Introduction

Imagine having a superpower that allows you to potentially magnify your returns on the stock market. That’s what options trading offers – a tantalizing opportunity to leverage your investments and amplify your profits. But like any superpower, option trading requires knowledge and skill to wield it effectively. Enter this comprehensive guide, your ultimate weapon to conquer the options trading arena. Get ready to unlock the secrets and skyrocket your financial prowess!

Deciphering Options: What’s the Hype All About?

Options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or index, at a specified price on or before a certain date. Think of them as tickets to a grand event – you have the choice to attend (exercise the option) or let it pass without further commitment.

The allure of options lies in their inherent flexibility. They offer investors an opportunity to fine-tune their strategies, manage risk, and potentially enhance returns. By understanding how options work, you gain the power to navigate unpredictable market conditions and make informed decisions that could propel your financial journey forward.

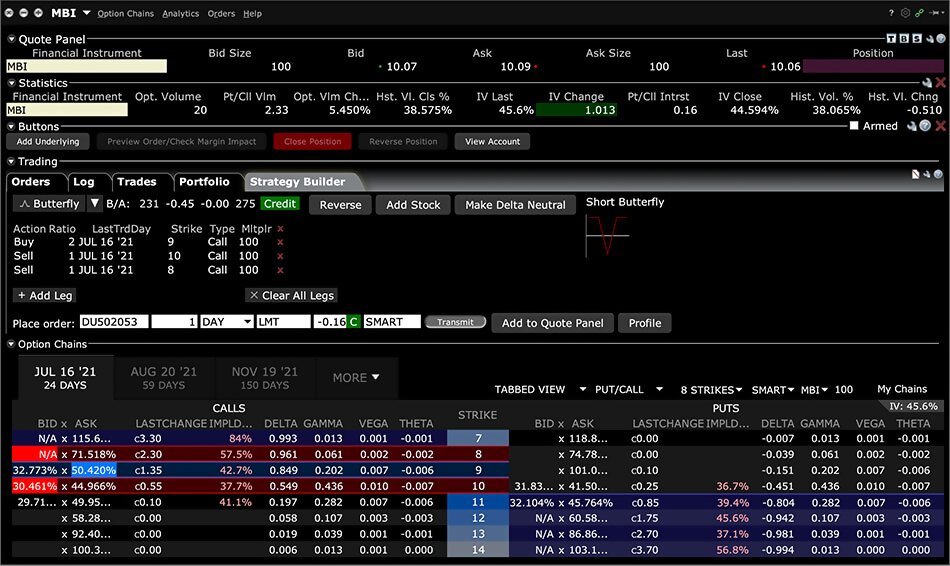

Image: www.interactivebrokers.co.uk

Call Options: Betting on a Rising Star

Call options are the epitome of optimism – a vote of confidence in a stock’s ability to soar. When you purchase a call option, you’re betting that the underlying stock’s price will climb above the strike price before the expiration date. If your prediction holds true, you have the golden opportunity to exercise your right to buy the stock at the agreed-upon strike price, regardless of the market price.

Put Options: Embracing the Pessimist Within

Put options, on the other hand, embody caution and a belief in the possibility of a stock’s decline. By investing in a put option, you’re essentially hedging your bets against a potential market downturn. If the stock’s price plummets below the strike price, you can exercise your option and sell the stock at the predetermined price, profiting from the dip.

Striking the Right Note: Understanding Strike Prices

Strike price is the pivotal point around which options contracts revolve. It represents the price at which you can exercise your right to buy (call) or sell (put) the underlying asset. Choosing the right strike price is crucial for successful options trading, as it significantly influences your potential profit and loss.

Image: www.youtube.com

Expiration Dates: Time Is of the Essence

The expiration date is the ultimate deadline for exercising your option contract. Once this date passes, the option loses its power, and the contract expires worthless. Understanding expiration dates is essential to time your trades wisely and make the most of market opportunities.

Option Premiums: The Price of Opportunity

When you buy an option, you pay a premium, which is the price for acquiring the right to buy or sell the underlying asset. This premium reflects factors such as the intrinsic value (the difference between the stock price and the strike price) and the time remaining until expiration. Understanding option premiums empowers you to make informed decisions about the cost-benefit ratio of each trade.

Real-World Examples to Illumine Your Path

Let’s illuminate the concepts with real-world examples. Suppose you believe that XYZ stock has the potential to surge. You can purchase a call option with a strike price of $50 and an expiration date in three months. If the stock price skyrockets to $60 before expiration, you can exercise your option to buy the stock at $50, locking in a profit of $10 per share (minus the premium you paid).

Conversely, if you anticipate a downturn in XYZ stock, you could buy a put option with the same strike price and expiration date. If the stock price tumbles to $40, you can exercise your option to sell the stock at $50, profiting from the decline in stock value (minus the premium).

Trading Options How To Buy

Image: myfinanceresources.com

Conclusion

Trading options is an empowering tool that can amplify your financial potential. With the knowledge and skills outlined in this comprehensive guide, you’re now equipped to step into the ring and make informed decisions that could propel your investments to greater heights. Remember, options trading involves inherent risk, but with careful planning and a deep understanding of the concepts discussed, you can navigate the market with confidence and emerge victorious.