Introduction

In the ever-evolving world of finance, options trading has gained immense popularity as an alternative source of income. Options for income spreads stand out as a particularly lucrative strategy that allows traders to capitalize on market fluctuations without substantial capital outlays.

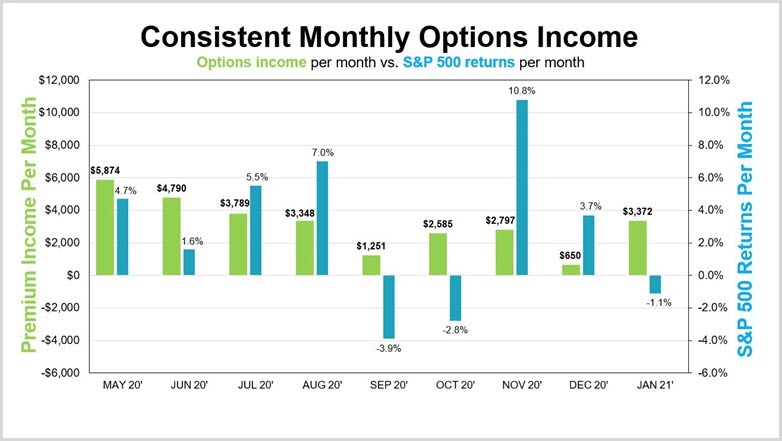

Image: www.ino.com

A personal anecdote can be added here to illustrate the potential of trading options for income spreads. For instance, a trader could describe how they generated a steady income using this strategy, providing a relatable starting point for the article.

Understanding Options for Income Spreads

Definition

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). An income spread involves simultaneously buying one option and selling another option with different strike prices and expiration dates on the same underlying asset.

When the spread is established, the trader receives a net premium, which represents the difference between the purchase price of the bought option and the sale price of the sold option. This premium serves as the trader’s potential profit.

Types of Income Spreads

There are various types of income spreads, each with its unique characteristics and risk-reward profile. Some common spreads include:

- Bull call spread: Involves buying a call option at a lower strike price and selling a call option at a higher strike price, both with the same expiration date.

- Bear call spread: The inverse of a bull call spread, where a call option at a higher strike price is bought, and a call option at a lower strike price is sold.

- Bull put spread: Similar to a bull call spread, but involves buying a put option at a lower strike price and selling a put option at a higher strike price.

- Bear put spread: The opposite of a bull put spread, where a put option at a higher strike price is bought and a put option at a lower strike price is sold.

