Exploring the Costs Associated with Options Trading

Embarking on the journey of options trading with TD Ameritrade requires a thorough understanding of the associated fees. These charges can significantly impact your overall profitability, making it crucial to arm yourself with the necessary knowledge before diving into the markets. This guide will delve into the complexities of TD Ameritrade trading options fees, providing a comprehensive overview of costs and outlining strategies to optimize your trading experience.

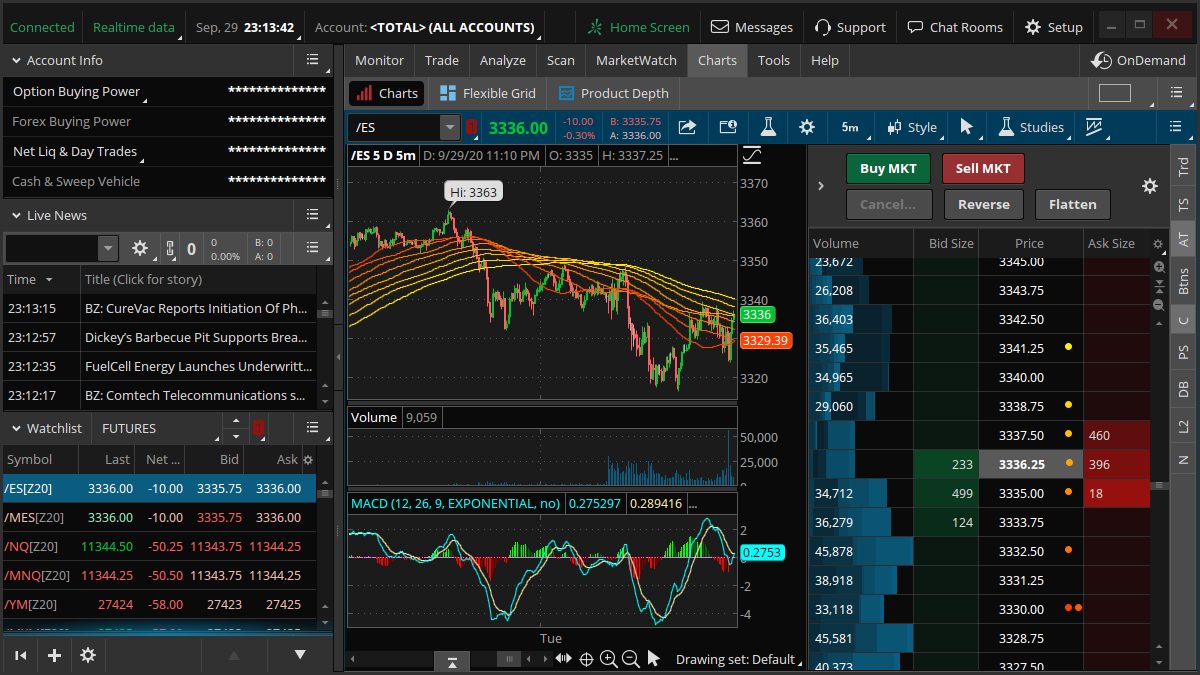

Image: thewaverlyfl.com

Fee Structure for Options Trading

TD Ameritrade employs a tiered fee structure for options trading, which varies depending on your account balance and trading volume. The following are the key fees you need to be aware of:

- Base Transaction Fee: A flat fee charged for each options contract traded, typically ranging from $0.65 to $0.75 per contract.

- Per-Share Fee: An additional fee charged based on the number of shares underlying the option contract, typically $0.05 per share.

- Exercise and Assignment Fees: Fees incurred when you exercise or assign an option contract, typically $0.15 per contract.

- Margin Interest: Interest charges if you trade options on margin, based on the prevailing interest rate.

Strategies for Minimizing Options Trading Fees

While options trading fees are an unavoidable part of the process, there are strategies you can adopt to minimize their impact on your profitability:

- Consider Account Balances and Volume: Opt for a higher account balance and increased trading volume to qualify for lower tiered fees.

- Negotiate with TD Ameritrade: Reach out to TD Ameritrade and inquire about potential fee discounts or rebates based on your trading activity.

- Utilize Options Trading Platforms: Explore third-party options trading platforms that may offer competitive fee structures.

- Trade during Off-Peak Hours: Trading options during low-volume periods can sometimes result in lower fees.

Frequently Asked Questions (FAQs) on TD Ameritrade Trading Options Fees

- Q: What is the minimum fee I can expect to pay per options contract?

A: Typically, the minimum fee is $0.65 for the base transaction fee.

- Q: Are there any discounts available on the per-share fee?

A: No, the per-share fee is fixed at $0.05 per share.

- Q: How can I calculate the total fees for an options trade?

A: Fees = (Base Transaction Fee + Per-Share Fee x Number of Shares) + Exercise or Assignment Fee.

- Q: Is it possible to avoid margin interest charges?

A: Yes, by trading options without using margin.

Image: www.pinterest.com

Td Ameritrade Trading Options Fees

Image: www.forexsfxgroup.com

Conclusion

Understanding and managing TD Ameritrade trading options fees are essential aspects of options trading. By leveraging the insights provided in this guide, you can optimize your trading strategy and enhance your profitability. Remember, careful planning and diligent execution can lead to a fulfilling experience in the world of options trading.

Are you interested in learning more about the intricacies of options trading fees? Join our community forum for lively discussions and expert advice that can further empower your trading journey.