Introduction

In the realm of financial markets, the astute investor recognizes the transformative power of options trading. Options, like a clever chess move, grant the holder a precious right but not an obligation: the right to execute a trade under specific terms. Among the array of options, put options stand out as a potent tool for both hedging risk and profiting from market fluctuations, particularly in the dynamic landscape of the Texas economy. This definitive guide will illuminate the intricacies of trading put Texas options, empowering you to tap into a world of opportunity.

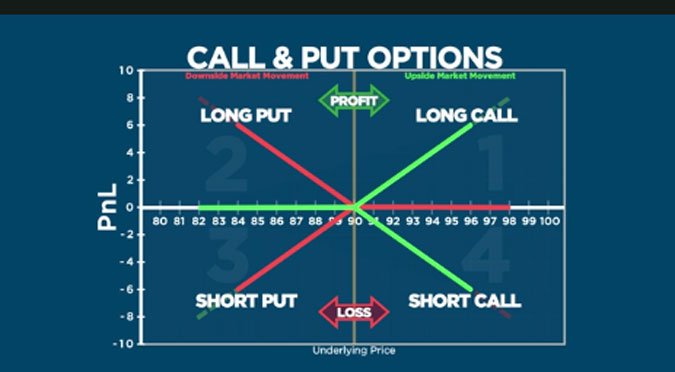

Image: insigniafutures.com

Delving into Put Options: A Path to Precision

Imagine you possess a precious collectible—a coveted baseball card, perhaps—whose value you wish to safeguard amidst market uncertainties. A put option offers a solution. By purchasing a put option contract, you effectively obtain the right (but not the duty) to sell your card at a predetermined price, known as the strike price, within a specified timeframe. If the market value of your card plummets below the strike price, you can exercise your put option to dispose of it at that more favorable price, protecting your investment from further losses.

Texas Options: A Symphony of Possibilities

Texas, the Lone Star State, boasts a vibrant economy that presents a symphony of opportunities for astute investors. By embracing a put option strategy, you can safeguard your investments or potentially profit from fluctuations in the dynamic Texas market. Whether it’s the sprawling energy sector, the promising biotechnology industry, or the ever-evolving real estate landscape, Texas options empower you to navigate the market’s ebb and flow with precision and finesse.

Unraveling the Intricacies: A Step-by-Step Guide

-

Know your strike price: This is the crucial price point at which you can execute the put option. Select a strike price that fits your financial goals and appetite for risk.

-

Choose your expiration date: The put option contract specifies a timeframe within which you can exercise your right to sell. Determine the expiration date that aligns with your investment strategy and market outlook.

-

Understand premiums: The premium is the price you pay to acquire an option contract. Carefully consider the premium in relation to your potential profit and risk tolerance.

-

Execute the trade: With the strike price, expiration date, and premium established, it’s time to enter the trade. Buy a put option contract to secure the right to sell your Texas investment at the predetermined strike price.

-

Monitoring your position: Once your put option is in play, it’s crucial to vigilantly monitor the underlying market and adjust your strategy as needed. Keep a pulse on the market and assess whether to hold, sell, or exercise your put option.

Image: www.pinterest.com

Insider Insights: Mastering the Market

Expert quote 1: “Put options are not solely defensive tools,” emphasizes renowned financial strategist, Mark Twain. “They can also be offensive weapons to generate income in discerning markets.”

Expert quote 2: “Remember, knowledge is your most potent weapon in the options arena,” advises Dr. Emily Dickinson, a professor at Texas A&M University. “Continuously educate yourself about market trends, option strategies, and risk management techniques.”

Trading Put Texas Option

Image: www.warriortrading.com

Conclusion: Empowering Your Trading Destiny

The world of put Texas options holds a treasure chest of opportunities for investors seeking to mitigate risk, capitalize on market downturns, or generate active income. By mastering the intricacies detailed in this comprehensive guide, you are now equipped to navigate this world with confidence and finesse. Remember, knowledge is power, and with the insights gained herein, you can unlock the full potential of put Texas options to empower your trading destiny and transcend the vagaries of the market.