Put options are financial instruments that grant the buyer the right, but not the obligation, to sell a specific underlying asset at a predetermined price (strike price) before a certain expiration date. Put options are ideal for investors seeking to protect against potential declines in the value of an asset or speculate on its price movements.

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Image: www.thebalancemoney.com

Unlike call options, which give the buyer the right to buy an asset, put options allow the buyer to profit from a decrease in the underlying asset’s price. If the asset’s price falls below the strike price before the expiration date, the put option holder can exercise the option and sell the asset at the higher strike price, thereby generating a profit.

Understanding Put Option Contracts

Put options contracts specify the following key terms:

- Underlying Asset: The asset being tracked by the option, such as stocks, indices, or commodities.

- Strike Price: The price at which the holder has the right to sell the underlying asset.

- Expiration Date: The date after which the option expires and can no longer be exercised.

- Premium: The price paid upfront to acquire the put option.

Benefits of Trading Put Options

- Hedging against Downside Risk: Put options provide a safety net for investors holding long positions in an underlying asset. If the asset’s price declines, the put option holder can exercise the option to sell the asset at the higher strike price, limiting their losses.

- Income Generation: Put options can be used to generate income through option premiums. By selling put options, investors collect a premium while retaining the obligation to buy the underlying asset if the option is exercised.

- Price Speculation: Put options allow investors to speculate on future price movements of the underlying asset. If they expect a decline in price, they can purchase put options and profit if their prediction holds true.

Types of Put Options Strategies

- Naked Put: Selling a put option without owning the underlying asset. This strategy is high-risk and only recommended for experienced traders.

- Covered Put: Selling a put option while already owning the underlying asset. This strategy provides downside protection while generating income.

- Protective Put: Buying a put option to hedge against an existing long position in the underlying asset. This strategy limits potential losses but also reduces potential gains.

- Collar Strategy: Combining a covered call with a protective put. This strategy limits both upside and downside potential in exchange for a fixed income.

Image: www.onlinefinancialmarkets.com

Risks Associated with Put Options

- Price Fluctuations: Put option prices are directly influenced by the underlying asset’s price movements. Sudden or unexpected changes in the asset’s price can result in significant losses for option holders.

- Time Decay: Put options lose value as they approach their expiration date, regardless of whether the underlying asset’s price has changed. This time decay can erode the option premium paid at the purchase.

- Execution Risk: If an option is exercised, the holder may encounter difficulties executing the sale of the underlying asset at the desired strike price, especially in illiquid markets.

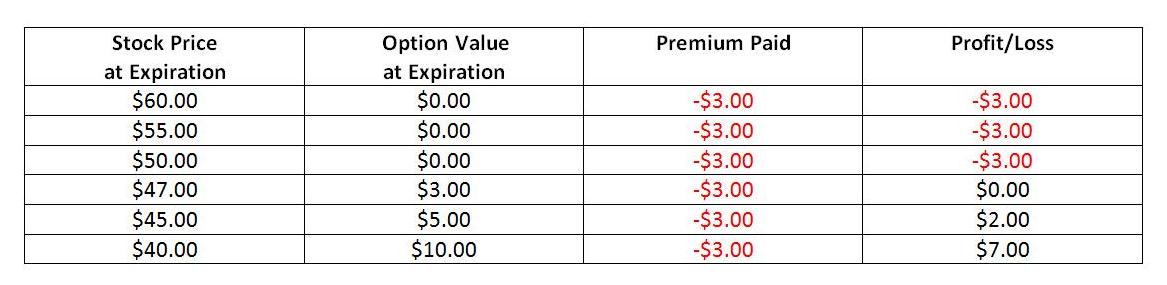

Trading Put Options Example

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Image: scuba-dawgs.com

Conclusion

Trading put options can be a valuable tool for investors and traders seeking to manage downside risk, generate income, or speculate on price movements. However, it is crucial to fully understand the nature of put options, the associated risks, and the various strategies to employ them effectively. By conducting thorough research and considering personal risk tolerance, investors can leverage put options to enhance their investment portfolios and potentially achieve their financial goals.