Introduction

Navigating the dynamic world of options trading requires a keen eye for market fluctuations and a strategy that allows you to capitalize on short-term market movements. Swing trading options alerts empower traders with the necessary signals and analysis to confidently make informed trading decisions.

Image: relaxedtrader.com

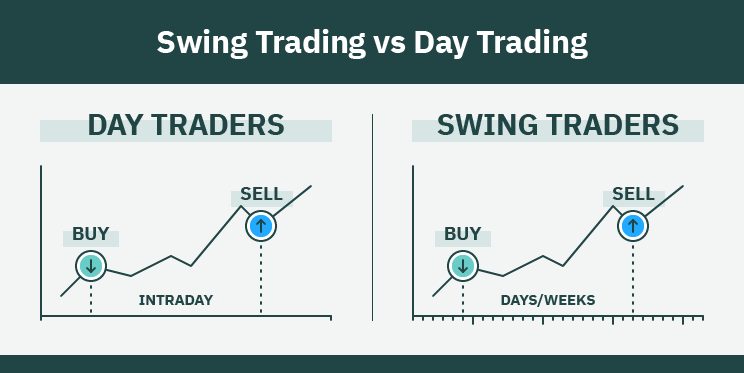

Swing trading involves holding options contracts for periods longer than a day but shorter than months, capturing price swings within specific time frames. Options alerts provide real-time notifications based on predefined criteria, enabling traders to enter and exit positions strategically.

Understanding Swing Trading Options Alerts

Types of Options Alerts

- Price Breakouts: Alerts traders when an underlying asset’s price breaks through a predefined support or resistance level.

- Technical Indicators: Triggered when a technical indicator crosses a specified threshold, such as a moving average or an oscillator.

- Volume Changes: Notify traders when there’s a significant change in trading volume, indicating potential market activity.

- News and Events: Provide alerts based on relevant news or economic events that may impact the underlying asset.

Benefits of Using Swing Trading Options Alerts

- Enhanced Sensitivity: Alerts can identify market opportunities that might be missed by manual monitoring.

- Time Savings: Automation saves you precious time by continuously scanning the markets for potential trades.

- Reduced Emotional Trading: Alerts remove the subjectivity from decision-making, preventing emotional biases from influencing your trades.

- Real-Time Opportunities: Alerts deliver up-to-the-minute notifications, allowing you to capitalize on sudden market movements.

- Improved Risk Management: Alerts can incorporate stop-loss parameters, helping you limit potential losses.

Image: tokenist.com

Practical Considerations

Choosing a Swing Trading Options Alert Service

- Accuracy: Ensure the accuracy and reliability of the alert service through reviews and testimonials.

- Customization: Opt for services that allow customization of alert parameters based on your trading strategy.

- Mobile Accessibility: Choose alerts that can be accessed via mobile devices for on-the-go convenience.

- Historical Performance: Consider services that provide historical performance data, demonstrating the effectiveness of their alerts.

Utilizing Swing Trading Options Alerts Effectively

- Complement Other Analysis: Use alerts alongside other research and analysis tools to form a comprehensive trading strategy.

- Manage Expectations: Recognize that alerts are not a guarantee of profit and should be used cautiously.

- Risk Management: Always set realistic profit targets and appropriate risk management measures to mitigate potential losses.

- Emotional Discipline: Stick to your trading plan and avoid impulsive decisions influenced by market volatility or fear of missing out.

Expert Insights and Actionable Tips

“Swing trading options alerts can provide a valuable advantage in identifying market opportunities,” says industry expert Samuel Jones. “However, it’s crucial to approach them with caution and supplement them with thorough market analysis and a disciplined trading plan.”

Here are actionable tips to maximize the benefits of swing trading options alerts:

- Test Multiple Alerts: Experiment with different alert parameters to find what works best for your strategies.

- Use Alerts as a Confirmation: Treat alerts as supporting signals rather than definitive trade triggers.

- Set Realistic Expectations: The key to successful trading is consistency over time, rather than aiming for home runs every trade.

- Stay Disciplined: Stick to your trading plan and adjust your alerts accordingly, often favoring a slightly conservative approach.

Swing Trading Options Alerts

Image: blog.elearnmarkets.com

Conclusion

Swing trading options alerts can empower traders with timely signals and enhanced market awareness. By utilizing these alerts judiciously, traders can navigate market fluctuations with more confidence, identify potential trading opportunities, and potentially improve their trading outcomes. Remember, the key to success in swing trading lies in a balanced approach of technical proficiency, emotional discipline, and a well-crafted trading strategy supported by reliable tools like swing trading options alerts.

For further exploration, we recommend referring to reputable sources such as the Options Industry Council (OIC) and the International Securities Exchange (ISE) for additional insights and educational materials on options trading and related strategies.