Introduction

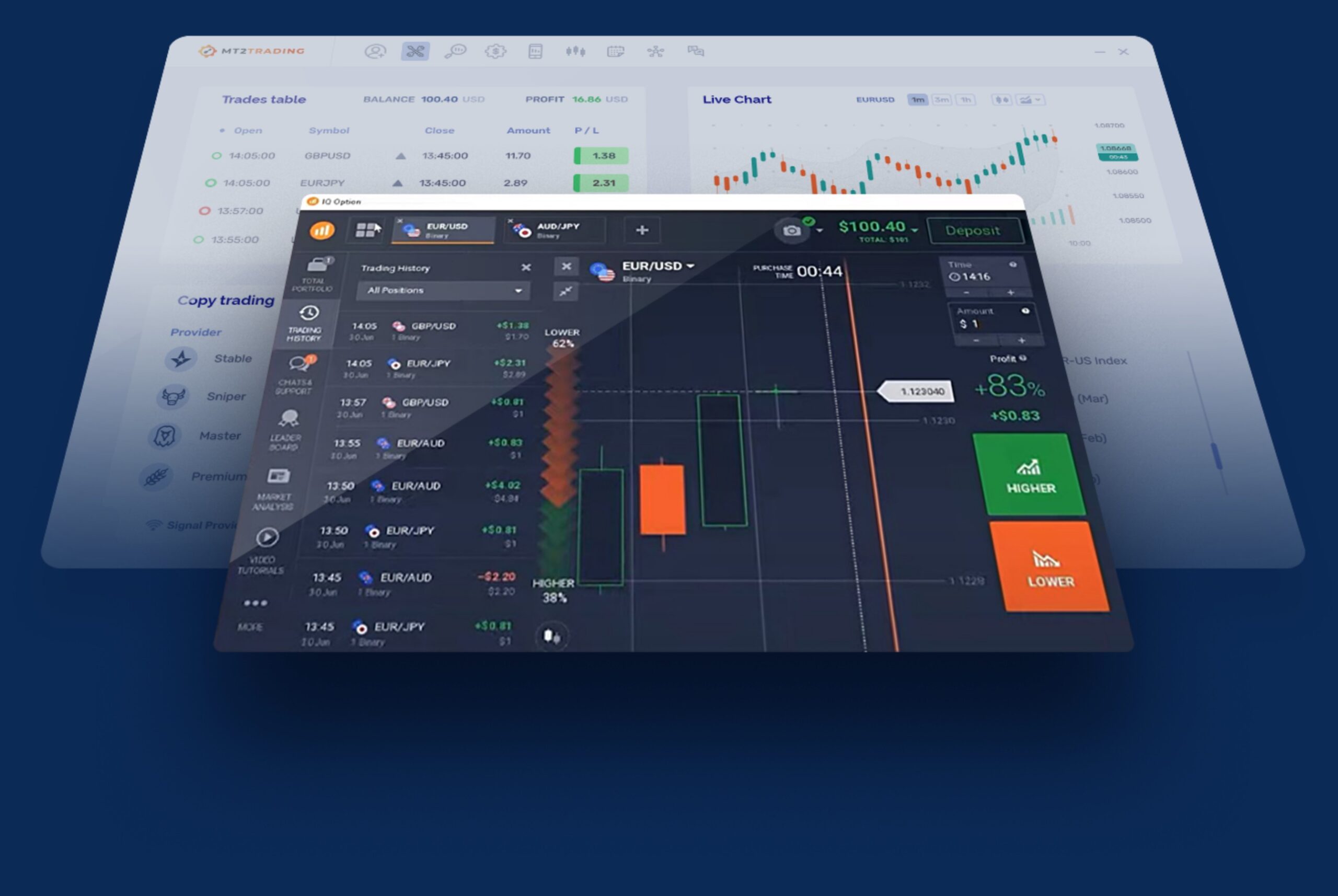

With its advanced platform and intuitive interface, IQ Option has emerged as a leading choice among traders worldwide. Its suite of trading tools, including trading robots (also known as algorithmic trading or auto trading), empowers traders to automate their strategies and enhance their trading efficiency. This comprehensive guide explores the world of trading robots for IQ Option, providing an in-depth understanding of how they work, their benefits, and how to select and use them effectively.

Image: www.mt2trading.com

What Are Trading Robots?

Trading robots are software programs that automate trading decisions based on predefined algorithms and parameters. They continuously monitor market data and execute trades according to a set of rules, eliminating the need for manual intervention. By leveraging algorithms, traders can backtest trading strategies, optimize execution, and maintain precise risk management, ultimately striving for enhanced profitability.

Benefits of Using Trading Robots for IQ Option

-

Enhanced Efficiency: Trading robots eliminate the need for constant manual trading, freeing up time for other aspects of strategy development and market analysis.

