Unveiling the Dynamics Behind DIN Options

The realm of finance is constantly evolving, and the introduction of new financial instruments offers exciting opportunities for traders and investors alike. One such instrument that has gained significant traction lately is the options contract for the Dow Jones Industrial Average (DIN). Understanding the intricacies of DIN options, including their inception date, is crucial for effective participation in this dynamic market.

Image: www.trade-ideas.com

Introduction to DIN Options

Options contracts, in general, grant the buyer the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specified date (expiration date). The underlying asset could be a stock, bond, commodity, or an index like the Dow Jones Industrial Average (DIN).

DIN options provide traders with an array of opportunities. They can be employed for hedging risk, speculating on price movements, generating income, or implementing advanced trading strategies. Their versatility has made them increasingly popular among both institutional and retail traders.

The Debut of DIN Options Trading

The highly anticipated trading of DIN options was finally realized on January 17, 2023. This marked a significant milestone in the financial industry, as it provided market participants with a direct and accessible way to trade on the performance of one of the world’s most widely followed and influential stock market indices.

With the launch of DIN options, traders gained the flexibility to leverage the price fluctuations of the Dow Jones Industrial Average to execute various trading strategies. The options contracts empowered traders to express their market views and capitalize on market movements, adding a new dimension to the equity derivatives landscape.

Benefits and Implications of DIN Options Trading

The advent of DIN options trading has brought forth a plethora of implications and benefits for traders of all levels:

- Hedging and Risk Management: DIN options provide a means to mitigate risk associated with the volatility of the broader stock market. Traders can hedge their portfolios or specific positions through options strategies, protecting their capital and limiting potential losses.

- Speculation and Profit Opportunities: DIN options enable traders to speculate on the direction of the Dow Jones Industrial Average, offering the potential for significant gains. By accurately forecasting market trends, traders can employ various options strategies to capitalize on price movements.

- Income Generation: Options contracts can be used to generate income through strategies like selling covered calls or writing cash-secured puts. This approach can provide a steady stream of income while potentially limiting downside risk.

- Enhanced Market Participation: DIN options make it possible for a broader range of market participants to engage with the Dow Jones Industrial Average. Small-scale investors and retail traders can participate in the market through options contracts, diversifying their portfolios and accessing sophisticated trading strategies.

Image: www.reddit.com

Expert Tips for Effective DIN Options Trading

To navigate the complexities of DIN options trading successfully, consider incorporating these expert tips:

- Understand the Fundamentals: Thoroughly grasp the concepts of options pricing, volatility, and Greeks. This knowledge will serve as a solid foundation for making informed trading decisions.

- **Define Trading Objectives: Clearly outline your trading goals and risk tolerance before executing any trades. This will help you select appropriate strategies and manage expectations.

- **Manage Risk Prudently: Always prioritize risk management. Use stop-loss orders, position sizing, and hedging techniques to mitigate potential losses.

- **Monitor Market Conditions: Continuously monitor economic indicators, market news, and technical analysis to stay abreast of market dynamics. This information will inform your trading decisions and enhance your responsiveness to market shifts.

- **Seek Professional Guidance if Needed: If you lack experience or find navigating the options market challenging, consider seeking guidance from a financial advisor or experienced trader. Their expertise can help you avoid potential pitfalls and optimize your trading approach.

Frequently Asked Questions (FAQs)

Q: What is the minimum investment required to trade DIN options?

A: The minimum investment depends on the specific option contract and the market price of the underlying asset (DIN). It is influenced by factors like strike price, expiration date, and volatility.

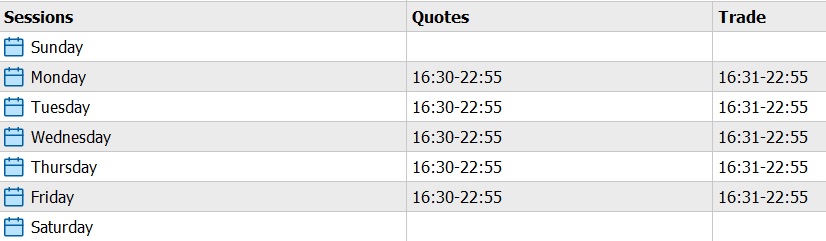

Q: Which trading platform can I use for DIN options trading?

A: Most reputable online brokerages offer DIN options trading capabilities. Choose a platform that aligns with your trading style, account size, and fee structure.

Q: How do I determine the right strike price and expiration date for DIN options?

A: Consider your trading objectives, market analysis, and risk tolerance when selecting strike prices and expiration dates. Your strategy should align with the potential price movements of the underlying asset and your desired holding period.

The Symbol Din Started Trading Options On What Day

Image: www.mql5.com

Conclusion

The introduction of DIN options trading on January 17, 2023, has opened up a world of opportunities for both experienced and novice traders to engage with the Dow Jones Industrial Average. By understanding the nuances of DIN options, leveraging expert advice, and adhering to sound trading practices, you can harness the power of these financial instruments effectively.

Are you excited about the possibilities that DIN options offer in the dynamic landscape of financial markets? Engage with the topic further by exploring online forums, following market news, and connecting with other traders to delve deeper into the world of DIN options trading.