Introduction

Image: www.financialtechwiz.com

In the dynamic financial landscape, options trading has emerged as a powerful tool for maximizing returns and managing risk. With the ability to multiply profits and hedge against market volatility, options offer traders an array of strategies to enhance their portfolios. To embark on this rewarding journey, aspiring traders require a solid foundation of knowledge and practical skills. Among the wealth of resources available, books play an indispensable role in guiding traders through the complexities of option trading. This comprehensive article delves into the world of options trading books, unearthing the best options for both beginners and seasoned professionals.

Essential Elements of a Great Option Trading Book

A valuable option trading book should encompass a comprehensive yet accessible exploration of the subject matter. It should empower traders with a thorough understanding of the following key elements:

-

Fundamental Concepts: A clear exposition of options contracts, their types, and the underlying principles that govern option pricing and trading.

-

Historical Context: A glimpse into the historical evolution of options trading, providing insights into the factors that have shaped its modern-day practices.

-

Practical Techniques: Step-by-step guidance on various option trading strategies, risk management techniques, and analytical tools to facilitate informed decision-making.

-

Real-World Applications: Case studies and examples that illustrate the practical implementation of option trading concepts in diverse market scenarios.

-

Expert Perspectives: Insights and strategies from experienced traders and industry professionals, offering valuable perspectives on successful option trading practices.

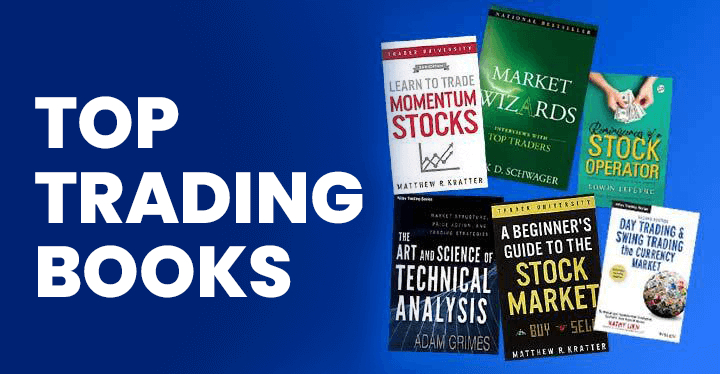

Top Picks for Beginners

1. Options Trading for Dummies by Joe Duarte: A beginner-friendly guide that simplifies the complexities of option trading, making it accessible to all. Its clear explanations and practical examples provide a solid foundation for understanding options basics.

2. Option Trading: A Beginner’s Guide by Jay Kaeppel: Tailored specifically for newcomers, this book takes a structured approach to option trading, meticulously explaining key concepts, strategies, and risk management principles.

3. The Complete Guide to Option Trading: Strategy Guide for Beginners and Intermediate Traders by S. N. Tibrewala: This comprehensive resource offers a holistic overview of option trading, equipping beginners with a robust understanding of fundamental principles and practical applications.

Recommended Reads for Seasoned Traders

1. Option Pricing, Hedging and Speculating by Sheldon Natenberg: A seminal work in the field, Natenberg’s book provides an in-depth analysis of option pricing models, risk hedging strategies, and speculative trading techniques, catering to the needs of experienced traders.

2. Volatility Trading: Strategies for Profiting from Market Swings by Colin Bennett: This advanced guide delves into the world of volatility trading, empowering traders with a comprehensive understanding of volatility measurement, pricing, and trading strategies.

3. Greeks: A Guide for Option Traders by Dan Passarelli and Susan Wood: An indispensable resource for traders seeking a deeper understanding of option Greeks, this book offers a practical exploration of their impact on option pricing and trading strategies.

Image: www.barnesandnoble.com

The Best Book On Option Trading

Image: mews.in

Conclusion

Investing in a well-crafted option trading book is an invaluable step toward mastering this complex but rewarding discipline. Whether you are a budding trader or a seasoned professional, the books discussed in this article provide a comprehensive range of options to cater to your specific needs. By immersing yourself in the knowledge and insights contained within these pages, you can navigate the dynamic landscape of option trading with confidence and reap the benefits that this powerful financial tool offers.