-

Emotionless Trading: Bots operate based on predefined rules, devoid of human emotions such as fear or greed that can cloud judgment and lead to poor trading decisions.

-

Backtesting and Optimization: Robots allow for extensive backtesting of strategies on historical data, enabling traders to refine their approaches and identify optimal settings.

-

Risk Management: Trading robots can be configured with specific risk management parameters to protect against excessive losses and ensure controlled risk exposure.

-

24/7 Trading: Unlike humans who require rest, robots can operate continuously, monitoring markets and executing trades even outside regular trading hours.

How to Choose a Trading Robot for IQ Option

Choosing the right trading robot is paramount to successful algorithmic trading. Consider the following factors:

-

Strategy: Select a robot that aligns with your trading strategy and risk tolerance. Different robots employ varied algorithms for trend following, scalping, or other trading styles.

-

Performance: Evaluate the bot’s historical performance through backtesting and simulation to assess its accuracy and profitability.

-

Customization: Look for robots that offer customizable parameters, enabling you to tailor them to specific market conditions and your risk appetite.

-

Support: Choose a robot from a provider with reliable customer support, ensuring timely assistance should any issues arise.

-

Cost: Trading robots vary in cost, so consider your budget and the potential return on investment before making a purchase decision.

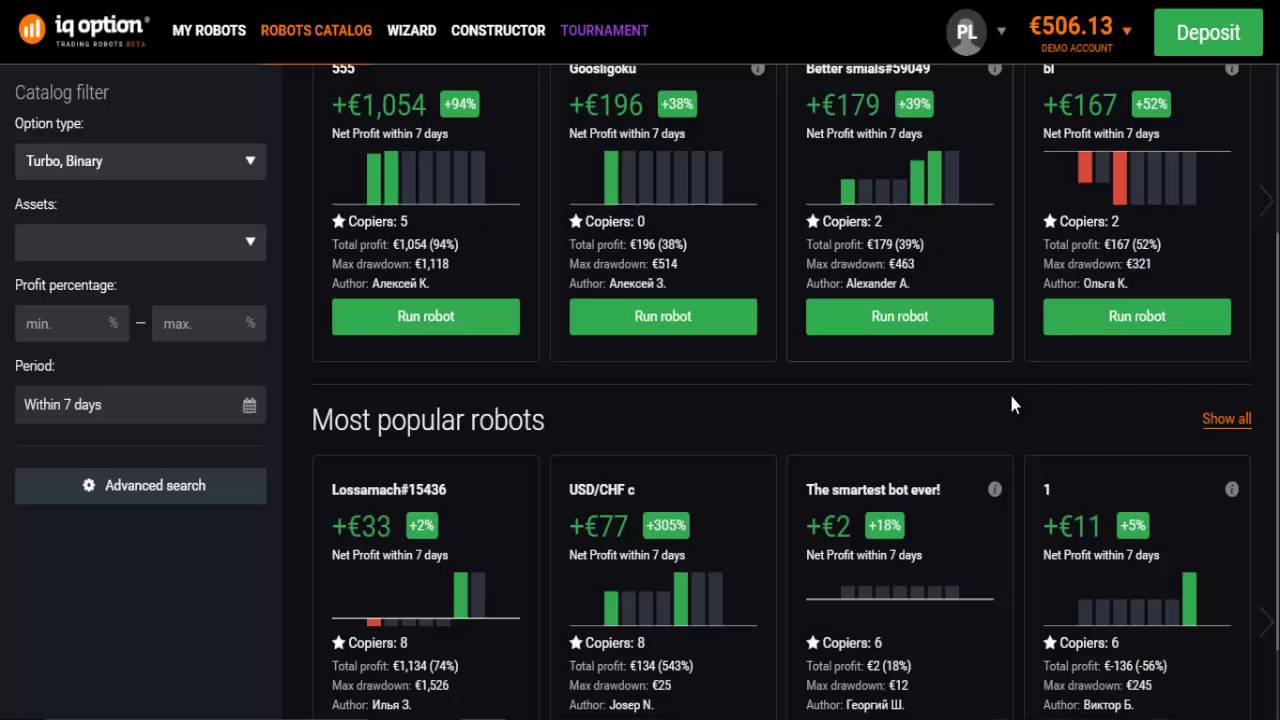

Image: www.youtube.com

Best Trading Robots for IQ Option

The choice of the best trading robot depends on individual trading preferences and strategies. Here are some popular and reputable options:

-

SuperTrend EA: Designed for trend following strategies, this robot uses the SuperTrend indicator to identify market trends and execute trades accordingly.

-

RSI Divergence EA: This robot focuses on identifying and trading divergence between price and the Relative Strength Index (RSI), offering potential profit opportunities during market reversals.

-

CCI Scalping EA: Employing the Commodity Channel Index (CCI), this robot seeks to profit from short-term price fluctuations by executing a series of small trades with minimal drawdown.

