Welcome to the world of options trading, where informed decisions and savvy strategies can unlock exceptional financial opportunities. As a beginner or a seasoned trader, this guide will equip you with an in-depth understanding of options trading using the intuitive thinkorswim app. Let’s embark on an empowering journey to master this game-changing investment tool.

Image: www.youtube.com

What is Options Trading?

At its core, options trading involves buying or selling contracts that give you the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price and date. Understanding this concept is paramount to unraveling the intricacies of options trading.

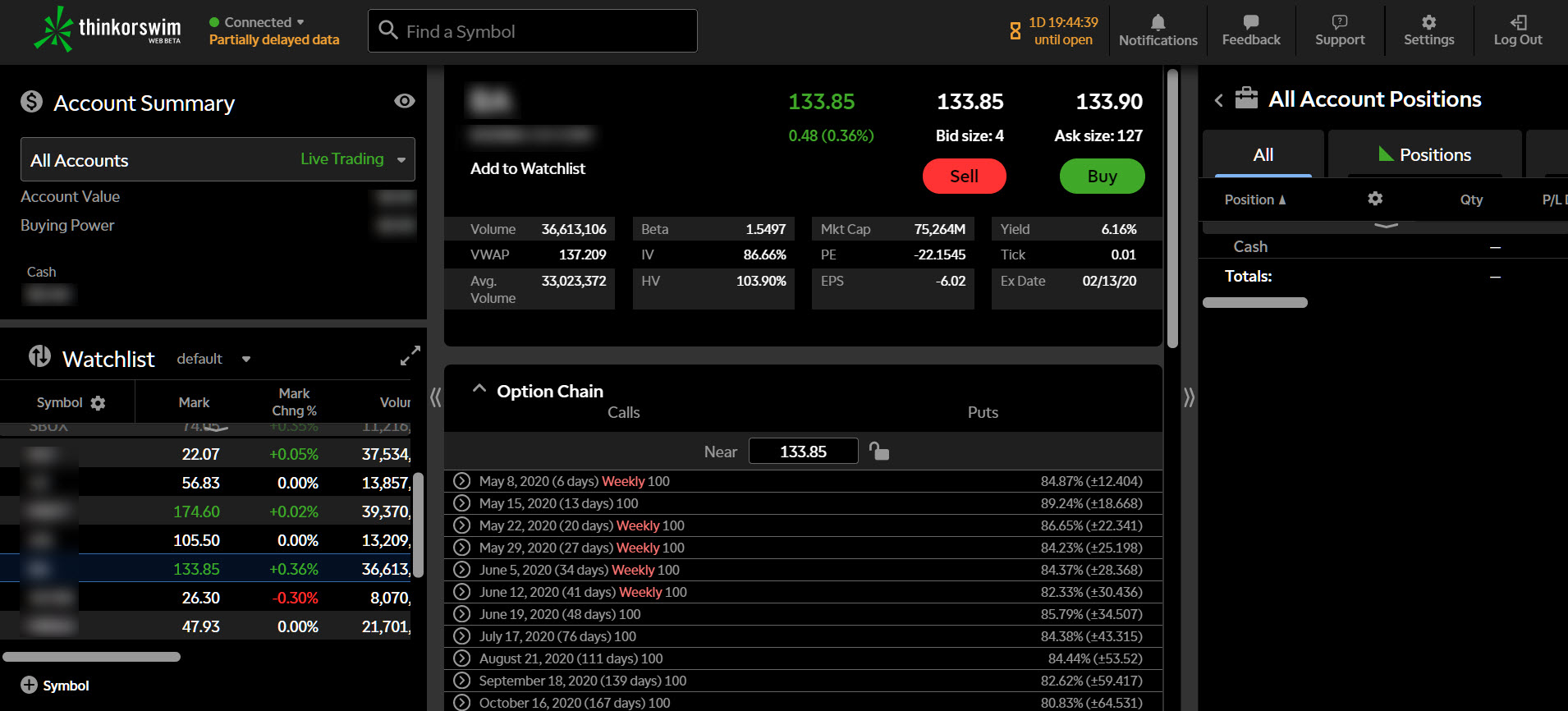

Meet the thinkorswim App: Your Options Trading Hub

The thinkorswim app is your passport to the world of options trading. As a comprehensive trading platform, it offers a user-friendly interface, robust functionality, and a vast array of analytical tools. From charting and research to trade execution and risk management, the thinkorswim app empowers traders with everything they need to navigate the options market.

Key Features of the thinkorswim App

- Real-time market data and streaming charts

- Live paperMoney® trading for risk-free practice

- Powerful charting tools with customizable indicators

- Extensive technical analysis tools for informed decision-making

- Access to educational resources and market insights

Image: www.youtube.com

Getting Started with Options Trading

Before you dive into options trading, it’s crucial to establish a solid foundation. Here are some prerequisites to consider before placing your first trade:

- Understand the basics of options contracts (rights and responsibilities)

- Learn about different types of options (calls, puts, expirations)

- Research and evaluate underlying assets (stocks, indices, commodities)

- Develop strategies for managing risk and potential rewards

Unlocking the Potential of Options Trading

Options trading offers a versatile array of strategies tailored to different risk appetites and financial goals. Common options trading strategies include:

- Covered Call: Generating income while limiting downside risk

- Protective Put: Hedging against potential losses on a long stock position

- Bull Call Spread: Betting on a limited rise in the underlying asset’s price

- Bear Put Spread: Profiting from a limited decline in the underlying asset’s price

Becoming a Successful Options Trader

Mastering options trading requires dedication, perseverance, and a continuous quest for knowledge. Here are some tips to help you embark on a successful trading journey:

- Educate yourself through books, webinars, and online courses

- Practice paper trading before risking real funds

- Backtest strategies to evaluate their historical performance

- Manage risk prudently by using stop orders and position sizing

- Stay informed about market news and economic events

Thinkorswim App Options Trading

Image: laddelf.blogspot.com

Conclusion

Embracing the world of options trading with the thinkorswim app can empower you to explore new financial opportunities and potentially enhance your investment portfolio. By embracing a structured approach, leveraging the power of the thinkorswim app, and continuously seeking knowledge, you can navigate the options market with confidence. Remember, trading involves both rewards and risks, so proceed cautiously and consult with a financial advisor as needed.