Imagine a world where you could predict the price of a stock, oil, or even gold months in advance. Sounds like a superpower, doesn’t it? While accurate predictions are far from guaranteed, the world of options and futures trading offers a unique opportunity to harness the power of market movements and potentially generate substantial returns. But before you jump headfirst into this complex and exhilarating realm, let’s delve deeper into its intricacies.

Image: www.pinterest.com

Options and futures trading, often referred to as “derivatives,” are financial instruments that derive their value from underlying assets like stocks, commodities, or currencies. They allow you to take positions on the future price of an asset without actually buying or selling the underlying asset itself. Think of it as a bet on the future, where you can profit or lose depending on your prediction’s accuracy. While seemingly daunting, mastering the art of options and futures trading can open doors to a world of financial possibilities, potentially boosting your portfolio and securing a brighter financial future.

Unraveling the Mysteries of Options and Futures: A Journey into the World of Derivatives

To truly understand the power of options and futures trading, we must first grasp their fundamentals. Let’s begin with options. Imagine you believe a particular stock, let’s say Apple, is going to skyrocket in value. Instead of buying the stock directly, you purchase a call option giving you the right, though not the obligation, to buy Apple shares at a predetermined price (the strike price) on or before a specific date (the expiration date). If the stock price rises above the strike price, you can exercise the option, buy the shares at a discount, and sell them at the higher market price, pocketing the difference. Conversely, if the price drops, you simply let the option expire worthless, minimizing your losses.

Futures, on the other hand, are legally binding contracts promising to buy or sell a specific asset at a predetermined price on a future date. Unlike options, futures obligate both parties to the agreement, meaning you are committed to buying or selling the asset regardless of the price change. For instance, imagine you believe the price of oil will fall. You can then sell a futures contract, promising to deliver oil at a specific price on a future date. If the price falls, you buy the oil at the lower market price and collect the difference. However, if the price rises, you lose money as you are obliged to sell the oil at the lower agreed-upon price.

Diving Deeper: Exploring the Nuances of Options

Options trading presents a wide range of possibilities due to its inherent flexibility. Let’s explore some common types:

- Call options give the buyer the right to buy the underlying asset at a predetermined price.

- Put options grant the buyer the right to sell the underlying asset at a predetermined price.

- American options allow the holder to exercise the right to buy or sell the asset at any time up to the expiration date.

- European options can only be exercised on the expiration date.

Unveiling the Complexity of Futures Contracts

Futures trading offers a powerful way to control and manage risk associated with price fluctuations. Here are some notable aspects:

- Margin requirements mean traders need to deposit a certain percentage of the contract value to secure the agreement.

- Leverage magnifies both profits and losses, potentially leading to significant returns but also substantial risks.

- Hedge funds and commodity trading advisors utilize futures to manage portfolios and speculate on price movements.

- Settlement for futures contracts occurs at the end of each trading day, with profits and losses settled daily.

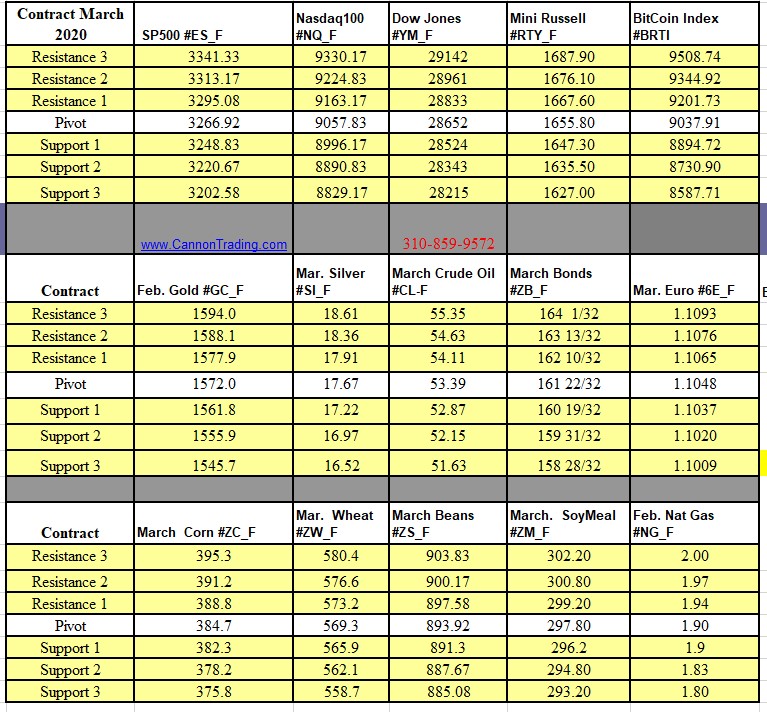

Image: www.cannontrading.com

Unlocking the Secrets: Experts Reveal their Strategies

While both options and futures trading offer exciting opportunities, navigating this complex world requires expert guidance. Let’s hear from some renowned figures:

- Mark Douglas, a prominent trading psychologist, emphasizes the importance of managing emotions and risk to avoid irrational decision-making.

- Peter Lynch, the legendary investor, highlights the need to understand the underlying asset before engaging in any option or futures trading, emphasizing fundamental analysis.

- Warren Buffett, the Oracle of Omaha, cautions against speculative trading, advocating for long-term investment strategies based on intrinsic value.

Building your Path to Success: Actionable Tips for Aspiring Traders

Now that you have a strong grasp of the fundamentals, let’s translate theory into action. Here are some actionable steps to take:

- Start small: Begin with a small investment and gradually increase your stake as you gain experience and confidence.

- Educate yourself relentlessly: Continuously learn about the markets, analyze trends, and refine your trading strategies.

- Practice with simulations: Utilize online trading platforms and simulators to hone your skills and test different strategies in a risk-free environment.

- Manage your risk: Never invest more than you can afford to lose. Implement stop-loss orders to limit potential losses and protect your capital.

- Stay disciplined: Avoid emotional trading and stick to your predetermined plan, even during periods of volatile market movements.

Options And Futures Trading

Embracing the Future: A Call to Action

The world of options and futures trading offers a captivating landscape of opportunity and challenge. By thoroughly understanding the fundamentals, seeking expert guidance, and applying the principles of risk management, you can embark on a journey toward financial success. Don’t be intimidated by the complexity; embrace the learning process, practice diligently, and leverage these powerful instruments to potentially transform your financial future. Remember, the key is to approach this exciting journey with both caution and determination, always prioritizing safety and financial well-being above all else.