Introduction: Unlocking the Potential of Deep Out of the Money Options

In the realm of options trading, venturing into the depths of deep out of the money (DOTM) contracts can be a captivating yet nuanced endeavor. DOTM options are characterized by strike prices that are significantly distant from the current price of the underlying asset, rendering them less likely to expire in the money. Despite their inherent risk, DOTM options offer unique opportunities for both seasoned traders and those seeking a potentially lucrative edge in the fast-paced world of finance.

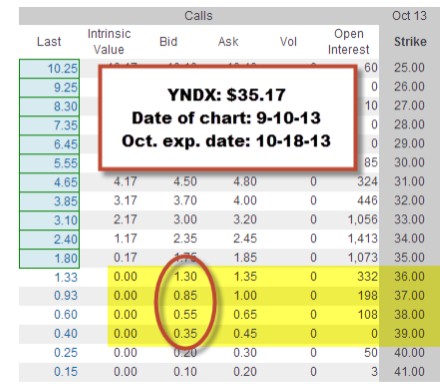

Image: ofosixijudu.web.fc2.com

Understanding Deep Out of the Money Options

Deep out of the money options are a fascinating subset of the options market, where strike prices deviate substantially from the underlying asset’s prevailing spot price. Calls with strike prices above the current price and puts with strike prices below it are considered to be DOTM. Their intrinsic value, which represents the difference between the strike price and the underlying asset’s price, is typically negligible when compared to options closer to the money. However, DOTM options possess a distinct characteristic that sets them apart: time value.

Leveraging Time Value for Strategic Positioning

Time value, the component of an option’s premium that diminishes as expiration nears, plays a crucial role in the trading of DOTM options. Unlike in-the-money or at-the-money options, where time value decays more rapidly, DOTM options retain a higher proportion of time value due to their extended lifespan. This lingering time value allows traders to exploit the potential for significant price fluctuations in the underlying asset over a longer horizon.

Hedging and Tail Risk Management

DOTM options are not solely confined to speculative trading. They have found diverse applications in risk management strategies. For instance, insurance companies may employ DOTM calls as a form of tail risk hedging, protecting against potential large losses by purchasing options with strike prices well below the current asset price. This hedging strategy becomes increasingly valuable in volatile markets or when safeguarding against catastrophic events that could lead to substantial financial repercussions.

Image: optionalpha.com

Income Generation and Arbitrage Techniques

Traders seeking alternative methods of income generation and arbitrage opportunities may find solace in the intricacies of DOTM options. By capitalizing on the disparity between implied volatility and realized volatility, traders can employ strategies such as selling DOTM options to generate income over time. Moreover, clever arbitrageurs may recognize the occasional mispricing of DOTM options, allowing for profitable trades that exploit inefficiencies in the market.

Essential Tips and Expert Guidance for DOTM Trading

Navigating the realm of deep out of the money options requires a keen understanding of the underlying principles and a calculated approach. Here are some invaluable tips from seasoned traders:

-

Start with a plan: Define clear objectives, risk tolerance, and trading parameters before embarking on DOTM transactions.

-

Stay abreast of market trends: Monitor the underlying asset’s price action, volatility metrics, and fundamental developments to assess the potential trajectory.

-

Consider factors affecting implied volatility: Understand how news events, economic releases, and investor sentiment can influence implied volatility, which impacts DOTM option pricing.

-

Manage risk appropriately: Determine the optimal position sizing and exit strategies to mitigate potential losses and protect capital.

-

Seek professional advice if needed: Consult with financial professionals or experienced traders for guidance, particularly during complex market conditions or when encountering unfamiliar strategies.

Frequently Asked Questions About Deep Out of the Money Options

Q: How do I identify deep out of the money options?

A: DOTM options possess strike prices significantly distant from the current underlying asset’s price, resulting in minimal intrinsic value.

Q: Why trade deep out of the money options?

A: DOTM options offer opportunities for time value appreciation, risk management through tail risk hedging, income generation through option selling, and arbitrage strategies exploiting price discrepancies.

Q: What are the potential risks associated with DOTM trading?

A: DOTM options carry inherent risk due to their low probability of finishing in the money, leading to premium erosion and potential loss of capital.

Trading Deep Out Of The Money Options

Image: www.youtube.com

Conclusion: Embracing the Potential of Deep Out of the Money Options

Trading deep out of the money options presents a unique landscape for strategic investors, risk managers, and traders seeking compelling opportunities. By understanding the dynamics of DOTM options, leveraging time value, and adhering to sound trading principles, individuals can unlock the potential of this captivating market segment.

Are you intrigued by the world of deep out of the money options and eager to explore their potential further? Join the conversation and share your insights, queries, and trading experiences in the comments section below.