-

ATR Stop EA: Based on the Average True Range (ATR), this robot helps manage risk by automatically adjusting stop-loss levels based on market volatility.

-

Martingale EA: While controversial, the Martingale strategy involves doubling the trade size after each loss, with the potential for high returns but also elevated risk.

Tips for Using Trading Robots Effectively

-

Start Small: Begin with a small account and a limited number of bots to minimize potential losses while gaining experience.

-

Monitor Performance: Regularly monitor the performance of your bots, adjusting settings or strategies as needed to maintain profitability.

-

Control Risk: Set appropriate stop-loss levels and risk management parameters to prevent excessive losses and preserve capital.

-

Diversify your Strategies: Don’t rely solely on a single bot. Diversify your algorithmic trading portfolio by using multiple robots with different strategies.

-

Education and Research: Continuously educate yourself about algorithmic trading concepts, strategies, and market dynamics to make informed decisions.

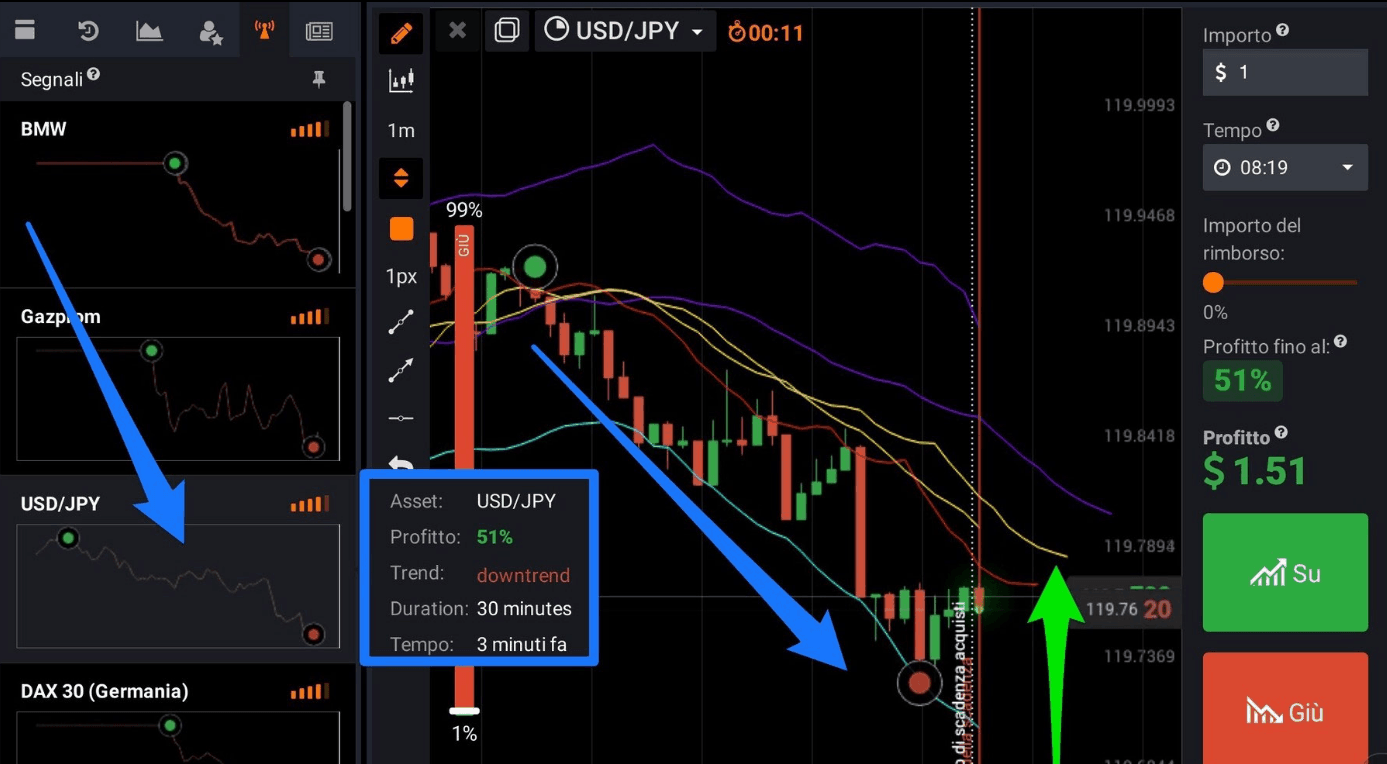

Trading Robot Iq Option

Image: affectivehealthcare.com

Conclusion

Trading robots can be powerful tools for traders seeking to automate their strategies, improve efficiency, and enhance profitability. By understanding their benefits, selecting the right bot, and implementing effective trading practices, traders can harness the potential of algorithmic trading on the IQ Option platform. However, it’s crucial to remember that trading involves risk, and a disciplined approach, sound risk management, and ongoing learning are essential for success.