Trading option calls can be a daunting prospect, especially for those who are new to the world of investing. However, with the right knowledge and guidance, you can harness the potential of option calls to enhance your portfolio. This comprehensive guide will delve into the intricate world of option calls, empowering you to understand their mechanics, assess their risks and rewards, and develop a sound trading strategy.

Image: optionclue.com

What are Option Calls and How Do They Work?

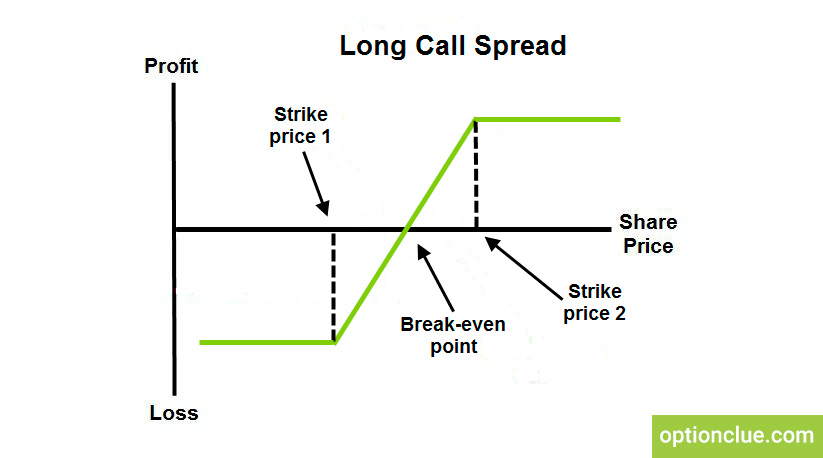

An option call is a contract that gives you the right, but not the obligation, to purchase a particular asset (such as a stock or commodity) at a predetermined price (the strike price) on or before a specified date (the expiration date). By purchasing an option call, you gain the potential to profit from an increase in the underlying asset’s price. The price of an option call is determined by a combination of factors including the stock price, time to expiration, interest rates, and market volatility.

When you purchase an option call, you are essentially betting that the underlying asset will rise in value. If the price of the asset goes up, you can exercise your option to purchase the asset at the strike price and then immediately sell it at the higher market price, generating a profit. However, if the price of the asset drops below the strike price, your option call will expire worthless, and you will lose the premium you paid for it.

Benefits of Trading Option Calls

Trading option calls offers several potential benefits for investors:

- Leverage: Option calls provide leverage, allowing you to control a larger position in the underlying asset with less capital than you would need to purchase the asset outright.

- Profit Potential: Option calls have the potential to generate significant profits if the underlying asset’s price moves in your favor.

- Limited Risk: Unlike owning the underlying asset, your risk is limited to the premium you paid for the option call. This can be a valuable risk-management tool.

Risks of Trading Option Calls

While option calls can enhance your portfolio’s potential, it’s crucial to be aware of the risks involved:

- Time Decay: Option calls lose value over time as the expiration date approaches. This is known as time decay, and it can significantly impact your profits if the underlying asset’s price doesn’t move in your favor quickly enough.

- Volatility: Option calls are sensitive to changes in volatility. Increased volatility can lead to rapid price fluctuations, potentially affecting your profits or losses.

- Liquidity: Option calls may not always be as liquid as other financial instruments, meaning it could be challenging to sell them quickly at a fair price.

Image: www.schwab.co.uk

Expert Insights and Actionable Tips

Trading option calls successfully requires knowledge, skill, and a disciplined approach. Here are some insights from experts to help you navigate the market with confidence:

- “Understand your risk tolerance first. Option calls can be a powerful tool, but they also carry risk. Make sure you understand the potential risks before trading options.” – Peter Tchir, Founder and Chief Strategist, TF Market Advisors

- “Focus on learning and staying updated. The financial markets are constantly evolving. Keep abreast of the latest trends and developments to make informed trading decisions.” – Anna Coulling, Founder and CEO, Mentora Group

- “Don’t chase quick profits. Trading option calls is a long-term game. Have patience and develop a sound strategy that aligns with your financial goals.” – Jaime Rogozinski, Founder and CEO, Atlas Trading

Trading Option Calls

Image: www.fool.com

Conclusion

Trading option calls can be a valuable strategy to enhance your portfolio’s return potential. By understanding the concepts, assessing the risks and rewards, and adhering to a disciplined approach, you can leverage option calls to navigate the market with confidence. Remember to consult with a financial advisor if you are unsure about any aspect of option trading. With knowledge, patience, and a calculated approach, you can unlock the benefits of option calls and become a more informed and successful investor.