Are you tired of losing money in the stock market? Do you want to learn how to make consistent profits without having to spend hours staring at charts? If so, then this article is for you!

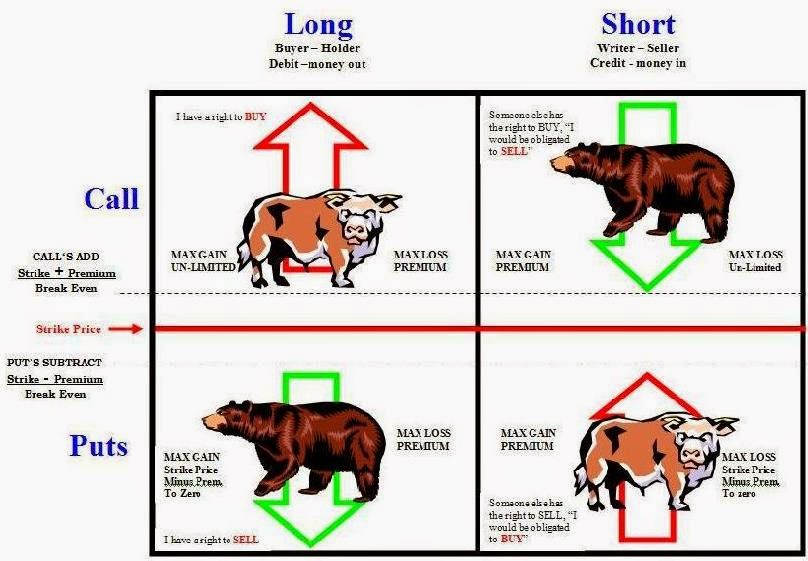

Image: www.derivativetradingacademy.com

We are going to teach you everything you need to know about options trading, including the basics, strategies and how to avoid common pitfalls. By the end of this article, you will be able to trade options confidently and profitably!

What are options?

Options are a type of financial derivative that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. This means that options can be used to speculate on the future price of an asset, hedge against risk, or generate income.

There are two main types of options: calls and puts. Calls give you the right to buy an asset at a specified price, while puts give you the right to sell an asset at a specified price.

How do options work?

Options are traded on exchanges, just like stocks and bonds. When you buy an option, you are paying a premium to the seller of the option. The premium is the price of the option.

If your guess is correct, and the price of the underlying asset rises (in the case of a call) or falls (in the case of a put), then your option will increase in value. You will be able to sell it for a profit, or you can exercise the option and buy or sell the underlying asset.

If your guess is wrong and the price of the underlying asset does not move in your favor, then your option will lose value. You will have to pay the premium, and you will not be able to exercise the option.

What are the benefits of options trading?

There are several benefits to options trading, including:

- Leverage: Options give you the ability to control a large amount of an underlying asset with a small amount of capital. This is because the premium you pay for an option is a fraction of the price of the underlying asset.

- Flexibility: Options can be used to trade a wide variety of assets, including stocks, bonds, commodities, and currencies. You can also use options to trade in a variety of markets, including bull markets and bear markets.

- Income generation: Options can be used to generate income in a variety of ways. You can sell options, collect premiums, and exercise options.

- Hedging risk: Options can also help you reduce your risk when investing in the stock market. By buying puts, you can protect yourself from losses if the market declines.

Image: www.audible.com

What are the risks of options trading?

There are also some risks associated with options trading, including:

- Loss of capital: You can lose all of the money that you invest in options trading. This is because options are a leveraged product, which means that you can control a large amount of an underlying asset with a small amount of capital.

- Volatility: Options prices are highly volatile, which means that they can change rapidly in value. This can make it difficult to predict the profitability of an options trade.

- Complexity: Options can be a complex product, which can make it difficult for inexperienced investors to understand. It is important to remember that the more complexities/features an entity has, the more failure nodes there are. Typically, good investment entities are simple!

Trading Options For Dummies By Joe

Image: www.amazon.com

How to get started with options trading

If you are interested in starting to trade options, there are a few things you need to do:

- Learn the basics of options trading. There are a number of resources available that can help you learn about options trading, including books, websites, and courses.

- Open an options trading account. You will need to open an options trading account with a broker in order to trade options.

- Start trading options with a small amount of capital. It is important to start trading options with a small amount of capital until you have gained experience and become comfortable with the risks involved.