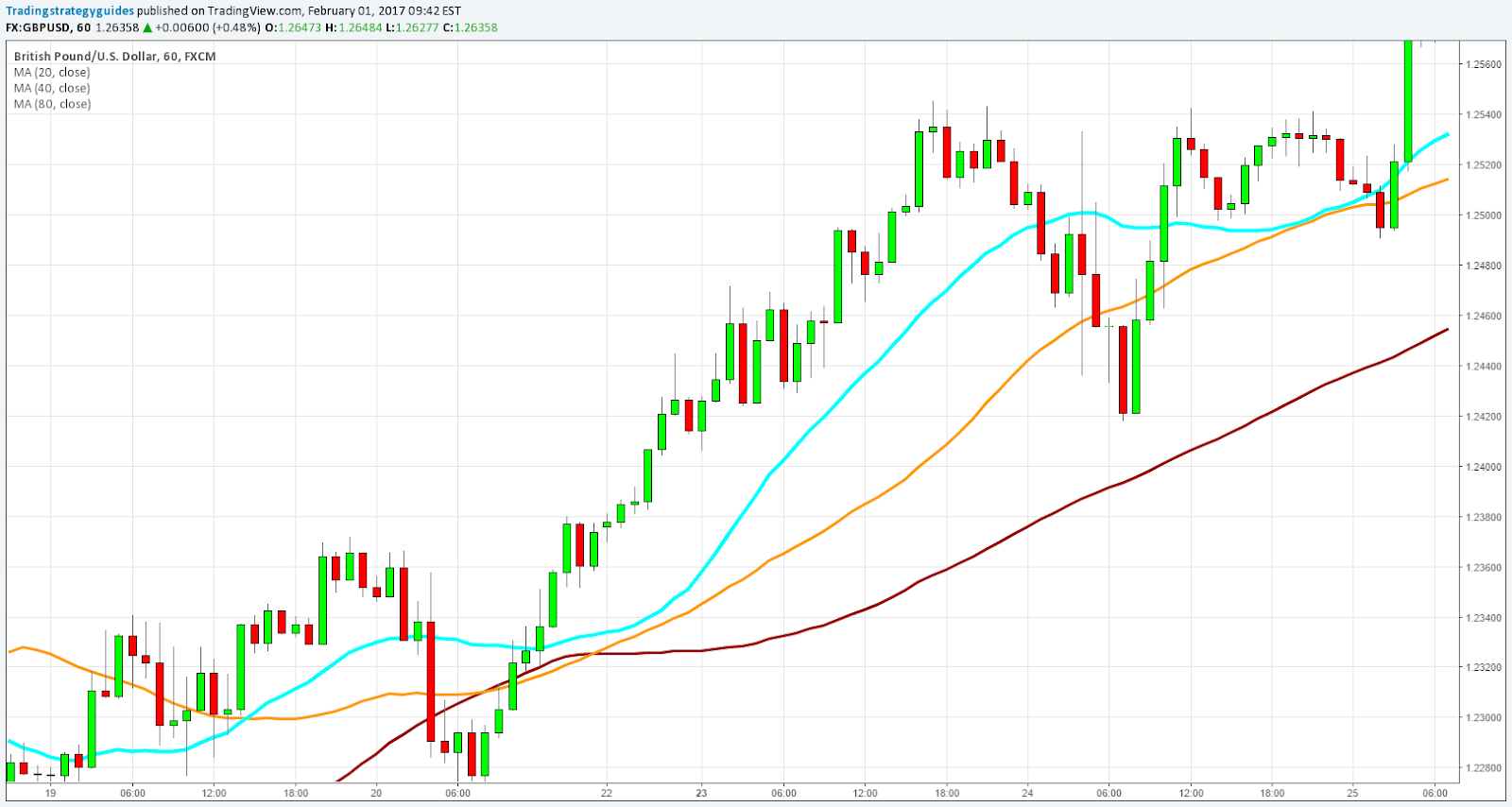

Image: xtremetrading.net

How Income Spreads Work

The profitability of an income spread hinges on the difference between the strike prices of the bought and sold options. When the underlying asset’s price moves in the trader’s favor, the bought option increases in value while the sold option loses value. This asymmetry leads to a net gain for the trader.

However, if the underlying asset’s price moves against the trader, the sold option may gain value while the bought option loses value, resulting in a net loss. Therefore, careful consideration and analysis are crucial in determining the optimal strike prices and expiration dates for the spread.

Latest Trends and Developments

The options market is constantly evolving, with new trends and developments emerging. By staying abreast of these updates, traders can gain a competitive edge and refine their income spread strategies.

One notable trend is the growing popularity of exchange-traded funds (ETFs) as underlying assets for options spreads. ETFs provide diversification and liquidity, making them appealing to traders seeking to manage risk.

Tips and Expert Advice

To enhance your success in trading options for income spreads, consider the following tips and expert advice:

- Choose underlying assets with high volatility: Higher volatility provides greater potential for price movement, leading to larger profits.

- Select strike prices carefully: The difference between the strike prices should be sufficient to generate a meaningful premium.

- Manage risk effectively: Utilize stop-loss orders and position sizing to limit potential losses.

- Monitor market conditions: Stay informed about economic events and news that can impact the underlying asset’s price.

Remember, options trading involves inherent risks. Before using any strategy, it is essential to conduct thorough research and gain a deep understanding of the financial markets.

FAQs on Options for Income Spreads

Q: What are the advantages of trading options for income spreads?

A: Income spreads offer the potential for generating a steady income, reducing risk compared to buying or selling a single option, and providing flexibility in adjusting the spread based on market conditions.

Q: What are the risks associated with income spreads?

A: Options trading carries the risk of losing the entire investment if the underlying asset’s price moves against the trader. Income spreads can also experience time decay, which reduces the spread’s value over time.

Trading Options For Income Spreads

Image: www.beyond2015.org

Conclusion

Trading options for income spreads is a viable income-generating strategy with significant potential. However, it requires a comprehensive understanding of options trading mechanics, risk management, and market dynamics.

In this article, we explored the fundamental concepts of income spreads, their types, and how they work in practice. By following the tips and expert advice outlined, traders can improve their chances of success and navigate the ever-changing options market effectively.

Are you ready to embark on the exciting journey of trading options for income spreads? Join the conversation in the comments section below to share your experiences and insights or ask any further questions.