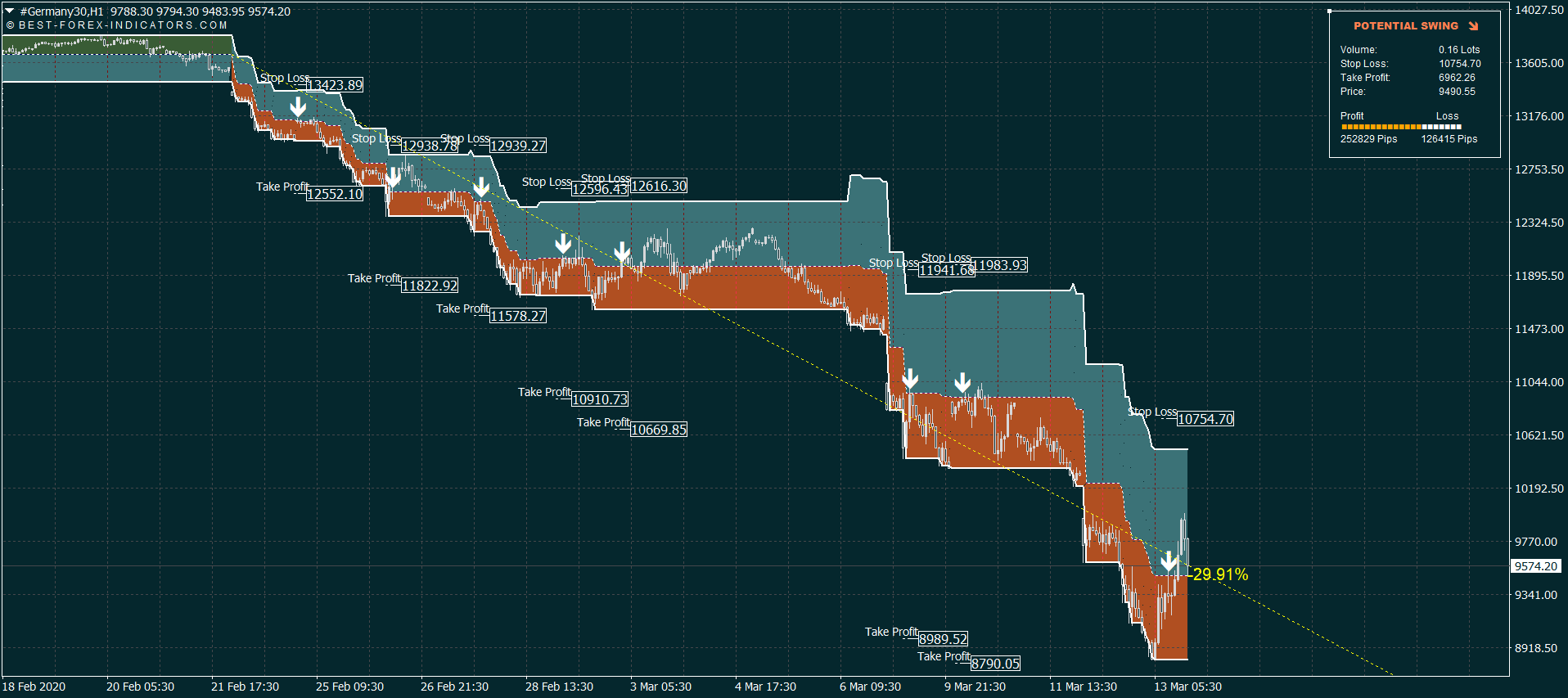

Image: best-forex-indicators.com

3. Masterstrokes for Successful Index Options Trading:

As you embark on your options trading odyssey, keep these valuable tips in mind:

-

Know Your Battleground: Arm yourself with a thorough understanding of index movements, historical trends, and economic factors that shape their trajectory.

-

Plan Your Moves Strategically: Carefully consider your entry and exit points. Time your trades with precision, paying close attention to market sentiment and technical indicators.

-

Manage Risk Prudently: Options trading is not for the faint-hearted. Implement robust risk management strategies, including position sizing and stop-loss orders, to safeguard your hard-earned capital.

-

Harness Bollinger Bands: These technical indicators provide valuable insights into market volatility. Bollinger Bands can guide your decisions on when to enter and exit trades for optimal outcomes.

-

Seek Expert Guidance: If you’re traversing the options landscape for the first time, consider seeking the counsel of experienced professionals. Their wisdom can illuminate your path and help you navigate the complexities of this dynamic market.

Trading Stock Index Options

Image: s3.amazonaws.com

Conclusion: Embracing the Power of Stock Index Options

Trading stock index options presents a thrilling opportunity to amplify your returns, hedge against market volatility, and generate income. By understanding the core concepts, embracing proven strategies, and exercising prudent risk management, you can harness the full potential of this exhilarating realm. Remember, options trading is not merely a game of chance; it’s an art that requires knowledge, skill, and the unwavering pursuit of excellence. Embrace the challenges, push your limits, and unlock the captivating possibilities that lie within the stock index options market.