Ignite Your Trading Journey: Embrace the Power of Options

Embark on an extraordinary trading adventure with TD Ameritrade, where options await as a gateway to expanding your financial horizons. Like a skilled navigator, this guide will equip you with the knowledge and strategies to harness the power of options and unlock the potential of informed decision-making in the dynamic market landscape.

Image: www.makeupera.com

Beyond the Veil: Unveiling the Enigmatic World of Options

Options, often shrouded in complexity, are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price within a specific timeframe. This flexibility empowers traders to navigate market fluctuations, capitalize on opportunities, and potentially mitigate risks.

A Masterclass in Options Trading: Step-by-Step Mastery

To embark on your options trading journey with TD Ameritrade, a series of carefully orchestrated steps await:

-

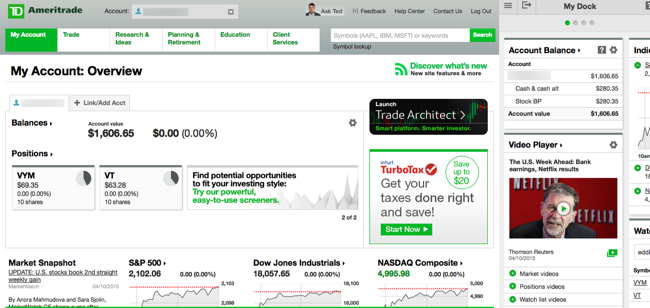

Establish Your TD Ameritrade Account: Open a trading account tailored to your specific needs and investment objectives.

-

Approve Options Trading: Submit an application to activate options trading privileges, ensuring alignment with your risk tolerance and investment knowledge.

-

Education and Understanding: Immerse yourself in educational resources to familiarize yourself with options strategies, risk management techniques, and market dynamics.

-

Platform Proficiency: Master the intuitive TD Ameritrade trading platform, equipping you with the tools for strategic execution.

-

Develop a Trading Plan: Define your trading strategy, outlining entry and exit points, risk management parameters, and profit targets.

Harnessing the Momentum: Latest Trends and Developments

The options trading arena is constantly evolving, presenting a dynamic environment for traders to explore:

-

Growth in Retail Trading: A surge in retail investors embracing options trading, seeking alternative paths to financial growth.

-

Technology Enhancements: Advanced trading platforms empower traders with real-time data analysis, automated execution, and AI-driven insights.

-

Regulatory Updates: Ongoing regulatory changes shape the options trading landscape, ensuring investor protection and market integrity.

Image: www.chokleong.com

Expert Insights: Unlocking the Secrets of Successful Trading

Seasoned traders reveal invaluable tips to navigate the options market with precision:

-

Thorough Research: Meticulously analyze underlying assets, market conditions, and historical trends before venturing into any trade.

-

Risk Management Mindset: Adopt a prudent approach by understanding risk-reward ratios, implementing stop-loss orders, and diversifying your portfolio.

-

Continuous Learning: Embrace ongoing education to keep pace with market dynamics, innovative strategies, and regulatory developments.

Frequently Asked Questions: Demystifying Options

Q: What is the difference between a call and a put option?

A: A call option grants the right to buy an underlying asset at a specified price, while a put option grants the right to sell the asset.

Q: How do I determine the value of an option?

A: Option pricing models, such as the Black-Scholes model, consider factors like stock price, strike price, time to expiration, interest rates, and volatility.

Q: What are the risks associated with options trading?

A: Options trading involves inherent risks, including the potential for substantial losses, volatility, and time decay.

How To Allow Options Trading On Td Ameritrade

Image: www.reddit.com

Embracing the Future: The Transformative Power of Options

As you embark on your options trading journey, remember that knowledge is your compass and risk management your guiding light. Unveil the hidden potential of the financial markets with TD Ameritrade, where opportunities await those who dare to explore.

Would you like to delve deeper into the captivating realm of options trading? Engage with us to refine your strategies, unlock expert insights, and elevate your trading prowess.