Unleashing the Potential of Derivatives

In the dynamic world of finance, options trading offers traders the opportunity to leverage derivatives to manage risk and potentially enhance returns. As a leading brokerage firm, Interactive Brokers provides a comprehensive platform for individuals seeking to navigate the intricacies of options trading. In this article, we delve into the specifics of trading options with Interactive Brokers, empowering you with the knowledge and strategies to succeed in this complex yet rewarding market.

Image: everydayinvestinginyou.com

Interactive Brokers: A Gateway to Options Market

Interactive Brokers has emerged as a preferred platform for options traders due to its robust suite of tools, competitive commissions, and extensive product offerings. The platform’s user-friendly interface, advanced charting capabilities, and real-time market data equip traders with the resources necessary to make informed decisions. Additionally, Interactive Brokers offers a wide range of options contracts, covering diverse asset classes such as stocks, indices, commodities, and currencies.

Understanding Options Trading

Options are financial instruments that provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options contracts typically consist of two parties: the buyer and the seller. The buyer pays a premium to the seller in exchange for the right to exercise the option. The seller is obligated to fulfill the contract if the buyer decides to exercise the option.

Call and Put Options

There are two main types of options: call options and put options. Call options give the holder the right to buy the underlying asset at the strike price. Put options, on the other hand, grant the holder the right to sell the underlying asset at the strike price. The strike price is the price at which the option can be exercised.

Image: markus-heitkoetter.medium.com

Strategic Options Trading

Strategic options trading involves using options as a means of managing risk and enhancing returns within an overall investment portfolio. Common strategies include covered calls, cash-secured puts, and long straddles. By understanding the nuances of these strategies, traders can effectively leverage options to suit their investment objectives.

Tips and Expert Advice

-

Understand the Risks: Options trading involves inherent risks, including the potential loss of capital. Before engaging in options trading, it’s crucial to thoroughly assess your risk tolerance and financial situation.

-

Study the Underlying: Before trading options, gain a comprehensive understanding of the underlying asset’s historical price movements, volatility, and relevant market factors.

-

Manage Expectations: Options trading doesn’t guarantee instant riches. Set realistic expectations and recognize that success often involves a long-term, disciplined approach.

-

Seek Professional Guidance: Consult with a financial advisor or experienced options trader to gain valuable insights and personalized guidance.

FAQs on Options Trading

- Q: What is an options chain?

A: An options chain is a table that displays the prices and volume of different options contracts for a specific underlying asset with varying strike prices and expiration dates.

- Q: What is the difference between ITM, OTM, and ATM options?

A: ITM (in the money) options have a strike price that is favorable to the buyer. OTM (out of the money) options have a strike price that is unfavorable to the buyer. ATM (at the money) options have a strike price that is close to the current price of the underlying asset.

- Q: Can I make money selling options?

A: Yes, it is possible to make money selling options by collecting premiums from buyers. However, it involves assuming the obligation to fulfill the contract if the option is exercised.

Trading Options With Interactive Brokers

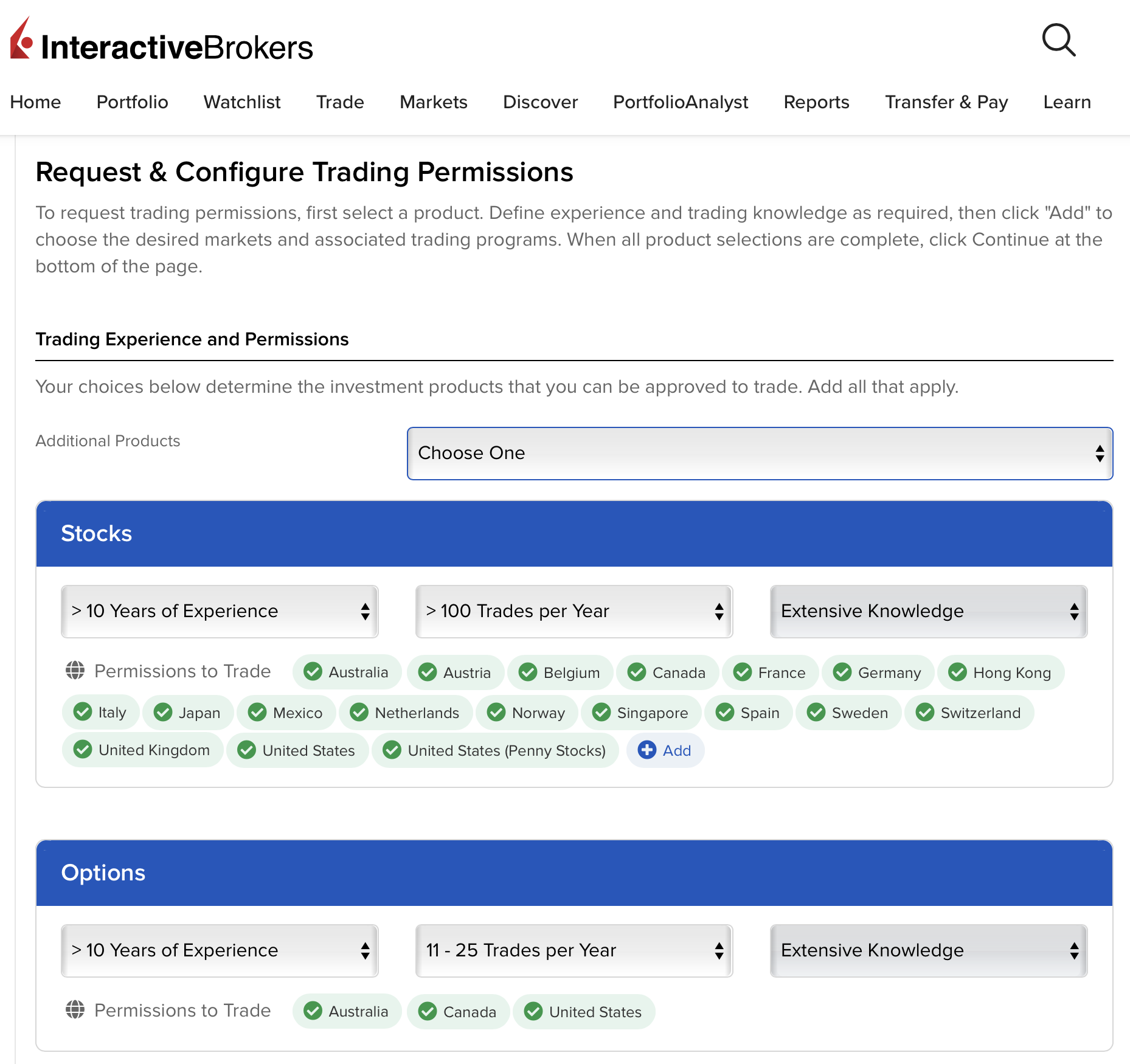

Image: gfmasset.com

Conclusion

Trading options with Interactive Brokers offers a powerful opportunity to leverage derivatives and enhance investment strategies. By embracing the principles outlined in this article, you can navigate the complexities of options trading and unlock its potential for risk management and return enhancement. Embrace the learning curve, seek professional guidance when necessary, and remember to always approach options trading with a thoughtful and measured approach.

Join the growing community of traders who have found success with options trading on Interactive Brokers. Take the next step towards building a more robust investment portfolio by exploring the world of options trading today.