Harnessing Market Potential: An Overview

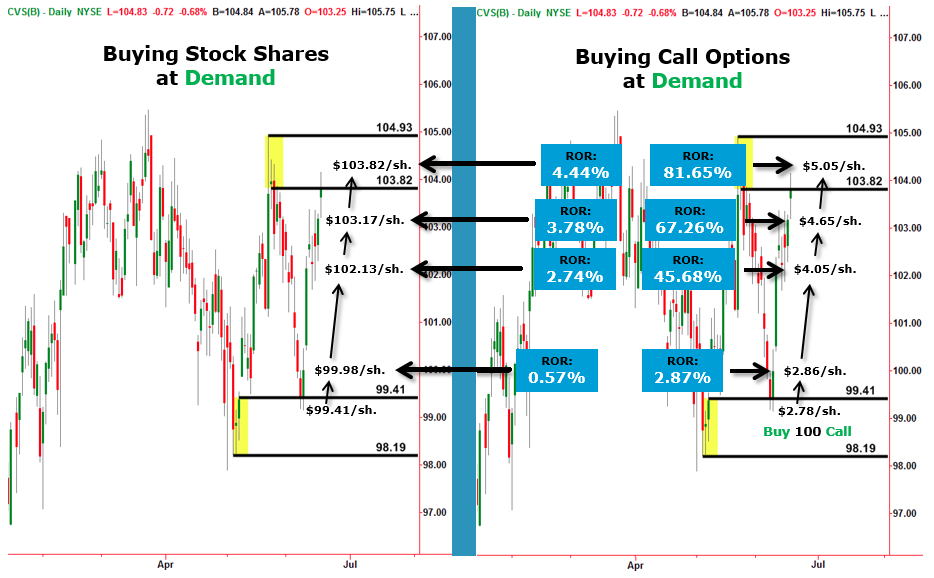

Traditionally, investing in the stock market involves purchasing shares of ownership in a company. However, there is an alternative and potentially lucrative avenue for savvy investors: options trading. Options provide investors with the ability to speculate on the price movements of underlying assets, including stocks, without the need to own the underlying security directly. This dynamic approach opens up new possibilities for investors seeking to capitalize on market trends and manage risk effectively.

Image: www.tradingacademy.com

Understanding Options: A Path to Market Insight

Options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined period. Unlike stock ownership, options do not convey any ownership interest in the underlying asset. Instead, they offer the potential for high returns while limiting the investor’s financial exposure.

There are two main types of options: calls and puts. Call options give the buyer the right to buy the underlying asset at the strike price on or before the expiration date. Put options, on the other hand, provide the right to sell the underlying asset at the strike price. The strike price is the agreed-upon price at which the option can be exercised.

Navigating the Options Landscape: Strategies and Considerations

Options trading offers a diverse range of strategies, each tailored to specific market scenarios and investor goals. Covered calls involve selling call options while owning the underlying stock. This strategy aims to generate income while limiting downside risk. Naked calls, on the other hand, are sold without owning the underlying stock, exposing the seller to potentially unlimited losses.

Put options can be utilized for downside protection and income generation. Cash-secured puts involve selling put options while holding cash reserves to potentially buy the underlying asset at the strike price. Naked puts expose the seller to potentially unlimited losses if the underlying asset price falls below the strike price.

Leveraging Options: Enhancing Portfolio Performance

Options provide investors with several advantages over traditional stock ownership. They offer:

- Asymmetric Risk and Reward: Options limit the investor’s potential loss to the premium paid, while offering the potential for substantial gains.

- Flexibility and Leverage: Options allow investors to make directional bets on the market without committing large amounts of capital.

- Income Generation Potential: Selling options can provide income through premiums, regardless of the direction of the underlying asset price.

Image: finance.yahoo.com

Mastering Options Trading: Essential Principles and Best Practices

To maximize success in options trading, adherence to certain principles is crucial:

- Understand the Risks: Options trading involves significant risk, and investors should thoroughly research and understand the potential risks involved.

- Define Trading Goals: Identify specific trading objectives and tailor strategies accordingly.

- Manage Positions: Monitor positions regularly and adjust as needed to manage risk and optimize returns.

- Seek Education: Continuous education is essential to stay abreast of market trends and enhance trading skills.

Trading Options Without Owning Stock

/financial-stock-market-graph-chart-of-stock-market-investment-trading-1086745334-129a8996fb374cc889aae30eb8e43bff.jpg)

Image: industrialtrading.co.za

Conclusion: Embracing the Options Frontier

Trading options without owning stock offers investors a powerful tool to navigate the market and potentially enhance portfolio returns. By embracing this innovative approach, investors can capitalize on market opportunities, optimize risk management, and pursue their financial goals with greater flexibility. However, it is imperative to approach options trading with a sound understanding of the risks involved and a commitment to ongoing education. With careful planning and execution, options trading can be a rewarding journey to financial success.